Big Moves Ahead: 3 Crypto Token Unlocks This Week You Need to Watch

Jakarta, Pintu News – Next week, there will be a major token unlock for Sui , Omni Network , and Optimism , which has the potential to affect price volatility as well as changes in market trends.

Each of these unlocking processes involves millions of dollars worth of tokens going into the market, thus attracting serious attention from traders and investors.

Optimism (OP)

On April 30, 2025, Optimism will unlock approximately 31.34 million OP tokens, which is equivalent to 1.89% of its circulating supply.

This unlocking is part of the vesting schedule set by Optimism and includes distributions to investors as well as core contributors.

Read also: Massive Gains Ahead? 5 Meme Coins Every Investor Should Watch This May

Although the percentage increase in supply is relatively small, investors still need to be cautious.

Even a small amount of unlocking can affect market dynamics, especially if coupled with changes in investor sentiment or broader market trends.

Technically, OP previously surged in a rising wedge pattern and completed a five-wave move near the $0.81 level, right at the 0.5 Fibonacci area of the previous drop.

Divergence in RSI confirms potential exhaustion. A correction with pattern (a)-(b)-(c) is expected, with a correction target to the $0.72-$0.65 range.

This technical setup is in line with the token unlock on April 30, where 1.89% of the supply will enter the market.

If OP is able to hold in the $0.70 area during the correction phase, there is a chance to resume the uptrend once the new supply is absorbed.

However, if the price drops below $0.65, the short-term bullish scenario will be invalidated, and a potential deeper drop could occur.

Sui (SUI)

On May 1, Sui will unlock 74 million SUI tokens, which equates to approximately 2.28% of the total circulating supply.

This unlock is part of Sui’s structured token release schedule, which aims to gradually maintain liquidity while maintaining market balance.

With a total supply capped at 10 billion tokens, this gradual token opening mechanism is designed to prevent sudden supply shocks that could destabilize prices.

Investors are advised to monitor the market reaction closely, as the unlocking could either reinforce existing price gains or trigger a short-term correction.

SUI prices previously broke out of the descending channel pattern and surged through $3.50, reaching the overbought region on the RSI indicator.

This sharp rise has likely completed the bullish impulsive wave, and now the market is preparing to enter corrective pattern (a)-(b)-(c). The Relative Strength Index (RSI) also shows a bearish divergence, signaling a weakening momentum.

The 0.382 Fibonacci level around $3.50 is an important resistance area, while the 0.5 level at $2.93 is the next support area. It is expected that there will be a price correction towards these zones before there is a possibility of uptrend continuation.

Read also: Whales Are Betting Big: 3 Altcoin You Need to Watch!

With the token unlocking on May 1, potentialprofit-taking and supply pressure could coincide with this technical decline, making the price area between $2.90-$3.10 crucial to see if new demand will emerge.

Omni Network (OMNI)

On May 2, Omni Network will unlock approximately 15.98 million OMNI tokens, which is equivalent to 16% of the total existing supply.

This sizable increase in supply could potentially lead to higher price volatility, especially considering OMNI’s relatively low liquidity.

This unlocking includes allocations to core contributors, investors, and advisors, according to a schedule that has passed the 1-yearcliff and subsequent vesting periods.

The market reaction will largely depend on demand as well as the project’s ability to maintain investor confidence amid a flood of new supply.

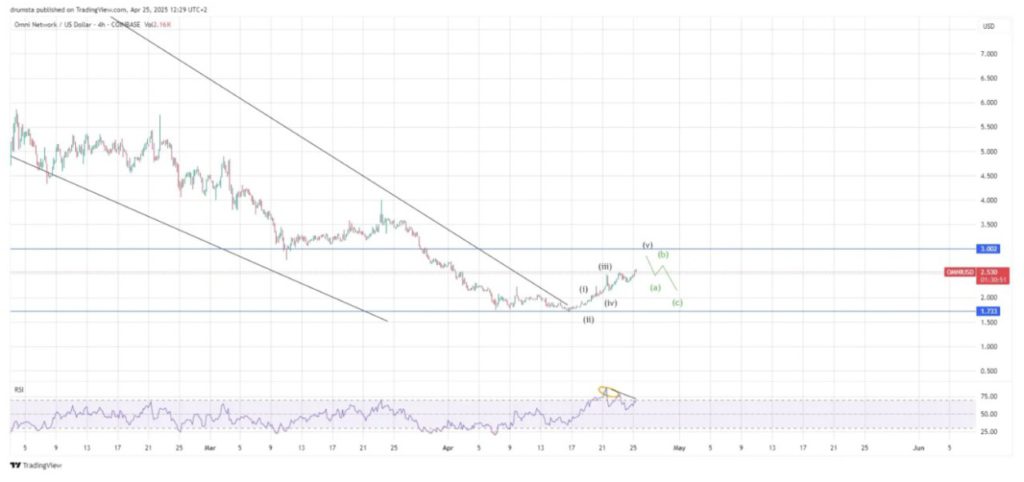

Currently, OMNI is close to completing a five-wave impulsive pattern, with the price hovering around $2.53, accompanied by the appearance of a bearish divergence on the RSI indicator that indicates signs of local exhaustion.

Technically, a correction of pattern (a)-(b)-(c) is expected to form, with a correction target towards the $2.00-$1.73 price zone.

Previously, OMNI has successfully broken the descending channel pattern, supporting a bullish bias in the medium term, although for now the outlook is corrective.

With 16% of the total supply set to open on May 2, selling pressure is likely to deepen this correction.

The price movement between the $1.73 to $2.00 range will be a crucial area to assess whether OMNI is able to absorb the new supply and form a higher low as a basis for further upside.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. 3 Biggest Token Unlocks For Next Week. Accessed on April 29, 2025