Bitcoin Climbs to $94.000 — Is a Massive Surge to $210.000 Next?

Jakarta, Pintu News – Peter Chung, head of research at quantitative trading firm Presto, has reiterated his prediction that the price of Bitcoin will reach $210,000 by the end of 2025.

In an interview with CNBC on April 28, Chung cited institutional adoption and increased global liquidity as the main factors behind his optimistic outlook in the long run.

He acknowledged that market conditions throughout the year were not entirely in line with expectations, mainly due to macroeconomic challenges and market reactions that were difficult to predict.

Then, how will the Bitcoin price move today?

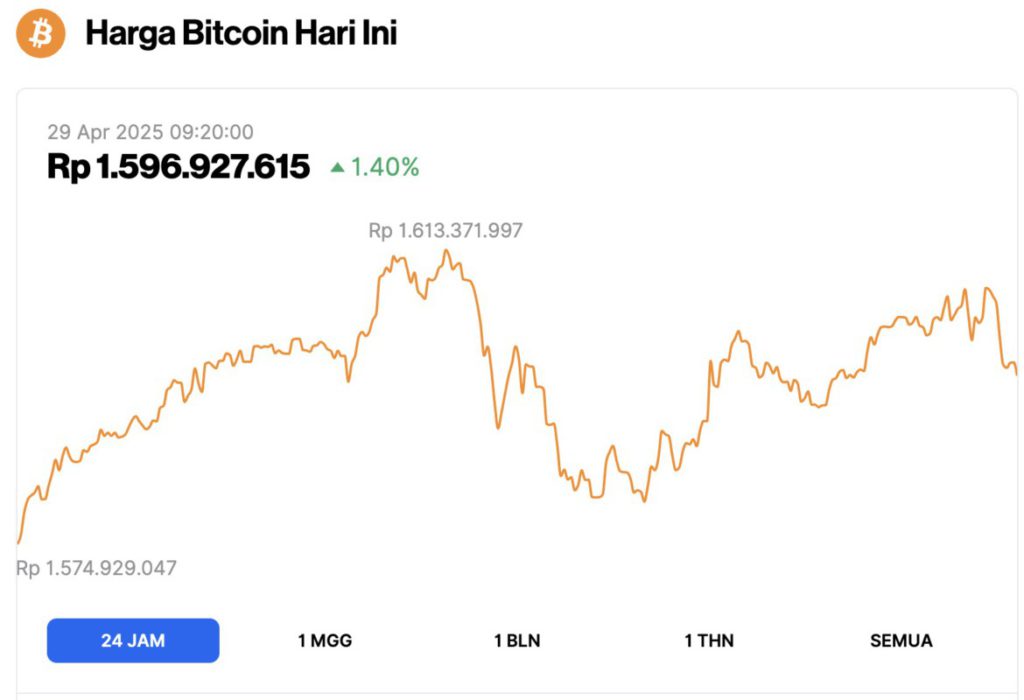

Bitcoin Price Up 1.40% in 24 Hours

On April 29, 2025, Bitcoin (BTC) was trading at $94,731, or approximately IDR 1,596,927,615, marking a 1.40% gain over the past 24 hours. Throughout the day, BTC dipped to a low of IDR 1,574,929,047 and climbed to a high of IDR 1,613,371,997.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.88 trillion, with trading volume in the last 24 hours also up 77% to $32.16 billion.

Read also: Big Moves Ahead: 3 Crypto Token Unlocks This Week You Need to Watch

Bitcoin’s Dual Role

In his interview with CNBC, Chung described the recent price correction as a “healthy” adjustment, which he said strengthens Bitcoin’s foundation to develop into a mainstream financial asset.

“In hindsight, I think this correction was actually a healthy adjustment, which paved the way for a reassessment of Bitcoin as a mainstream asset,” he said.

Furthermore, Peter Chung also discussed the dual nature of Bitcoin, describing it as both a “risk-on” asset and “digital gold.”

According to him, Bitcoin generally behaves like a high-risk asset driven by user adoption and network effects.

However, in times of financial instability – such as the outbreak of the Russia-Ukraine conflict in 2022 or the collapse of Silicon Valley Bank in 2023 – Bitcoin is likely to serve as a hedge asset, similar to gold.

“Moments like this are rare,” Chung explained, “[they] only appear when the market starts to doubt the stability of the US dollar-dominated financial system.”

Although in the recent market turmoil Bitcoin has lagged behind gold, Chung mentioned that BTC has the potential to “catch up” and possibly even outperform traditional hedge assets by the end of this year.

In addition, Chung also reiterated Presto’s target for Ethereum , maintaining a valuation model based on the ETH to BTC ratio, reflecting their belief in the continuous improvement of the Ethereum network.

Read also: When Will Pi Network’s Price Soar? Here’s What Analyst Dr. Altcoin Predicts!

Bitcoin Breaks $94,000 as Institutional Adoption Expands

In line with Peter Chung’s views, Bitwise CEO, Hunter Horsley, in a recent post on X, stated that Bitcoin’s price surge to $94,000 occurred with minimal retail participation.

He noted that searches for the word “Bitcoin” on Google are still at a long-term low.

According to Horsley, Bitcoin’s rally this time was driven by institutional investors, financial advisors, corporations, and even some countries.

“The types of investors buying Bitcoin are becoming more diverse,” says Horsley.

Based on data from BitcoinTreasuries.NET, the current cash of companies holding Bitcoin has reached nearly $65 billion in BTC.

On April 22, analysts from Standard Chartered and Intellectia AI also stated that institutional demand for Bitcoin – both through exchange-traded funds (ETFs) and from market participants looking to protect themselves from macroeconomic risks – could potentially see the price of Bitcoin more than double this year.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin could hit $210K in 2025, says Presto research head. Accessed on April 29, 2025