3 US Economic Indicators Driving Crypto Market Sentiment This Week

Jakarta, Pintu News – Bitcoin is currently trading below the $94,000 level and remains sensitive to US economic indicators.

US economic data due for release this week could trigger volatility in the cryptocurrency market, ranging from consumer confidence to labor market strength, which could impact sentiment and move crypto prices.

Check out the full news below!

Consumer Trust

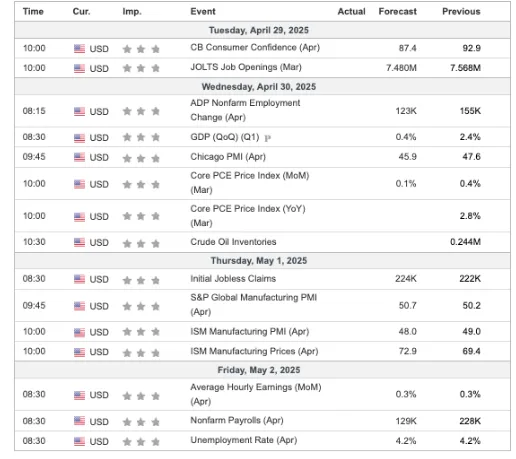

The Consumer Confidence report, to be released on Tuesday, is a key indicator that measures households’ optimism about financial conditions. The Consumer Confidence Index in March registered a reading of 92.9, indicating a relatively pessimistic view of the economy and economic situation in the United States.

The median prediction for April is 87.4. If the result is below expectations, it could trigger profit-taking and reduce confidence in the overall strength of the economy.

With global trade tensions, an unexpected downturn could increase demand for Bitcoin (BTC) as a safe haven asset, although volatility remains a risk.

Also read: Nike Hit with $5 Million Lawsuit Over RTFKT NFT Platform Closure

JOLTS Job Openings

The Job Openings and Labor Turnover Survey (JOLTS), to be released this week, includes data for March 2025. The last report showed job openings of 7.6 million. The median prediction for the following report is 7.4 million.

If the figure exceeds 7.6 million, it could signal economic resilience that boosts riskier assets, such as Bitcoin (BTC). Strong job openings indicate confidence in hiring, which could potentially increase income that could be used for crypto investments.

However, a lower-than-expected figure could trigger recession fears, prompting investors to turn to Bitcoin (BTC) as a hedge.

Read also: Altcoins Ready for Token Unlock This Week

ADP and NFP Jobs Report

The ADP National Jobs Report, which tracks private sector job growth, is scheduled for release on Wednesday. The March report showed the addition of 155,000 jobs, exceeding expectations.

If this month’s report shows a figure above 160,000, it could trigger bullish sentiment, as job growth supports consumer spending and risk appetite. However, if the data indicates a slowdown, this could prompt investors to turn to stablecoins or Bitcoin (BTC) as safe-haven assets.

The Non-farm Payrolls report, which will also be released on Friday, is another important indicator. The March report showed an addition of 228,000 jobs. If this report shows a substantial number, it could boost bullish momentum. However, a weak report could spark fears of a recession, driving capital to Bitcoin (BTC) as a hedge or stablecoin for stability.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. US Economic Indicators and Bitcoin & Crypto Sentiment. Accessed on April 29, 2025

- Featured Image: Generated by Ai