Will DeepBook (DEEP) Reach New Record Highs After 35% Rise?

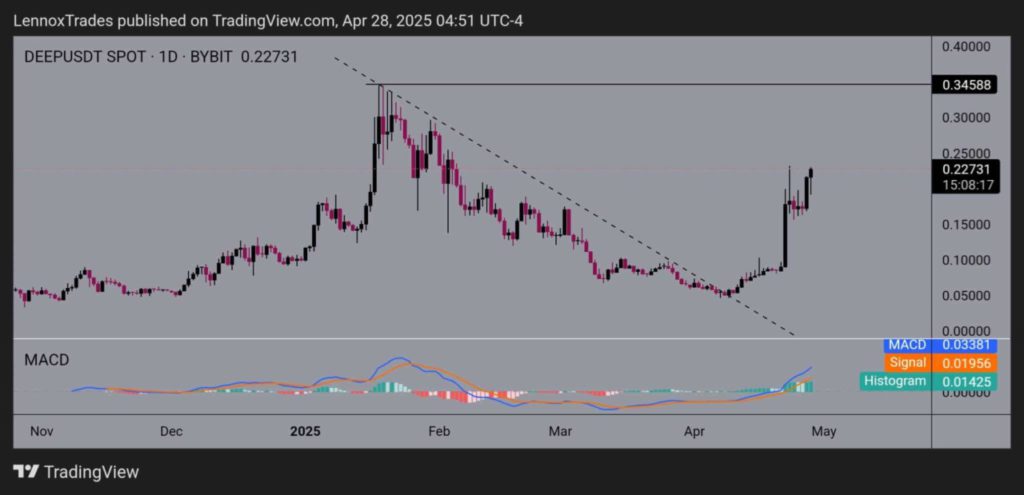

Jakarta, Pintu News – DeepBook is in the spotlight today after the price of this coin managed to break the downward trend line that it has maintained since January. This rise signifies the market’s increasing potential.

Introduction: DeepBook (DEEP) Price Increase

After successfully breaking the trend line, DEEP showed signs of accumulation around the price of $0.15, and finally started an uptrend. Currently, DEEP is trading at $0.22731, showing a 35% increase in price along with an increase in trading volume. The Moving Average Convergence Divergence (MACD) indicator also supports this bullish trend with the MACD line at $0.03381 crossing the signal line at $0.01956, while the positive histogram value reaches $0.01425.

Also Read: XRP Surges to $2.32: Can it Survive Crypto Whale Selling Pressure?

Technical Analysis and Potential New ATH Achievements

DEEP now has the opportunity to return to the previous high of $0.34588, if the current momentum continues. The market is expected to accelerate to the $0.34 to $0.35 range if the price manages to break above $0.23 during this bullish phase. Volume analysis near $0.23 suggests that there needs to be a close watch before DEEP goes any further. If the price stabilizes above $0.34, DEEP could potentially set a new record high in the market.

Market Dynamics and Their Impact on Trading Positions

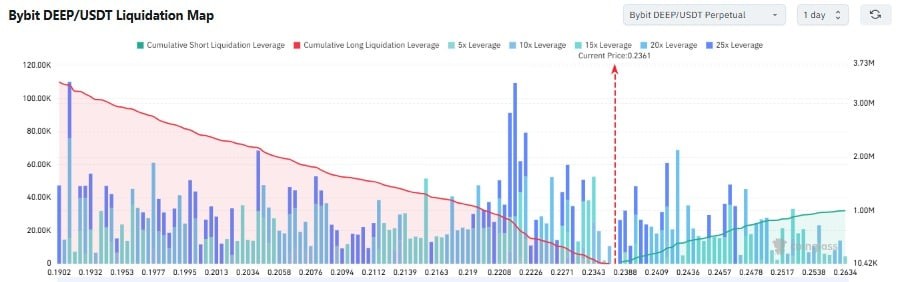

Based on analysis from AMBCrypto, long position leverage increased significantly when the price reached $0.2217, which was characterized by a spike at the 5x to 15x leverage point on the liquidation map. Long positions accumulated mainly in the price range from $0.2208 to $0.2280, with cumulative long liquidation leverage reaching a significant peak.

On the other hand, DEEP appears to be facing reduced resistance from short sellers in the market. A sustained upside push from DEEP would trigger liquidation for short positions located at $0.24 and $0.25, allowing for a short squeeze whose effects would be felt at $0.26 and $0.27.

Conclusion: DEEP’s Prospects in the Crypto Market

With reduced short selling activity near the current trading levels, it supports the idea of a continued uptrend in the market. However, a sharp market drop could occur from a congested long trading position at $0.22. Leveraged long traders positioned at $0.2217 may face the risk of liquidation if DEEP drops to the $0.22 price level, which would increase selling pressure to $0.21 or even lower.

Also Read: Is Bitcoin Miner’s Sales Hold a Good Sign?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Will the new ATH follow DEEP’s 35% rise on the charts? Accessed on April 29, 2025

- Main Image: X