Is Bitcoin (BTC) About to Hit a New Record High? Market Indicators Signal Positive!

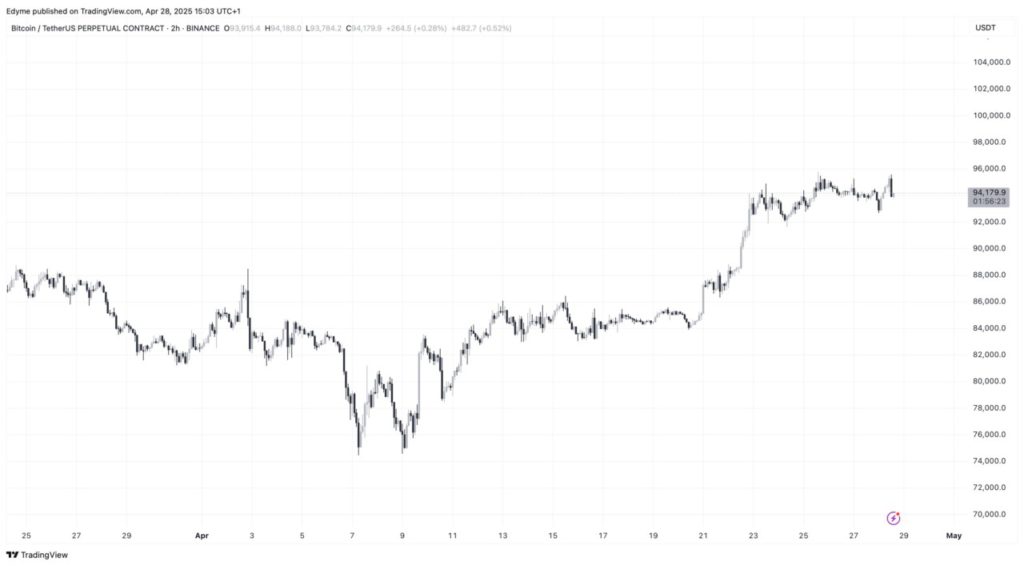

Jakarta, Pintu News – Bitcoin continues to show a steady recovery, with the current exchange rate reaching $95,409 after experiencing a 1.7% increase in the past 24 hours. In the past two weeks, Bitcoin (BTC) has increased by nearly 15%, recovering gradually from its recent correction period.

While this momentum looks more measured compared to previous price spikes, the underlying market data suggests that a structural shift is underway that could influence the next big move.

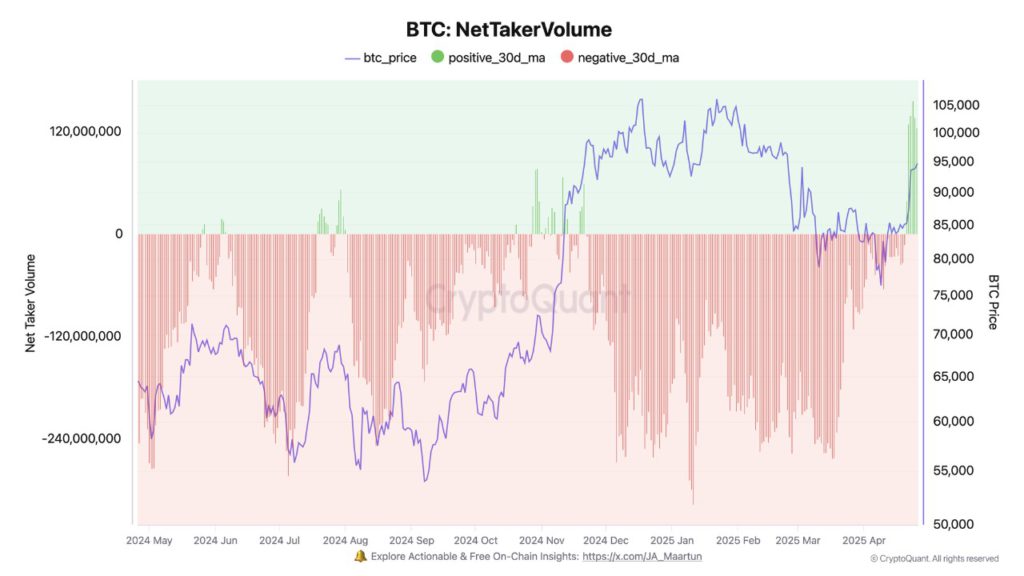

Bitcoin (BTC) Net Taker Volume Returns to Positive

According to CryptoQuant analyst Darkfost, the 30-day moving average of Bitcoin’s (BTC) Net Take-Up Volume has returned to positive territory. Net Take-Up Volume is an indicator that compares the relative size of long and short positions in the derivatives market over a given period.

A positive reading indicates that buying pressure (long positions) is greater than selling pressure (short positions), while a negative reading indicates the opposite. Darkfost notes that the derivatives market now accounts for about 90% of Bitcoin’s (BTC) total trading volume, surpassing spot and exchange-traded fund (ETF) volumes.

As a result, shifts in derivatives sentiment can often precede broader price movements. The return of Net Take-Up Volume to positive territory suggests that speculative participants are preparing for a sustained rise. This realignment in the derivatives market, if sustained, could act as a catalyst to reinforce Bitcoin’s (BTC) recent gains and pave the way for further price discovery.

Also Read: XRP Surges to $2.32: Can it Survive Crypto Whale Selling Pressure?

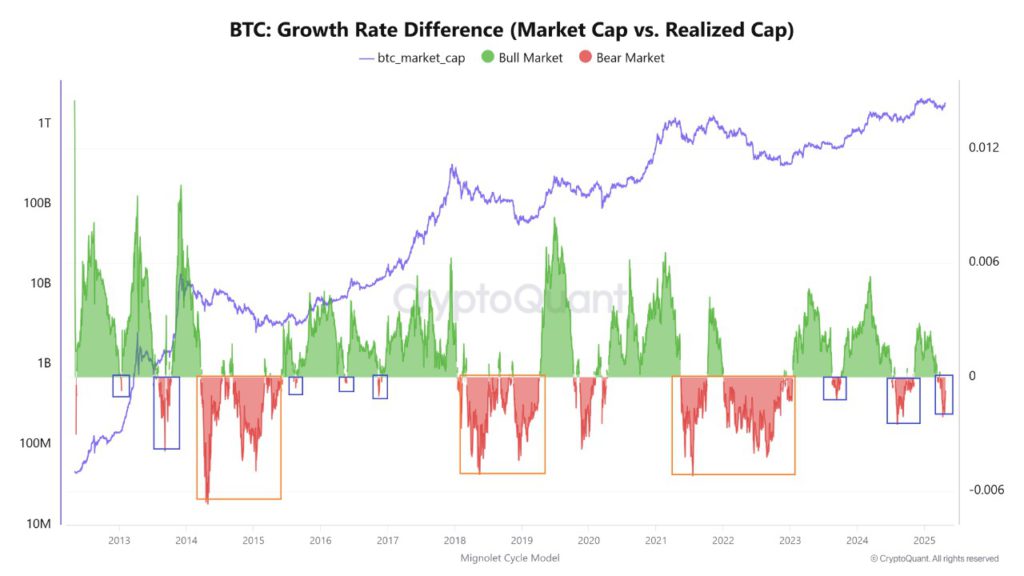

Cycle Model Adjustment Shows Continuation of Uptrend

In a separate analysis, CryptoQuant analyst Mignolet provided insight into Bitcoin’s (BTC) long-term trend outlook. Using an enhanced cycle model based on market capitalization data, Mignolet suggested that traditional cycle indicators are slow in reflecting the latest recovery.

To overcome this delay, adjustments were made to the model’s time series to detect shifts in market behavior earlier. Mignolet observed that what appears to be a “bear market” zone according to traditional models is actually a buying opportunity within an ongoing up cycle.

The current market structure, according to Mignolet, resembles the final stage of the 2017 bull market rather than the initial phase of a new downturn. If this parallel holds, Bitcoin (BTC) still has significant upside potential before entering a major correction phase.

Cover: Bitcoin’s (BTC) Upside Potential is Still Wide Open

With market indicators showing positive signals and in-depth analysis from experts, the opportunity for Bitcoin (BTC) to reach a new price record seems to be opening up. Investors and traders are advised to pay attention to derivatives market movements and cyclical model adjustments to make informed investment decisions. This latest rise may be just the beginning of what could be a larger bullish phase.

Also Read: Is Bitcoin Miner’s Sales Hold a Good Sign?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Net Taker Volume Turns Positive, New All-Time High Incoming. Accessed on April 29, 2025

- Featured Image: Generated by AI