Bitcoin (BTC) Nearing $100,000, Is the Next Rise Coming?

Jakarta, Pintu News – Bitcoin is now on the verge of a significant rise, with prices continuing to move in the $90,000s. Following reports that China has removed additional tariffs on some US products, the cryptocurrency has been on the rise. However, Bitcoin (BTC) now faces a critical resistance level at $96,000, which could determine the price direction in the near future.

On-Chain Analytics: What Does the Data Say?

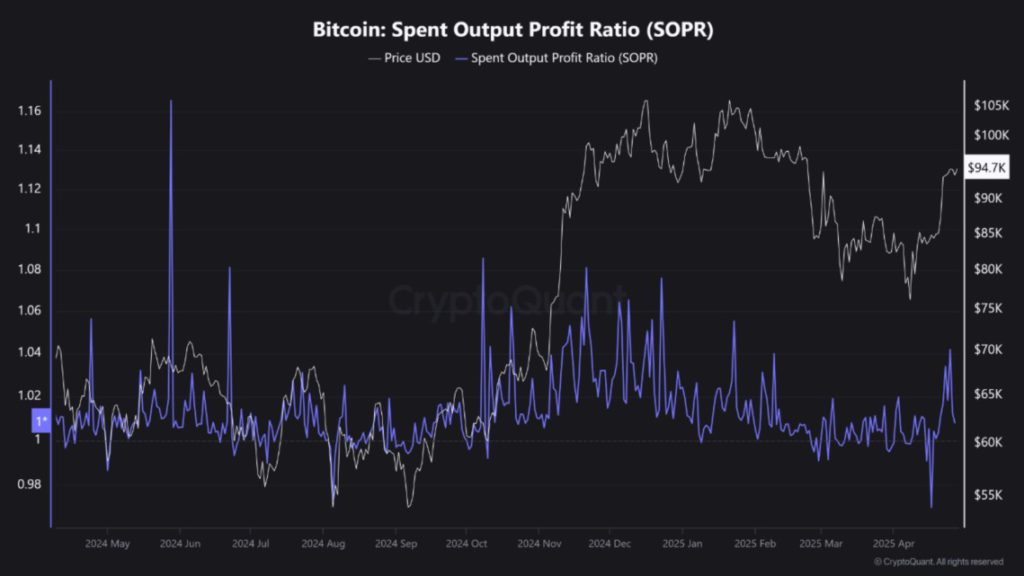

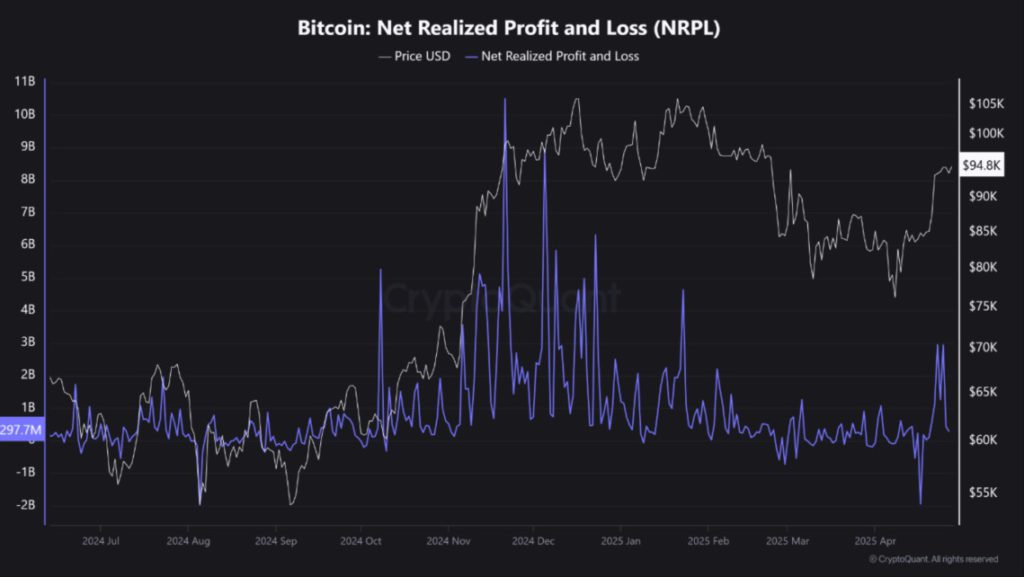

According to the latest analysis from CryptoQuant, Bitcoin (BTC) is entering a stagnation phase where short-term holders are starting to realize profits. BorisVest analysts warn that if these sales are not fully absorbed, it could trigger a new wave of selling. This suggests that the market may be unstable and investors should be wary of a possible price drop.

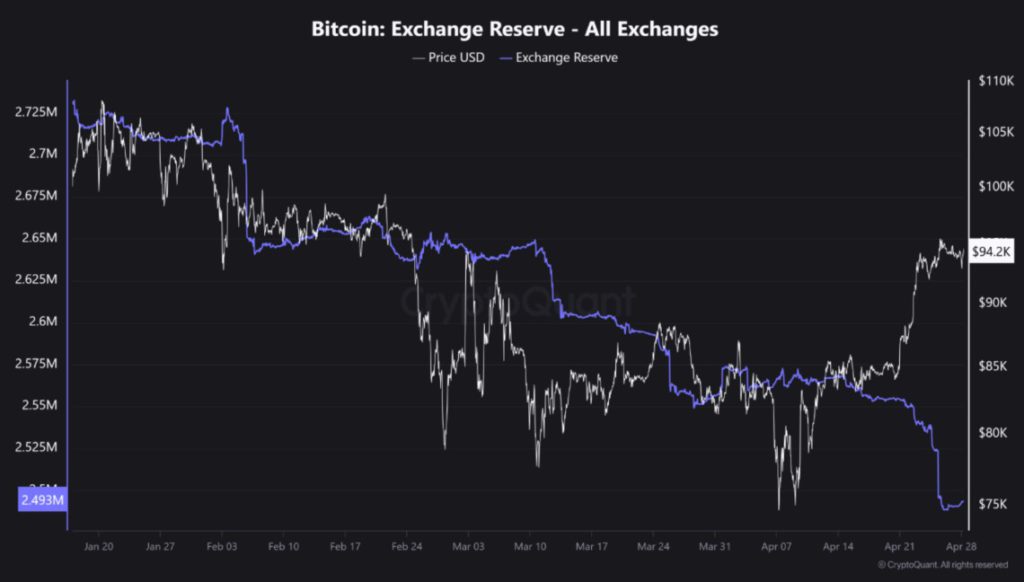

Furthermore, BorisVest emphasized that Bitcoin (BTC) reserves on exchanges, which had declined significantly until last week, are now stabilizing. This could increase selling pressure on Bitcoin (BTC). Currently, Bitcoin (BTC) inflows and outflows on crypto exchanges look balanced, suggesting that the market is in a neutral state.

Also Read: XRP Surges to $2.32: Can it Survive Crypto Whale Selling Pressure?

Critical Resistance and Upside Potential

Bitcoin (BTC) is currently facing important resistance at $96,000. If the currency manages to break through this level with strong volume and momentum, this resistance could turn into new support and push the price up further. Market analysts have set a medium-term target for Bitcoin (BTC) at $155,000, following in the footsteps of gold as a safe haven asset.

However, if Bitcoin (BTC) fails to break $96,000 decisively, it could hamper its rise and potentially trigger a price pullback back to the $80,000 range. Therefore, it is crucial to monitor Bitcoin (BTC) price behavior around this resistance level in anticipation of its next move.

Outlook and Future Price Predictions

Standard Chartered recently predicted that Bitcoin (BTC) could reach $120,000 in the second quarter of this year. This prediction is based on technical indicators that show significant upside potential. In addition, the volume of Bitcoin (BTC) purchases on Binance has surpassed sales for the first time in six months, signaling a change in momentum that may favor price increases.

With ETFs experiencing $3 billion in inflows and prices approaching $100,000, Bitcoin (BTC) is showing signs that the upward trend may be set to continue. Investors and analysts alike are watching closely to see if the currency will hit a new record in the near future.

Conclusion

With various factors favoring the upside potential, the Bitcoin (BTC) market is currently at a tipping point. Investment decisions should be based on in-depth analysis and constant monitoring of market indicators. The upcoming bull run will probably take Bitcoin (BTC) to price levels it has never reached before.

Also Read: Is Bitcoin Miner’s Sales Hold a Good Sign?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Battles Key Resistance Level, Is a Breakdown Imminent. Accessed on April 29, 2025

- Featured Image: Bitcoinist