Why has the Bitcoin (BTC) price increase stalled? On-Chain Data Gives Clues

Jakarta, Pintu News – Recent on-chain data points to several indicators that may explain why Bitcoin’s recent price gains have stagnated. This analysis delves deeper into how changes in several on-chain metrics may affect Bitcoin (BTC) market dynamics.

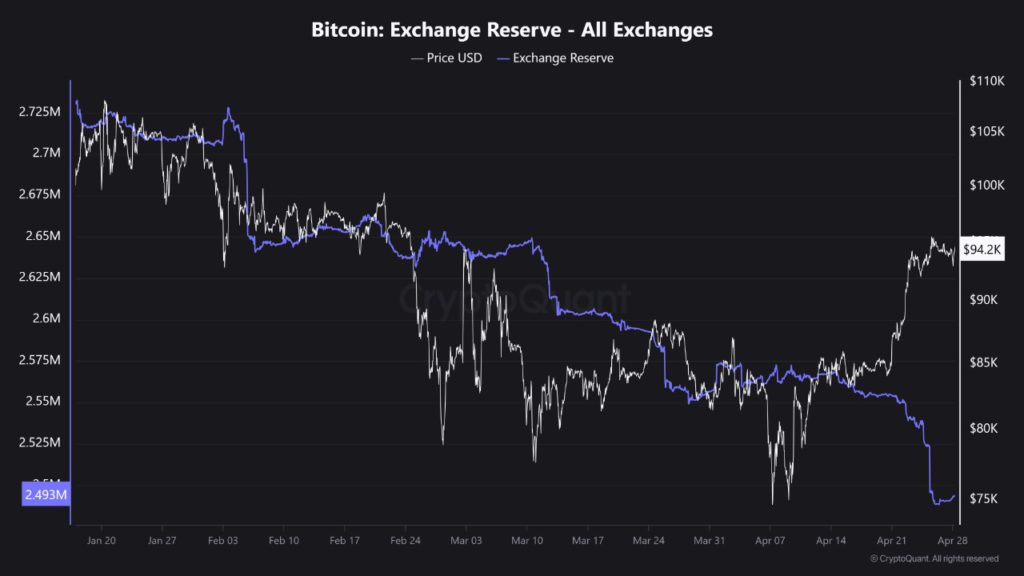

Exchange Reserves and Their Effect on Price

One of the most prominent metrics is the “Exchange Reserve,” which measures the total Bitcoin (BTC) stored in centralized exchange wallets. The latest chart shows that there was a sharp drop in the Exchange Reserve during the last price increase, signaling that investors withdrew large amounts of tokens from exchanges.

These large withdrawals are usually an indication that holders are accumulating Bitcoin (BTC), which may have helped drive the price up. However, in recent days, this decline has stopped and the indicator has started to flatten out. Unsurprisingly, the rise in Bitcoin (BTC) price has also stalled along with this trend.

Also Read: XRP Surges to $2.32: Can it Survive Crypto Whale Selling Pressure?

Profit Taking by Large Investors

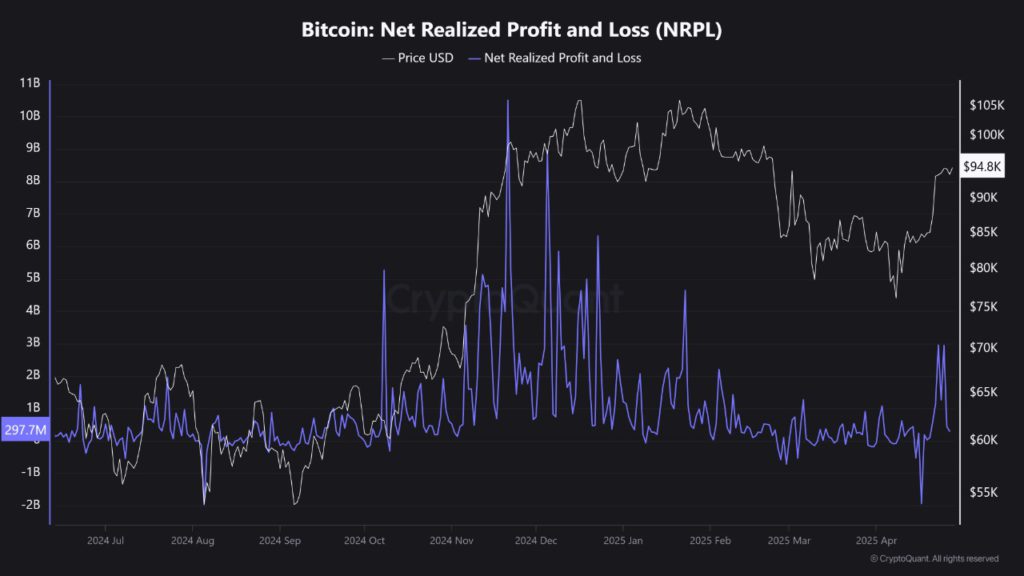

Another interesting metric to watch is the Net Realized Profit and Loss (NRPL), which records the amount of net profit or loss realized by Bitcoin (BTC) investors as a whole. Recently, the NRPL showed a large negative spike reflecting a realized loss of $2 billion, but with the rally, this value has reversed to positive.

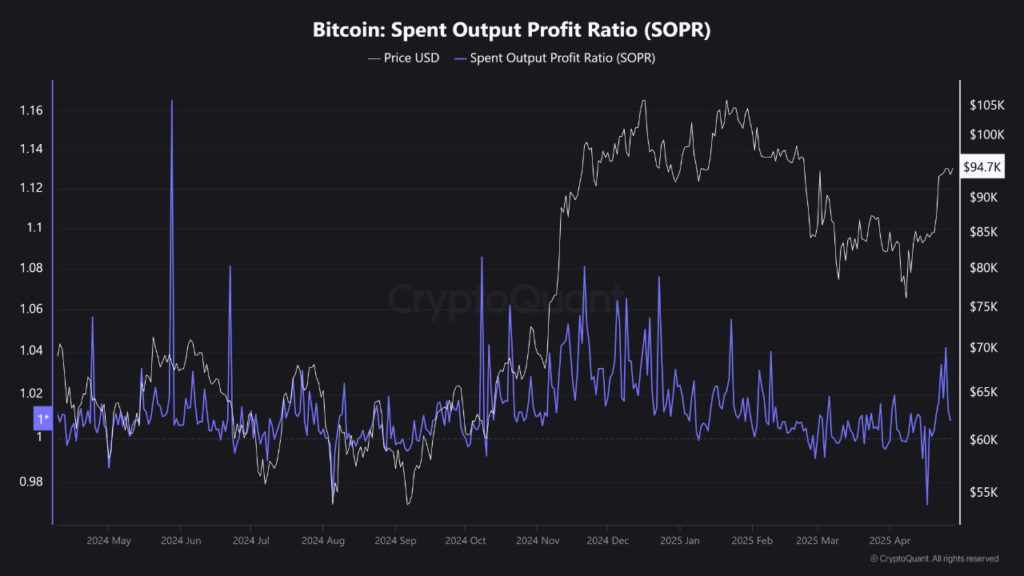

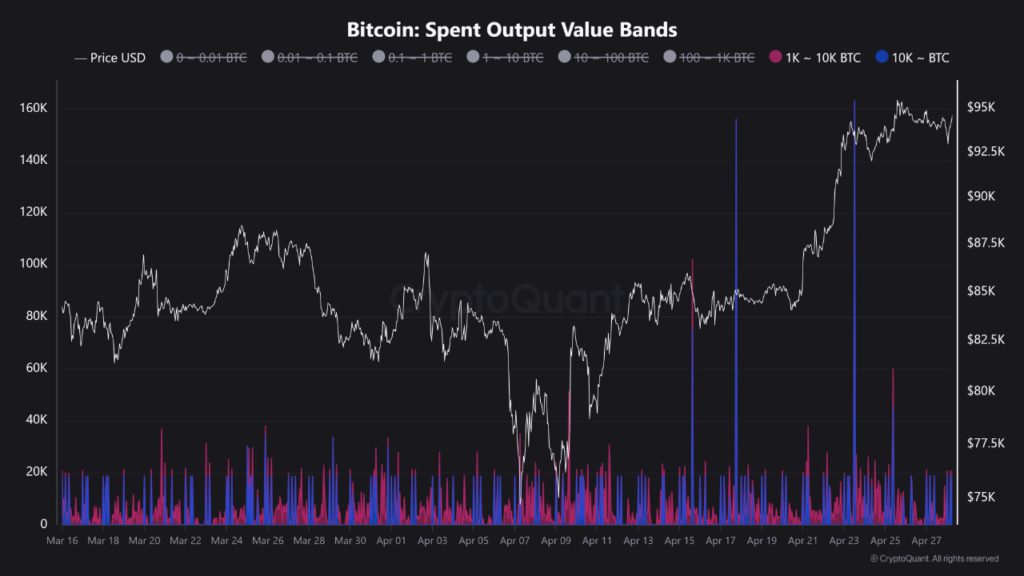

At the peak of this profit-taking period, NRPL reached a value of around $3 billion. The Spent Output Profit Ratio (SOPR) metric also confirmed the dominance of this profit-taking activity. Large investors, especially those with more than 1,000 Bitcoin (BTC), appear to have made large transactions that are worth keeping an eye on due to their significant influence on the market.

Whale’s role in market dynamics

Large investors or “whales” often have a strong influence in the Bitcoin (BTC) market. Their activities, especially when it comes to large transfers, are always in the limelight as they can provide signals about upcoming market trends. In this case, profit-taking activities by whales may have contributed to the current price stagnation.

Observing their movements can provide valuable insights into the market’s possible next direction. If the whales start accumulating Bitcoin (BTC) again or reduce their selling activities, this could be a strong bullish indicator for the market.

Conclusion

Although Bitcoin (BTC) is currently hovering around $95,000, with a gain of around 10% in the last week, on-chain dynamics and major investor activity need to be constantly monitored to understand the next direction of the market. This analysis shows how important on-chain data is in predicting Bitcoin (BTC) price movements.

Also Read: Is Bitcoin Miner’s Sales Hold a Good Sign?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Rally Stalled, On-Chain Data Provides Hints. Accessed on April 29, 2025

- Featured Image: CNBC