BONK Price Prediction: Does the Surge in Short Positions Threaten its Breakout?

Jakarta, Pintu News – Recent in-depth analysis shows that BONK has experienced a significant breakout from its consolidation range, a zone that it has failed to break several times before. This increase pushed the price of BONK to reach $0.00002011. To validate this breakout, it is imperative for BONK to remain above the $0.00002000 zone, with the upper limit of the pattern serving as support.

Technical Analysis and Price Predictions

The MACD indicator shows a strong bullish signal with the MACD line at $0.00000121 above the $0.00000082 Signal line, as well as showing an uptrend on the histogram. This indicates that buyer dominance still has the potential to persist with additional gains, as long as there is enough buying strength in the market.

However, if BONK cannot maintain stability above $0.00002000, the price may return to the previous wedge resistance near $0.00001500. If BONK fails to maintain $0.00002000 as support, its breakout structure could be questioned, which might cause the price to drop to the $0.00001000 area. BONK’s sustained price close above $0.00002000 could boost market confidence for further price increases.

Also Read: XRP Surges to $2.32: Can it Survive Crypto Whale Selling Pressure?

Dynamics of Leverage Position and Volume

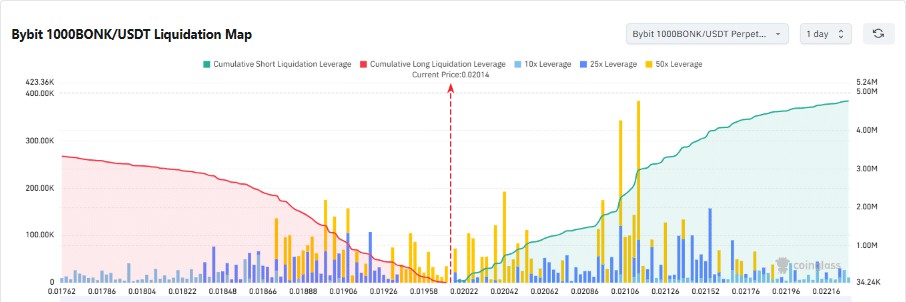

Increased short positions were seen when BONK was trading at $0.00002014, with most short leverage accumulating in the $0.00002100 region, slightly higher than the market price. The activity of traders who went long during the price drop was conservative, with their liquidation leverage reaching the $0.00001900-$0.00001960 zone, which is relatively low compared to short contracts.

A price rise above $0.00002100 could trigger heavy short liquidation, which would accelerate the market rise to $0.00002200. If BONK falls below $0.00001900, this could trigger additional market withdrawals, increasing pressure on the price.

Market Volatility and Speculation

Meanwhile, BONK at $0.021 had an Open Interest (OI) of $267.61 million and volume of $659.60 million. Although OI has increased from its mid-April level of around $150 million, volume remains consistently low. This divergence could reflect speculative positions that are not fully based on a lot of conviction, which could help induce volatility if prices make significant moves.

The strong long and short positions formed suggest that BONK’s next move is highly dependent on market volatility. The excessive short positions suggest that although traders may be expecting a decline, breaking resistance could trigger a strong short squeeze.

Conclusion

Given the strong indications from technical indicators and complex market dynamics, market participants should remain vigilant on BONK’s further price movements. Stability above key levels and market reaction to leveraged positions will determine the direction of BONK’s future price trend.

Also Read: Is Bitcoin Miner’s Sales Hold a Good Sign?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bonk Price Prediction: Is its breakout at risk after uptick in short positions?. Accessed on April 30, 2025

- Featured Image: CoinPedia