Bitcoin Crashes to $93,000 — Massive Liquidations Rock the Crypto Market!

Jakarta, Pintu News – Bitcoin price came under significant pressure today, May 5, 2025, with the trading value slipping to around $93,000. This decline marks a continuation of the correction trend that has been in place since hitting a 10-week high.

Mounting selling pressure triggered a wave of liquidation in the derivatives market, reflecting the rising tension among market participants ahead of the interest rate decision by the Federal Reserve. High volatility is also expected to continue in the next few days.

Then, how will the Bitcoin price move today?

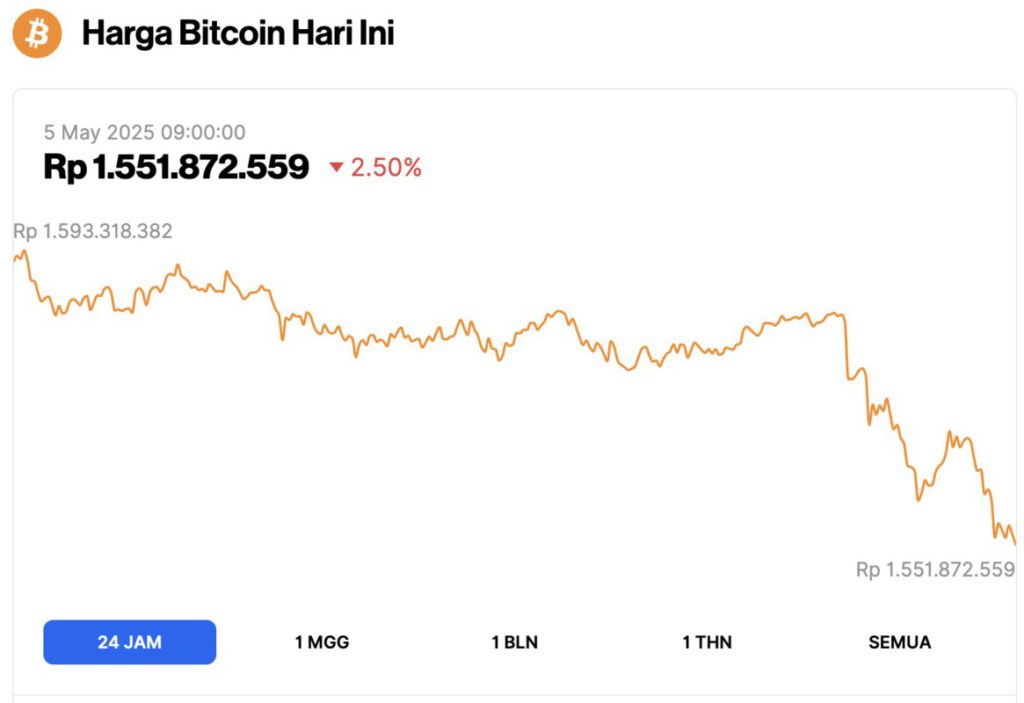

Bitcoin Price Drops 2.50% in 24 Hours

As of May 5, 2025, Bitcoin was trading at $93,633, equivalent to approximately IDR 1,551,872,559, marking a 2.50% drop over the past 24 hours. Throughout the day, BTC reached a high of IDR 1,593,318,382 and dipped to a low of IDR 1,551,872,559.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.86 trillion, with trading volume in the last 24 hours also up 29% to $$19.81 billion.

Read also: Vitalik Buterin Initiative to Change Ethereum to Be Simpler Like Bitcoin!

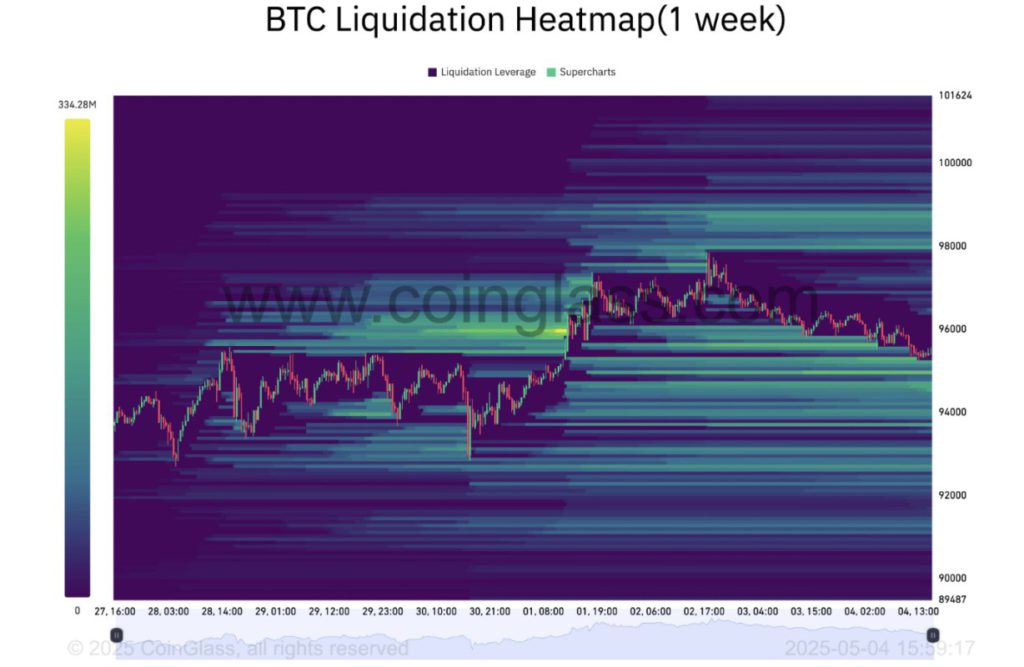

BTC Price Liquidation Increases After Hitting a 10-Week High

Data from Cointelegraph Markets Pro and TradingView (4/5/24) shows that the BTC/USD pair has declined from the highest level in recent months, near the opening price of May.

When it hits areas of concentrated liquidity around the current market price, Bitcoin creates the potential for volatility as market participants debate key levels.

“Clusters of solid long positions are in the range of 95.7K to 96K, while large short positions are at 96.5K to 97K – right around the current price (~96.2K),” wrote popular trader TheKingfisher in his analysis on the X platform.

“They are price magnets. Expect volatile moves when these levels are tested.”

The latest data from CoinGlass shows that prices are colliding with buying liquidity, with the majority of ask concentrated around $97,200.

In the past week, there have been several liquidity “drawdowns”, and some analysts predict that this pattern could continue, especially as the price approaches the psychological $100,000 level.

“Positions from $94K to $97K were swept over the weekend,” summarized the BitBull trader.

Meanwhile, crypto analyst and entrepreneur Michaël van de Poppe thinks that BTC/USD still has room to test support levels again without having to undo the latest recovery trend.

“I’d rather see BTC stay above $91,500-92,000,” he told his followers on X.

“That would confirm the continuation of the trend towards a new record high price , as the previous support zone again serves as support.”

Read also: Pi Network in May 2025: Will there be a Revival?

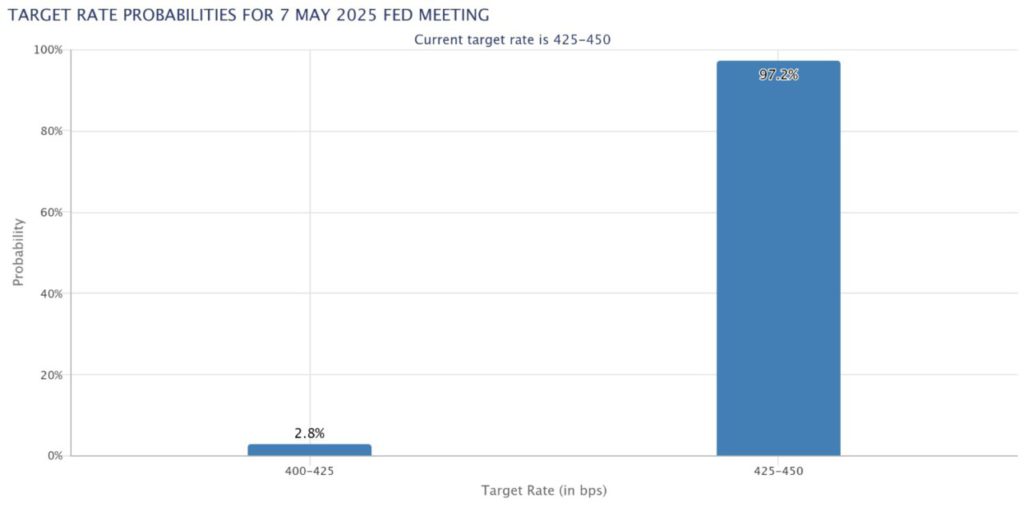

Bitcoin price drop expected ahead of Fed rate decision

As the new week approaches, expectations of increased market volatility are high as the US Federal Reserve is set to make a decision on interest rates.

As reported by the Cointelegraph website, market sentiment was in a sensitive situation ahead of the announcement. Recession warnings and pressure from former President Donald Trump combined with hawkish policy signals from Fed officials.

However, the latest data from CME Group’s FedWatch Tool shows that the chances of a rate cut on May 7 remain very slim.

“Keep in mind that crypto and altcoin markets tend to correct in the week before the Fed meeting,” commented analyst Van de Poppe.

“I expect this correction to end around Tuesday, after which prices will start rising again.”

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin eyes $95K retest as traders brace for Fed rate cut volatility. Accessed on May 5, 2025