Ethereum Dips 2% Today (May 5) — Is a Major Rebound Just Around the Corner?

Jakarta, Pintu News – On May 4, 2025, Ethereum managed to gain around 1%, despite the general crypto market being under pressure. This rise was in line with a spike in one of the important momentum metrics, the buy-sell taker ratio, which is now at its highest level in the last 30 days.

This indicates renewed buying pressure in the ETH futures market, reinforcing bullish sentiment among traders. So, how will Ethereum price move today?

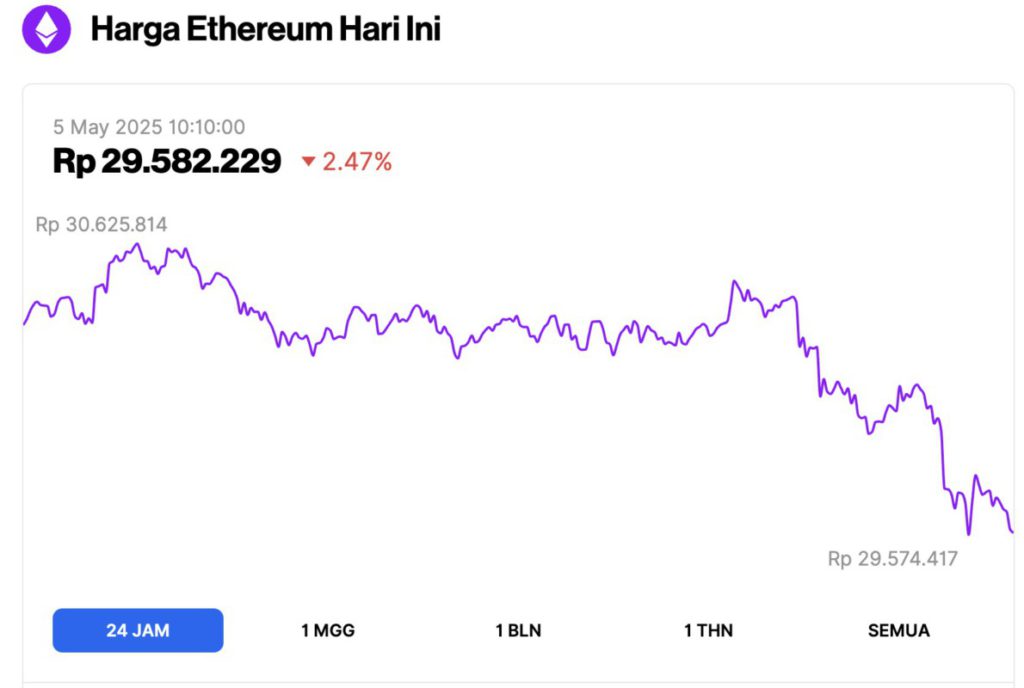

Ethereum Price Drops 2.47% in 24 Hours

As of May 5, 2025, Ethereum (ETH) was trading at approximately $1,796, or around IDR 29,582,229 — marking a 2.47% decline over the past 24 hours. During this time, ETH reached a daily high of IDR 30,625,814 and a low of IDR 29,574,417.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $216.89 billion, with daily trading volume rising 13% to $8.95 billion within the last 24 hours.

Read also: Vitalik Buterin Initiative to Change Ethereum to Be Simpler Like Bitcoin!

Traders Optimistic ETH will Rise due to Buy Pressure and Strong Fundamentals

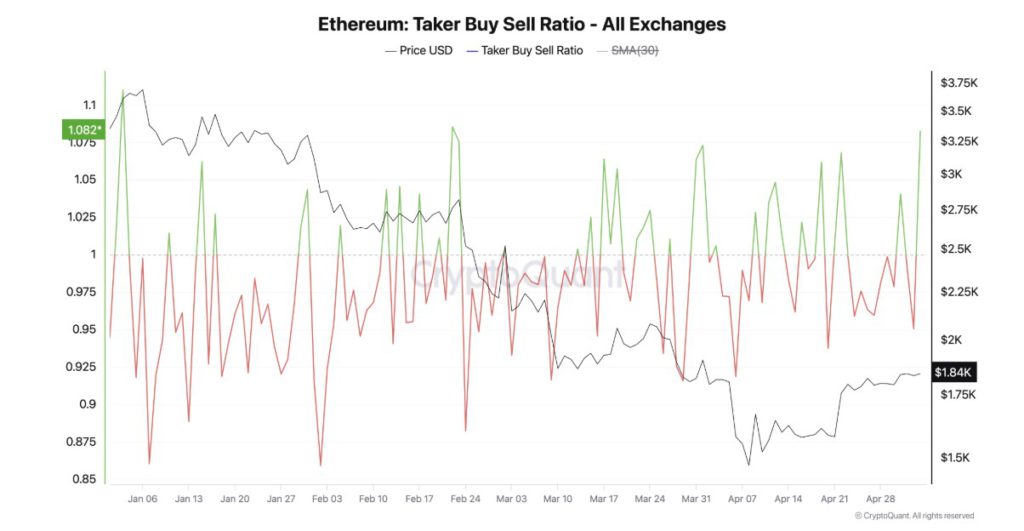

According to data from CryptoQuant (4/5/25), the buy-sell taker ratio for ETH is currently at 1.08, which is its highest level since early April.

This ratio measures the ratio between buy and sell volumes in the ETH futures market. A value above 1 indicates that more traders are aggressively buying ETH contracts than selling them. Conversely, if the value is below 1, it means that selling pressure is dominant.

At 1.08, the ratio shows a strong tendency towards buying, reflecting traders’ increasing confidence that ETH prices are likely to continue rising.

Additionally, the Relative Strength Index (RSI) for this altcoin is also showing an uptrend, which supports this optimistic sentiment. The RSI is currently at 58.39 and continues to rise.

The RSI indicator is used to measure market conditions whether an asset is overbought or oversold. The scale ranges from 0 to 100, where values above 70 indicate an overbought condition and a risk of decline, while values below 30 indicate oversold and a potential rebound.

This RSI reading on ETH reinforces the bullish view on the altcoin, and emphasizes the likelihood that the price will continue to strengthen going forward.

Read also: Bitcoin Crashes to $93,000 — Massive Liquidations Rock the Crypto Market!

ETH Builds Strength above Short-term Support

On May 4, 2025, the ETH price was above the 20-day exponential moving average (EMA), which acts as dynamic support below the price, at the level of $1,770.

The 20-day EMA calculates the average price of an asset over the last 20 trading days, with more weight given to the most recent prices.

If the asset’s price moves above this EMA line, it signals short-term bullish momentum. This means that the price of ETH has recently been trending higher than the average of the last 20 days. Traders usually take this as a signal of base strength or the beginning of an uptrend.

As such, ETH has the potential to continue its rally towards $2,027 if buying pressure continues to increase.

On the contrary, if buying activity weakens, ETH could lose its recent gains, break below the 20-day EMA, and possibly drop to around $1,385.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum (ETH) Bulls Regain Strength as Buying Pressure Hits Monthly High. Accessed on May 5, 2025