Potential Changes to China’s Bitcoin Mining Ban Policy Under Trump Tariffs

Jakarta, Pintu News – China has been known for its anti-cryptocurrency stance, including against Bitcoin and other cryptocurrencies. However, with the changing global dynamics, especially with the new dominance achieved by the United States in terms of Bitcoin mining, the question arises whether China will change its policy.

This article reviews the latest developments regarding US dominance in the Bitcoin mining industry and how political pressure, including tariffs imposed by President Donald Trump, may affect China’s policies.

US Dominance in Bitcoin Mining

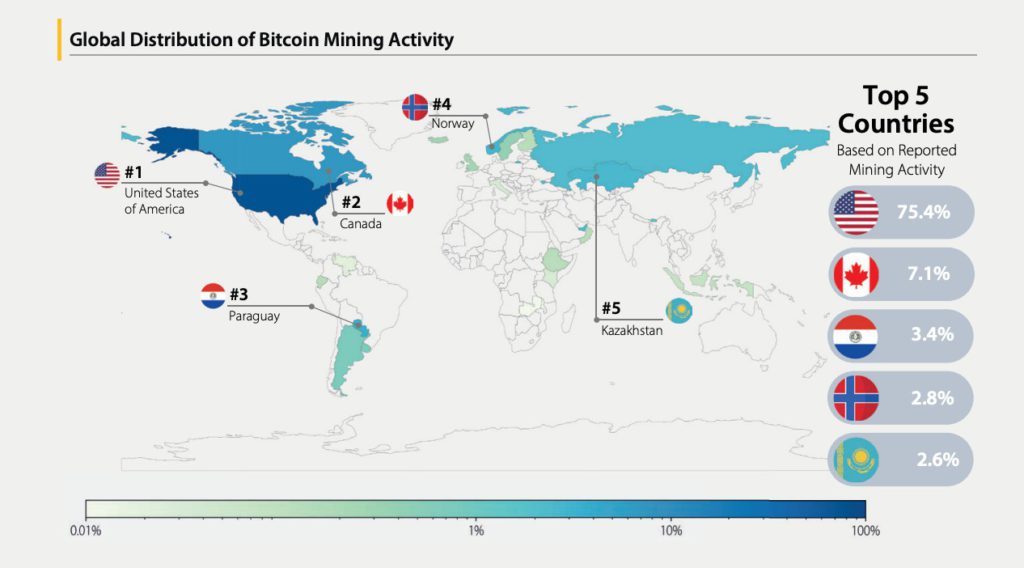

According to a recent report from the Cambridge Center for Alternative Finance (CCAF), the United States now controls 75.4% of the total global Bitcoin hashrate. This marks a major shift in the Bitcoin mining industry that was previously dominated by China. In 2017, China was a major leader in Bitcoin mining, utilizing low electricity costs and extensive mining infrastructure to control more than 75% of the world’s total hashrate.

However, in 2019, China began to take decisive steps by banning cryptocurrency mining activities. Some provinces in China even began to shut down their mining operations. This ban was further strengthened in 2021 when the Chinese government declared that all crypto-related transactions were illegal, including banning foreign crypto exchanges from serving Chinese citizens.

Also Read: 3 Altcoins Ready to Surge Before SEC-BlackRock Meeting, See Why!

Despite Ban, Mining Activities Continue in China

Despite the official ban, Bitcoin mining activity in China has not completely stopped. A recent report from Bitcoin environmental impact analyst Daniel Batten shows that China still controls around 15% of the total global hashrate. This suggests that despite the ban, the existing infrastructure in China can still support mining activities, both directly and through methods that are not officially registered.

Nic Puckrin, co-founder of Coin Bureau, stated that although China will not publicly change its policy anytime soon, potential trade tensions and US dominance in Bitcoin mining might motivate China to reconsider their position. Puckrin also highlighted that China has geographical and technological advantages, especially when it comes to the production of mining hardware such as the Application-Specific Integrated Circuit (ASIC) used to mine Bitcoin.

China and its Digital Currency Strategy

In addition to focusing on Bitcoin mining, China has also shown significant interest in the development of digital currencies, such as the digital yuan (e-CNY). This is in line with China’s efforts to reduce its dependence on the US dollar and strengthen the yuan’s position in the global market. The development of the digital yuan is also seen as a step to support the de-dollarization of the Chinese economy, with the aim of reducing the dominance of the US dollar in international trade.

Temujin Louie, CEO of Wanchain, mentioned that while China remains obstructive to the use of domestic cryptocurrencies, they remain active in the development of other digital assets, such as CBDC (Central Bank Digital Currency) research and the launch of the digital yuan. Louie also emphasized that China’s policies are not solely driven by pressure from the US, but also by global market trends and China’s own domestic strategies.

Trade Tension Risks and US Influence

Trade tensions between the US and China triggered by trade tariffs imposed by President Donald Trump add a layer of uncertainty in the cost efficiency of Bitcoin mining operations in the US. Puckrin suggests that China could use this moment to reconsider their Bitcoin mining policies, although they are unlikely to make any major changes immediately. China, according to Puckrin, is likely to adopt a more cautious and measured approach in response to these changes.

Will China Change Its Stance on Crypto?

Although China’s policy towards cryptocurrencies looks contradictory, some analysis suggests that there is a possibility of a change in policy direction, especially in relation to the de-dollarization strategy. Several countries, including China and Russia, have started using Bitcoin (BTC) in energy trade to circumvent the dominance of the US dollar. This is evidence that the use of cryptocurrencies as an alternative to international transactions is gaining attention at the global level.

In this case, China may choose to change their policy quietly, by adjusting their policy towards cryptocurrencies in order to support efforts to internationalize the digital yuan or e-CNY. This process, while perhaps not directly related to US dominance in mining, suggests that China retains a broader strategy in dealing with global challenges.

Conclusion

With the growing US dominance in the Bitcoin mining industry and global trade tensions, China may need to revisit its ban policy on cryptocurrency mining. Although this policy remains in place, global geopolitical and economic factors, such as de-dollarization and the development of digital currencies, could influence China’s future decisions regarding cryptocurrencies.

Also Read: New Hampshire Becomes a Pioneer, Officially Keeping Bitcoin as a Reserve!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto.“Will China Drop Its Bitcoin Mining Ban Amid Trump’s Tariff Pressure?” Accessed May 7, 2025.

- Featured Image: Coingape