3 Altcoins that are poised to surge before the SEC-BlackRock meeting, see why!

Jakarta, Pintu News – The upcoming meeting between the United States Securities and Exchange Commission (SEC) and BlackRock is a crucial moment for the crypto market. Several altcoins are showing significant growth potential ahead of the meeting, driven by innovation and strategic partnerships with major financial institutions. Here are in-depth reviews of five such altcoins.

1. Ondo Finance (ONDO)

Ondo Finance introduces an innovative approach in combining traditional financial instruments with blockchain technology. With the SEC meeting fast approaching, the current price of ONDO is $0.8715, showing an increase of 0.79% in the past day. This initiative opens up opportunities for traditional investors to engage in crypto markets in a more familiar and structured way.

Ondo Finance’s tokenization of traditional financial instruments allows assets such as bonds and stocks to be represented in the form of digital tokens. This not only increases liquidity but also facilitates access for a wide range of investors. As such, ONDO has the potential to be an important bridge between the world of conventional finance and the crypto ecosystem.

Also Read: BONK Freefalls 8% in 24 Hours: Check out the Price Levels that Can Prevent Further Declines!

2. Ethereum (ETH)

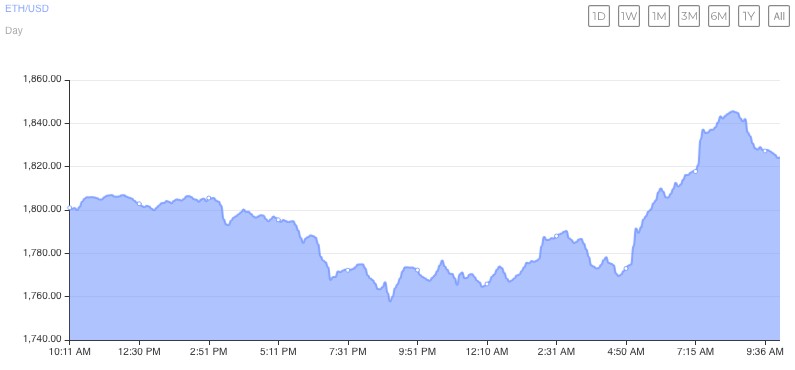

Ethereum continues to strengthen its position as the premier platform for decentralized applications and tokenization projects. Support from BlackRock through the largest spot Ethereum ETF, ETHA, adds legitimacy and exposure for Ethereum in the eyes of institutional investors. Currently, Ethereum is trading at $1,845.84, with a gain of 1.74% in the past day.

Ethereum’s price prediction of reaching $3,793 is based on bullish technical patterns and increased interest from institutions. As the backbone of many tokenization projects, Ethereum is expected to continue dominating the market with continuous innovation and scalability improvements. The involvement of institutions like BlackRock will only strengthen Ethereum’s position in the global market.

3. Ethene (ENA)

Ethena introduced USDe, a synthetic dollar protocol that has shaken up the stablecoin market. With over $4.6 billion in circulation, the collaboration between Ethena, Securitize, and BlackRock’s BUIDL fund puts ENA in a favorable position. The current ENA price is $0.2737, with a 4.61% gain in the past day.

Ethena’s USDe protocol offers stability and security in crypto transactions, making it an attractive option for investors seeking alternatives to traditional fiat currencies. With backing from big players like BlackRock, Ethena has the potential to play an important role in the evolution of the stablecoin market and wider crypto adoption.

Conclusion

In conclusion, the meeting between the SEC and BlackRock will probably be an important turning point for several altcoins that have demonstrated innovation and strategic partnerships. With increased institutional interest and the evolution of the regulatory framework, altcoins such as Ethereum (ETH), Ondo Finance , and Ethena are positioned for significant potential growth.

Also Read: Ethereum Hangs Above $1,770: Can It Reach $2,030 Next?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. 5 Altcoins Set to Surge Before SEC BlackRock Meeting – Here’s Why. Accessed on May 7, 2025

- Featured Image: Generated by Ai