Bitcoin Soars by $98,000 in a Day — Whale Buying Frenzy Could Spark the Next Major Bull Run!

Jakarta, Pintu News – Ahead of the FOMC meeting and after positive developments in trade talks between the US and China, the price of Bitcoin rose again, recording and breaking the $98,000 level today.

Currently, BTC is eyeing a major breakthrough above the $100,000 level, with the potential to set a new record high in the near future. Then, how is the current Bitcoin price movement?

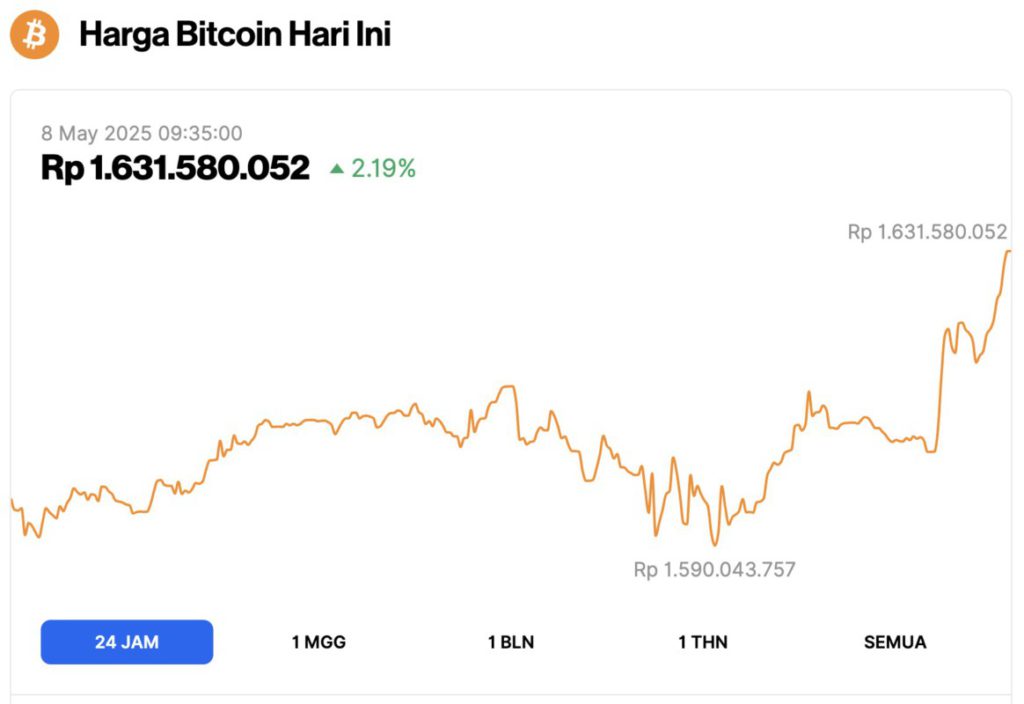

Bitcoin Price Rises 2.19% in 24 Hours

On May 8, 2025, Bitcoin’s price reached $98,796, equivalent to IDR 1,631,580,052 — marking a 2.19% increase over the past 24 hours. Throughout the day, BTC fluctuated between a low of IDR 1,590,043,747 and a high of IDR 1,631,580,052.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.96 trillion, with trading volume in the last 24 hours also up 41% to $43.67 billion.

Read also: Binance Founder Changpeng Zhao Reveals the 4 Altcoin Sectors Ready to Explode!

Bitcoin (BTC) Price at a Decision Point: Up or Down

In its latest report, crypto exchange Bitfinex noted that BTC has a chance to set a new record only if the price is able to stay above the crucial support level of $95,000. In a market report dated May 6, the exchange stated:

“The $95,000 level – which is currently in a consolidation phase – is a very important pivot point, serving as the lower limit of the three-month range that forms the market structure between November 2024 and February 2025.”

The report from Bitfinex also mentioned that if BTC is able to hold above the $95,000 level, it would mark a “structural shift” back to a bullish trend, opening up the opportunity for a new record high price. However, if it fails, there could be a major downturn in the price trend.

Analysts think that the next few days will be crucial to determine whether Bitcoin will experience a sustained breakthrough or retreat to retest lower support levels.

The US-China trade war negotiations and Jerome Powell’s positive comments in the FOMC meeting could determine the direction of Bitcoin’s next move.

Meanwhile, the US Federal Reserve has launched the largest bond-buying program in three years since 2021, injecting $20 billion per day, according to an update from Money Guru Digital on platform X.

On the other hand, the market is currently anticipating a possible interest rate cut in the FOMC meeting to be held on May 7.

Bitcoin (BTC) Whale Accumulation Increases

Large Bitcoin wallets holding between 10 and 10,000 BTC – often an indicator of market health – have accumulated an additional 81,338 BTC in the past six weeks, an increase of 0.61% amid a period of high volatility, according to a report from blockchain analytics firm Santiment.

Read also: Donald Trump Hosts Lavish Crypto Dinners Amidst Rising Ethics Scandals!

Institutional interest was also evident from the strong inflows into spot Bitcoin ETFs, especially in BlackRock’s IBIT, which absorbed most of the flows. IBIT recorded 16 consecutive days of inflows, with a value close to $5 billion.

In contrast, small wallets holding less than 0.1 BTC – often associated with lagging or opposing price movements – actually reduced their holdings by 290 BTC, equivalent to a 0.60% drop.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Bitcoin (BTC) Price Eyes $100K Breakout to All-Time High if This Support Holds. Accessed on May 8, 2025