Bitcoin Poised for a Big Spike Amid US Economic Chaos?

Jakarta, Pintu News – Amid growing economic instability in the United States, Bitcoin is back in the spotlight as a potential global safe asset. With investor confidence in traditional markets starting to falter, the crypto market’s leading asset is showing impressive signs of resilience.

Bitcoin: A Value Shield Amid Economic Uncertainty

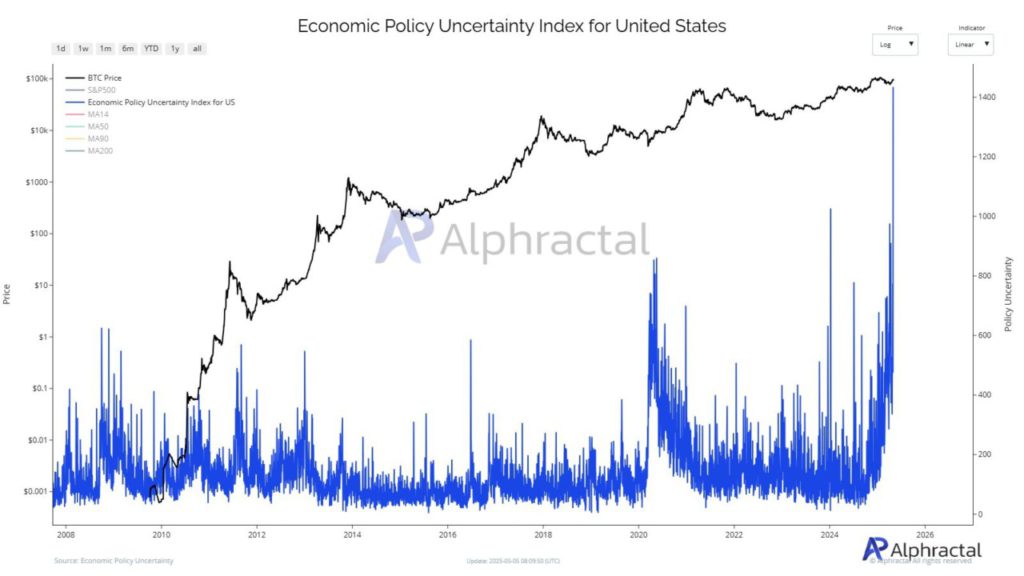

The US economic policy uncertainty index has reached a new high in 2025, signaling an unprecedented increase in uncertainty. Every previous spike in this index has corresponded with bullish momentum for Bitcoin (BTC), and this latest spike is the most extreme yet.

The second Trump administration’s escalated tariff policy, the re-imposition of the debt limit, the Federal Reserve’s stalled policies, and the US dollar’s credibility crisis have fueled investor anxiety. Coupled with geopolitical risks and regulatory uncertainty, traditional markets are experiencing high volatility.

In contrast, Bitcoin (BTC) appears to have structural immunity to such chaos. With declining confidence in fiat currencies, Bitcoin (BTC) is increasingly seen not just as a speculation, but as a strategic hedge that may be entering its next phase of accumulation ahead of a major surge.

Also Read: 3 Altcoins Ready to Surge Before SEC-BlackRock Meeting, See Why!

Reduced Selling Pressure on Bitcoin

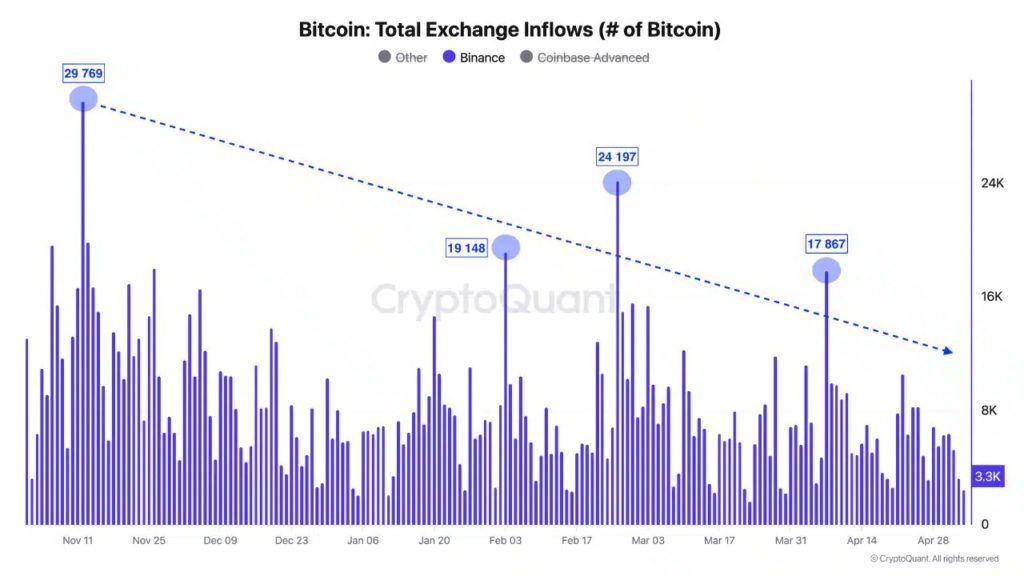

Bitcoin (BTC) inflows to Binance have shown a steady decline since the end of 2024, indicating an imminent decrease in selling pressure. Although there have been some notable spikes above 17,000 BTC, the trend is clear: fewer coins are being moved to exchanges for liquidation. With macro risks rising and investor confidence in the fiat system faltering, this may reflect a growing belief in Bitcoin’s (BTC) long-term role as a hedge.

Bitcoin Price Outlook

Bitcoin (BTC) is trading near $94,000 at press time, experiencing a minor pullback after testing the $96,000 mark. The Relative Strength Index (RSI) has dropped from overbought territory to around 58, indicating cooling momentum without suggesting overselling.

Meanwhile, the Moving Average Convergence Divergence (MACD) is approaching a bearish crossover; a potential consolidation or short-term weakness. However, the price structure remains intact above the previous resistance level, which now serves as support. If the bears find a foothold above $91,000-$92,000, the bulls could quickly take back control.

Conclusion

With increasing economic uncertainty and diminishing confidence in fiat currencies, Bitcoin (BTC) offers an attractive alternative as a safe asset. The current conditions may be an opportunity for Bitcoin (BTC) to not only weather the storm but also to strengthen its position as an important global asset.

Also Read: New Hampshire Becomes a Pioneer, Officially Keeping Bitcoin as a Reserve!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Is Bitcoin quietly gearing up for a major breakout amid economic chaos?. Accessed on May 7, 2025

- Featured Image: Generated by AI