Ethereum Spot Volume Declines While Long-Term Holders Continue to Accumulate

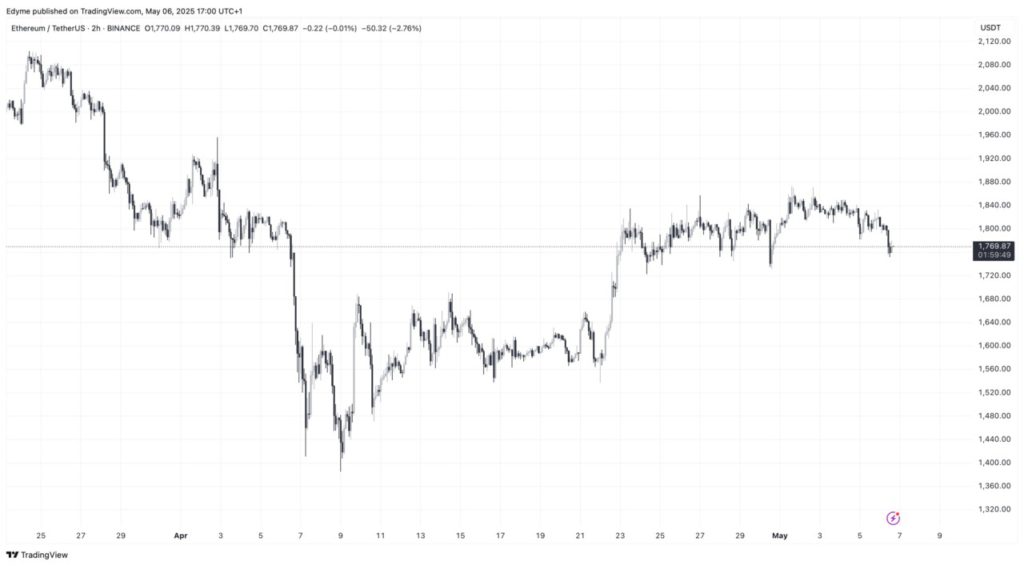

Jakarta, Pintu News – Ethereum appears to be extending its period of price stagnation, trading at $1,770 currently. The asset has dropped 3% over the past week and 1.6% in the last 24 hours, continuing its corrective trend after reaching a cyclical peak of $4,107 in December 2024. Despite limited price movement, on-chain data suggests that some fundamental shifts could affect market behavior in the short term.

Sharp Drop in Ethereum Spot Volume

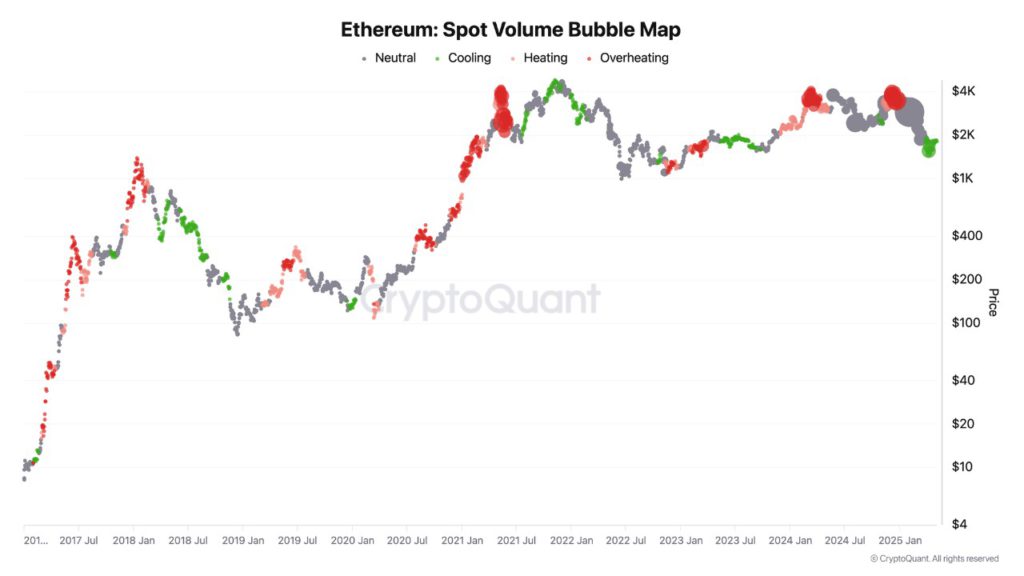

According to CryptoQuant analyst Darkfost, Ethereum’s spot volume has been on a consistent decline. His analysis uses a bubble chart that visualizes two dimensions: the size of each bubble represents the spot volume, and the color indicates the rate of volume change.

The data shows that the bubble is getting smaller and brighter, signaling that fewer trades are being made and the rate of volume decline is slowing down. A decline in spot volume can usually be seen as a sign of waning investor interest or weak momentum.

However, Darkfost interprets it differently in the context of a market correction. He suggests that a decrease in spot volume during a downtrend may act as a stabilizing force, potentially reducing the likelihood of sharp volatility spikes caused by large sell orders.

Also Read: Will Solana Reach $420 in 2025? Check out the Prediction!

Long-term Holders Increase Exposure Despite Unrealized Losses

In a separate update, CryptoQuant analyst Carmelo Alemán explored the behavior of long-term Ethereum holders and revealed that many ETH investors continue to accumulate, despite incurring unrealized losses. An accumulation address, defined as a wallet that consistently receives ETH without significant sales, is generally considered a strong hand with a longer investment horizon.

According to Alemán, March 10 marked a pivotal moment when the average realized price of accumulating addresses fell below the market price of ETH, pushing these wallets into negative territory. Despite this, data shows that accumulating addresses have increased their balances by more than 22% between March and early May, growing from 15.5 million ETH to 19 million ETH.

Accumulation Behavior and its Implications for the Market

This behavior reflects strong conviction and suggests that long-term holders believe that Ethereum (ETH) is undervalued at current prices. Historically, this kind of accumulation during downturns has preceded upward price movements, as decreased supply in the market creates favorable conditions for a rally when demand returns.

This accumulation behavior also suggests that despite market uncertainty, there is a segment of investors who remain optimistic about Ethereum’s (ETH) long-term prospects. This could be an important indicator for other investors trying to assess market sentiment and potential price recovery.

Conclusion

Although the Ethereum (ETH) market is currently experiencing volume and price declines, an in-depth analysis of long-term holder behavior suggests a potential recovery. Investors who understand these dynamics may find opportunities in the uncertainty, considering long-term strategies that focus on accumulation and patience.

Also Read: Bitcoin Poised for a Big Spike Amid US Economic Chaos?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Spot Volume Declines While Long-Term Holders Continue Accumulating. Accessed on May 7, 2025

- Featured Image: Bitcoinist