Ethereum Steadies at $1.800 — 4 Big Reasons a Comeback Could Be Near!

Jakarta, Pintu News – Ethereum has experienced five consecutive months of decline. However, entering May, there is growing optimism.

Historical trends, on-chain data, accumulation behavior by large investors (whales), as well as upcoming technological improvements provide a strong basis for a potential price recovery.

Here are four main reasons why analysts believe ETH is likely to experience a significant recovery in May. Before that, let’s take a look at Ethereum’s current price movements!

Ethereum Price Up 1.12% in 24 Hours

As of May 8, 2025, Ethereum (ETH) was trading at approximately $1,844, or around IDR 30,454,331 — marking a 1.12% gain over the past 24 hours. Within that time, ETH dipped to a low of IDR 29,620,379 and peaked at IDR 30,572,085.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $$222.49 billion, with daily trading volume dropping 5% to $14.06 billion within the last 24 hours.

Read also: Bitcoin Soars by $98,000 in a Day — Whale Buying Frenzy Could Spark the Next Major Bull Run!

Reasons Why Ethereum Could Recover by May 2025

The first reason comes from the historical performance of ETH prices. Data from CoinGlass shows that May is historically the best month for ETH.

Over the years, ETH has averaged a 27.36% gain in May-the highest number of any month.

While not all May months end with an uptick, historical trends indicate that this month usually brings positive sentiment and an upward price push for ETH.

Given the current conditions, analysts at Cyclop expect ETH to maintain this growth trend and reach the $2,500 target by the end of the month.

“May is historically the best month for ETH. $2,500 by the end of the month,” Cyclop said.

ETH’s MVRV Ratio Hits a Low Point

Another important factor supporting the optimistic outlook is on-chain data, specifically the MVRV (Market Value to Realized Value) ratio.

According to analyst Michaël van de Poppe, ETH’s MVRV ratio is currently at its lowest point since March 2020, when the COVID-19 pandemic hit the crypto market in a big way.

A low MVRV ratio indicates that ETH is currently undervalued when compared to on-chain data. This signal has only appeared six times in the last ten years, and is usually followed by a major recovery.

Read also: Uniswap and Sony Introduce a New Era of Crypto Trading with Soneium!

The chart also shows that ETH has the potential to experience significant growth in the next 3 to 12 months.

Whale Ethereum Adds to Their ETH Holdings

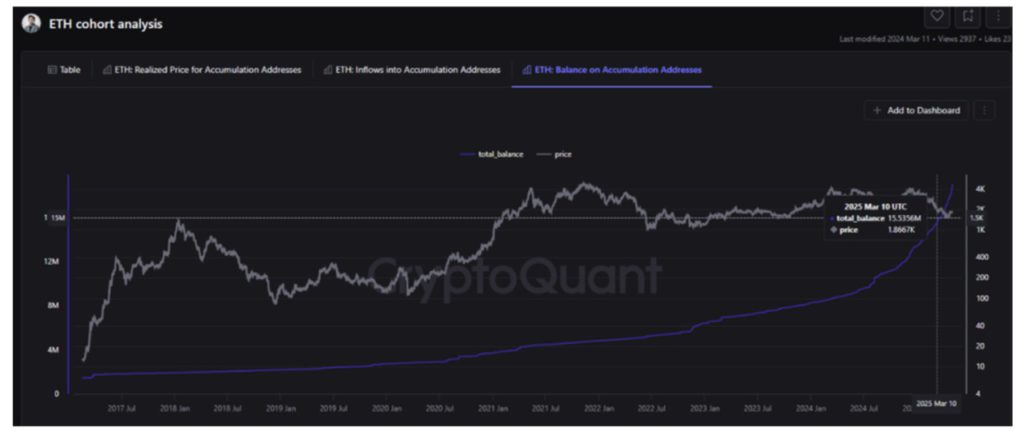

The third optimistic sign comes from the recent accumulation behavior of large investors (whales). Based on data from CryptoQuant, these investors have not changed their strategies despite the decline in ETH prices, and many accumulation addresses are still in an unrealized loss state.

Instead, they increased their ETH holdings.

On March 10, the accumulation address was recorded as having 15.5356 million ETH. By May 3, this had risen to 19.0378 million ETH – an increase of 22.54%.

Analyst Carmelo_Alemán stated, “ETH investors are showing strong faith in Ethereum assets, projects, and ecosystem. Their behavior on the network reflects structural conviction and a clear expectation of price appreciation in the short term – in line with Ethereum’s overall evolution.”

Ethereum’s Pectra Upgrade Adds to Optimism

Finally, Ethereum’s upcoming network upgrade, the Pectra upgrade, scheduled for May 7, 2025, contributed to market optimism.

These upgrades aim to improve wallet usability and user experience. This is expected to drive decentralized application (dApp) adoption and ETH demand in the long run.

Interestingly, May 7 also coincides with the FOMC (Federal Open Market Committee) meeting, where the Fed will announce its interest rate decision.

If the macroeconomic news announced is positive, this could reinforce the rise in ETH prices in the short term, along with other factors.

However, if the results of the announcement are negative, it could complicate ETH price movements during the month of May.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Analysts Highlight 4 Reasons Why ETH Price Could Rebound Strongly in May. Accessed on May 8, 2025