Donald Trump-backed World Liberty Financial Voting for USD1 Airdrop!

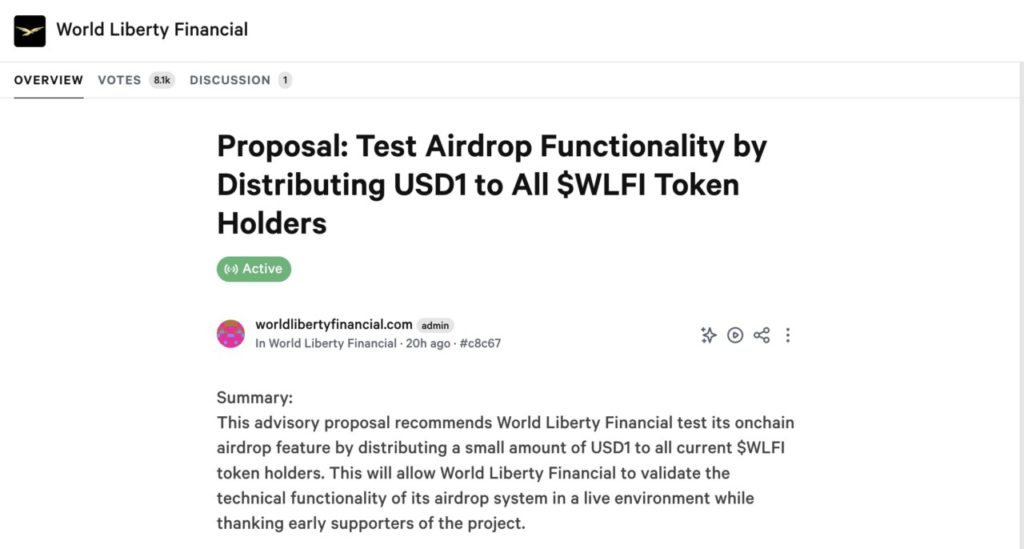

Jakarta, Pintu News – World Liberty Financial has opened voting to determine whether USD1 will be airdropped to early WLFI token holders. This vote is part of the testing of the airdrop mechanism they are developing.

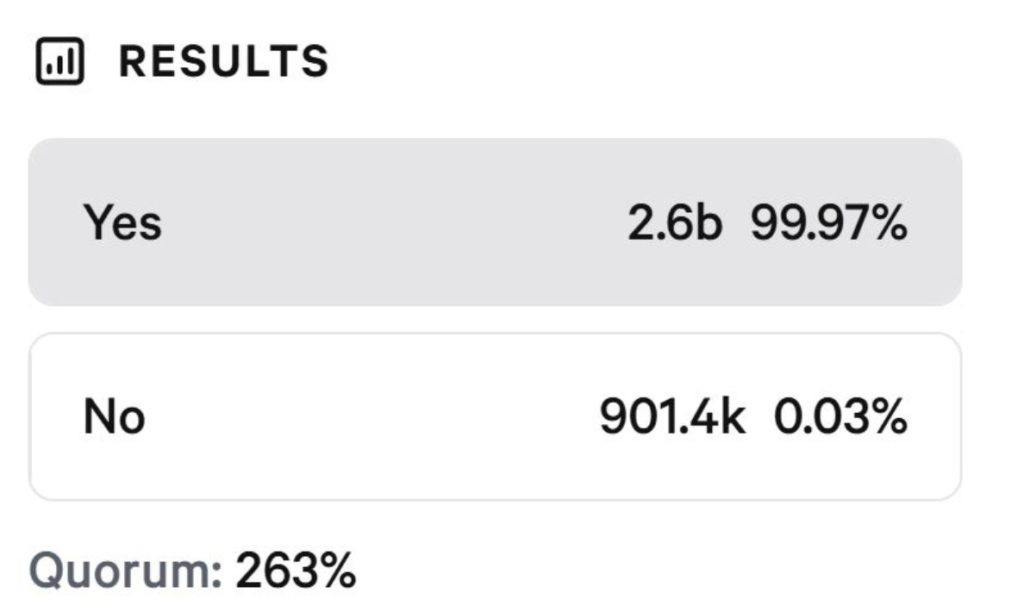

To date, support from the community has been strong with over 2.6 billion tokens, or about 99.97% of the vote, in favor of the proposal. Only a small number, around 940k tokens, are against the airdrop proposal.

World Liberty Financial (WLFI) Presents USD1 Airdrop

Crypto platform World Liberty Financial , which has the backing of the Trump family, plans to distribute a small amount of their new USD1 stablecoin – whose value is pegged to the US dollar.

Read also: Ethereum Steadies at $1.800 — 4 Big Reasons a Comeback Could Be Near!

This airdrop is intended as a token of appreciation to early holders of WLFI tokens, as well as a test run to ensure their airdrop system works well.

In a proposal submitted on May 6 at the WLFI governance forum, it was mentioned that more than 99% of the votes approved the plan. This airdrop will distribute a small amount of USD1 to eligible WLFI token holders.

“Testing the airdrop mechanism in a real-world situation is an important step to ensure the smart contract functions properly and is ready for use. This distribution is also a meaningful way to thank our early supporters and introduce them to USD1,” reads the proposal.

“This move will allow World Liberty Financial to validate the technical functionality of its airdrop system in a real-world environment, while recognizing the project’s early supporters.”

Voting Ends on May 14

The amount of USD1 to be distributed is still undetermined and will be adjusted based on the total eligible wallets and the available budget, according to the proposal.

The date of the airdrop has also not been confirmed. WLFI states that it reserves the right to “stop, suspend, modify, or terminate this airdrop trial at any time.”

Voting is scheduled to end on May 14. To date, those in favor of the proposal are ahead with 2.6 billion votes, or 99.97% of the total tokens used to vote. Meanwhile, opponents have only recorded around 901,000 votes, or 0.03%.

WLFI launched its stablecoin in early March. Since the platform was launched in September, the crypto company has completed two public token sales, raising a total of $550 million from 85,000 registered holders.

Other Countries Challenge US Dollar Stablecoin Dominance

According to a report from investment banking giant Citigroup, the market capitalization of stablecoins pegged to the US dollar surpassed $230 billion in April, a 54% increase compared to last year. The stablecoins Tether and USDC dominate about 90% of that market.

Read also: Tether Prints $1 Billion on Tron, Intensifies Competition with Ethereum!

However, some countries are beginning to announce plans to launch stablecoins backed by currencies other than the US dollar.

On April 28, three major institutions in Abu Dhabi, including the Emirati sovereign wealth fund, announced a joint initiative to launch a new stablecoin pegged to the dirham currency.

Meanwhile, on April 16, an official from the Russian finance ministry proposed plans to develop a national stablecoin. This plan comes after US authorities and stablecoin issuer Tether froze wallets connected to sanctioned Russian exchange Garantex.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. World Liberty Financial Plans Airdrop $1 WLFI Holders. Accessed on May 8, 2025

- Crypto News. World Liberty Financial Opens Vote to Airdrop $1 Stablecoin to WLFI Holders. Accessed on May 8, 2025