Pepe Coin Explodes in Price — Is This the Start of a Massive Crypto Comeback?

Jakarta, Pintu News – On May 12, 2025, the price of Pepe Coin jumped nearly 10% to reach $0.00001488, continuing the 68% upward trend that occurred last week.

This ongoing 87% price increase indicates a potential bullish pattern breakout that may continue throughout this week. In addition, PEPE’s price surge has led to the liquidation of $3.16 million worth of bearish positions, marking a strong and optimistic opening to the week.

Will this recovery lead Pepe Coin to set a new all-time record high price?

Pepe Price Analysis Targets a Massive Surge

Pepe Coin (PEPE) market price was briefly at $0.00001453, a level last seen on January 31, after 100 days. This strong price increase has managed to break the 200-day Exponential Moving Average (EMA) and the 61.80% Fibonacci level at $0.00001426. This marks an important breakout as investors witnessed a rounding bottom pattern on the PEPE technical chart.

Read also: Whale Snaps Up 70 Million Pi Coins on OKX — Is a Binance Listing Just Around the Corner?

Previously, the price of PEPE had dropped nearly 60% from $0.00001386 to $0.000005698, in the period from February 1 to March 10. However, the price formed a rounding bottom pattern above the $0.0000050 psychological demand zone, with theneckline at the 61.80% Fibonacci level.

As of May 12, the price of PEPE is trading above the neckline. If the daily closing price manages to hold above $0.00001426, this would confirm a significant breakout, with a potential upside of up to 170%.

The target is calculated by adding the depth of the semicircle formation to the breakout point, which is towards the $0.00003864 target. As such, the optimistic target of this pattern is in line with Coingape’s bullish PEPE price prediction.

As a frog-themed meme coin, PEPE managed to surpass the 200-day EMA, which prompted an increase in the daily 50 and 100 EMAs, indicating a potential positive crossover.

In addition, the rising MACD and signal lines, coupled with the strengthening green histogram, indicate a growing trend momentum.

Based on the potential breakout from the 61.80% Fibonacci level, the retracement tool is targeting the 100% level at $0.00002649, or a 75% increase. However, there is a minor resistance at the 78.60% level around $0.00001870 that could slow down PEPE’s progress towards new highs.

However, if PEPE fails to print a daily close above the neckline, the price will likely continue to fluctuate within this pattern.

Conversely, if the price drops below the 38.20% Fibonacci level around the psychological support of $0.000010, then this reversal pattern could be considered canceled. The next support is at $0.000007669.

Pepe Bull Absorbed $18.55 Million in Supply Pressure Last Week

The latest surge in PEPE prices reflects the short-term tug-of-war between profit-taking traders and long-term holders.

Based on data from Coinglass, PEPE inflows/outflows on the spot market showed net flows of $10.52 million to the exchange on May 12, followed by inflows of $18.55 million over the past week.

Despite the surge in supply, the PEPE price rally continued as buyers managed to absorb the selling pressure, signaling the strength of the bulls.

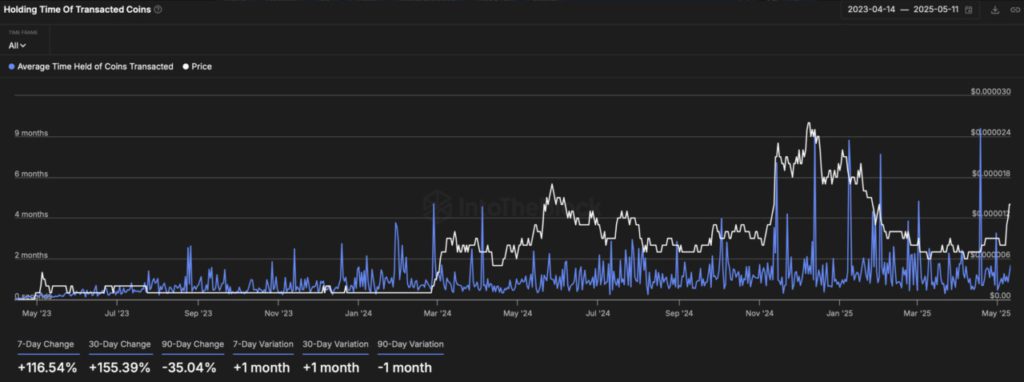

Meanwhile, data from IntoTheBlock shows that the average holding time of traded coins has remained below one month over the past few weeks. This indicates that the majority of activity is still dominated by short-term traders taking profits, while long-term investors choose to wait and see.

Read also: Dogecoin Tanks 6% in a Day—$20 Million in Long Positions Obliterated!

Open Interest Approaches $600 Million as $1 Million Worth of Short Positions Are Liquidated

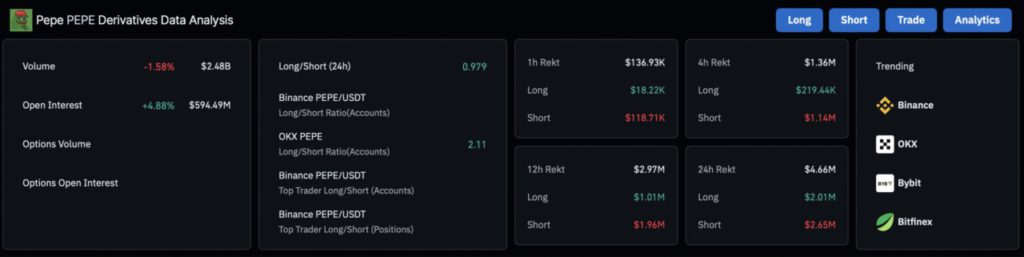

PEPE’s momentum strengthened further as derivatives data reflected increased market optimism.

According to data from Coinglass, Open Interest (OI) in the PEPE futures contract is approaching the $600 million mark, signaling a huge surge in leveraged trading activity.

In a bullish context, the liquidation of over $1 million worth of short positions in just four hours suggests a forced dissolution of bearish bets.

As traders who bet against PEPE are trapped by the price surge, the chances of a new breakout rally increase.

Amidst these conditions, according to HypurrScan, one whale is known to have taken a long position with 3x leverage on PEPE. This entity has deposited $2.29 million USDC into the Hyperliquid platform.

The whale is already known in the industry for previously betting $5 million USDC on HYPE and recording a floating profit of $2.99 million.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. PEPE Coin Price Eyes Record High With Bulls to Confirm Breakout Rally Amid $3M Short Liquidations. Accessed on May 13, 2025