Will Solana (SOL) Experience a Short Squeeze? Here’s the Analysis!

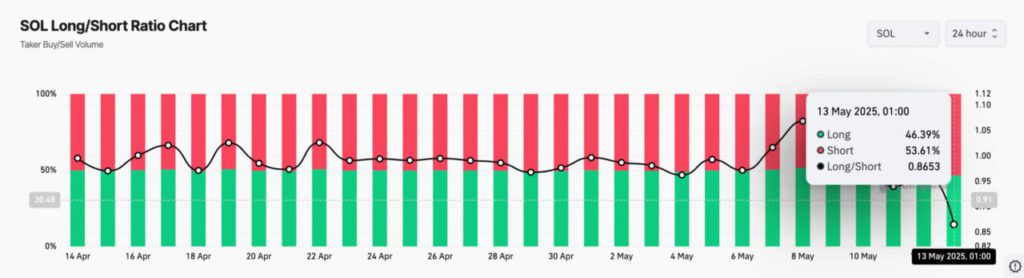

Jakarta, Pintu News – Amidst the trend of accumulating short positions against Solana , the market is exhibiting unique dynamics. Although Solana (SOL) still leads in trading volume on the DEX, the long/short ratio declining to 0.86 in the last 30 days raises concerns of a short squeeze. This situation caught the attention of traders and analysts around the world.

Market Sentiment Turns Bearish

Solana’s Long/Short Ratio (SOL) has dropped drastically to 0.8653 as of May 13, marking the lowest point in the last 30 days. This indicates that short positions are now outperforming long positions by a significant margin, at 53.61% versus 46.39%. This change in sentiment comes despite Solana (SOL) still leading in trading volume on the DEX.

This move may be an indication of market capitulation or could even be the start of a deeper decline. Analysts are watching closely to see if this will lead to a short squeeze, where prices suddenly spike as short traders are forced to buy back assets to cover their positions.

Also Read: Bitcoin (BTC) Breaks $100K: What are the Hidden Risks Lurking?

Solana (SOL) dominance in DEX

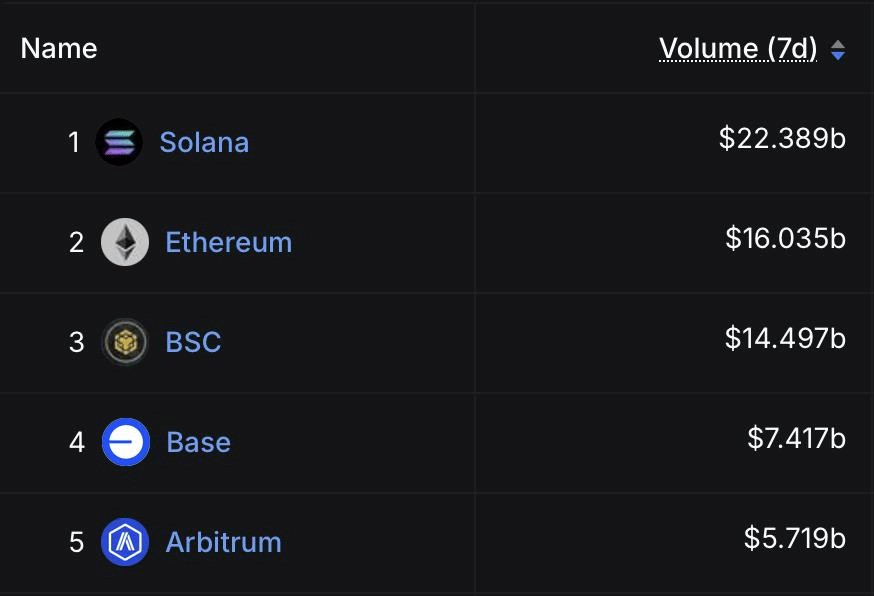

Despite increased bearish positioning, Solana (SOL) continues to dominate DEX activity by a significant margin. In the last seven days, Solana (SOL) recorded a trading volume of $22.4 billion, outperforming Ethereum by only $6 billion and far ahead of Binance Smart Chain (BSC), Base, and Arbitrum.

The network’s high performance and low fees continue to attract traders, meme coins, and liquidity. Despite fears of a short squeeze, this dominance shows the strong confidence that some market participants still have in Solana (SOL). This suggests that despite selling pressure, there are still strong inflows that could drive price recovery.

Solana (SOL) Price Outlook

Currently, Solana (SOL) is trading around $174.53, consolidating after a sharp rally earlier in the month. The RSI indicator stands at 71.83, indicating overbought conditions that may limit price gains in the short term. Meanwhile, the MACD is still in bullish territory with a clear divergence above the signal line, suggesting that momentum has not been completely lost.

If Solana (SOL) manages to break above $176, it could target the $185-$190 range. However, if it fails to hold the $170 support zone, it may trigger a retracement towards $160. Traders and investors are advised to keep an eye on these indicators to make informed decisions.

Conclusion

With ever-changing market dynamics, Solana (SOL) remains a hot topic among crypto investors and analysts. Despite the bearish tendencies, the strong performance in DEX and technical indicators still showing strength give hope for a recovery. Market participants should remain wary of the potential for high volatility in the days ahead.

Also Read: GD Culture Group Invests $300 Million in Bitcoin and Trump Memecoins

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana short squeeze fears arise as traders bet against the network. Accessed on May 14, 2025

- Featured Image: DL News