Shiba Inu Breaks $0.000015, SHIB Remains Resilient Amid Trump Coin Volatility!

Jakarta, Pintu News – After shaking up the market with an impressive surge earlier in the year, Shiba Inu is back in the spotlight with a performance that shows technical strength amidst pressure from the memecoin sector.

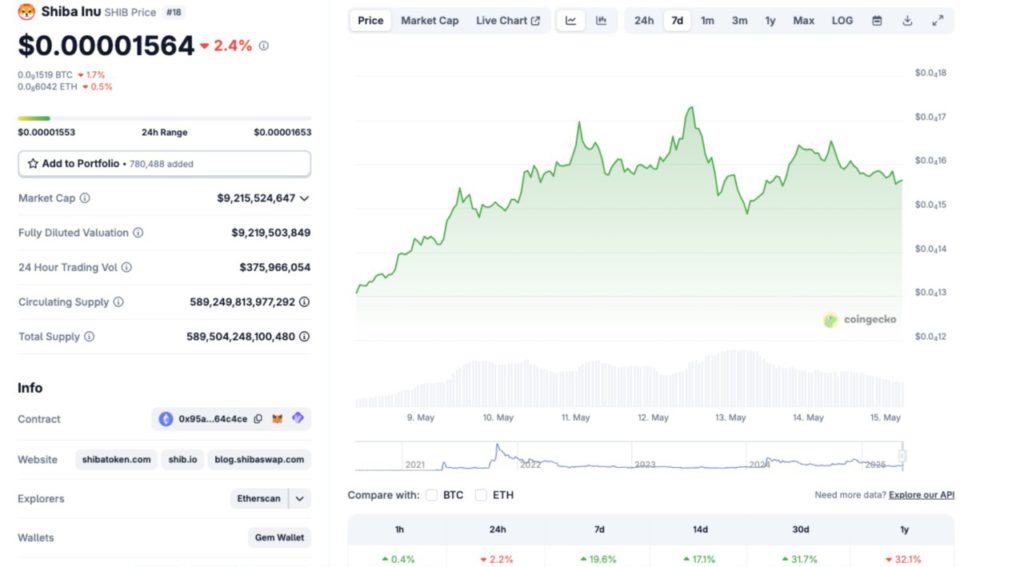

While volatility remains high-fueled by dynamics such as the surge of funds into Trump Coin and short-term price corrections-SHIB is showing remarkable resilience. With prices holding above the key $0.000015 level, trading volumes remaining active, and technical signals leaning bullish, analysts and traders are starting to consider the potential for a significant rebound.

Shiba Inu Remains Resilient Amid $300 Million Trump Coin Volatility

Shiba Inu (SHIB) managed to hold above the $0.000015 level on Wednesday (14/5), despite falling 3.6% intraday, following the turmoil in theecoin market due to a large cash injection into Trump Coin.

A $300 million buyout by a Chinese tech company sparked widespread concerns in the market regarding potential political and regulatory pressure. The company reportedly has ties to TikTok stakeholders, and now controls nearly 11% of Trump Coin’s $2.7 billion market capitalization.

Read also: Is Shiba Inu About to Soar? Bull Flag Pattern and Burn Rate Surge Spark Major Rebound Hopes!

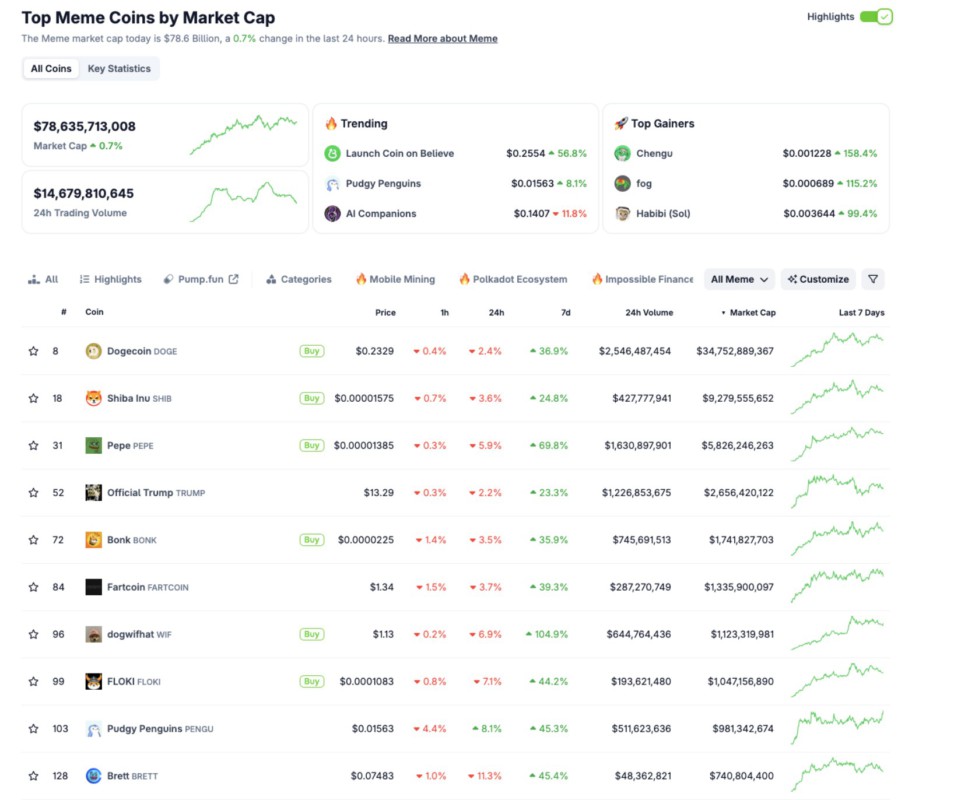

Despite the negative market sentiment, SHIB maintained its weekly gain of 25%, closing the trading session strongly. This resilience is quite striking, especially when compared to the declines experienced by 9 of the top 10 memecoins, including Dogecoin which fell 2.4%, and BONK which lost 3.5%.

Overall, the market capitalization of the memecoin sector fell to $78.6 billion, which is down 0.7% in the last 24 hours.

However, the most notable change was seen in the shift of investor interest to mid-capecoins that are not associated with US political figures.

One of the standouts was Pudgy Penguins , which was the only meme asset in the top 10 to register a gain of 8%.

Amidst market concerns, SHIB’s ability to hold at $0.000015 reflects the confidence of market participants. It shows that SHIB is still considered one of the most stable memecoins, even when the market is under pressure.

From $1,000 to $10,000 in SHIB, Is it Possible?

For those of you wondering if Shiba Inu (SHIB) still offers attractive potential from current price levels, historical data suggests there is a chance.

With the current SHIB price at $0.000015, an investment of $1,000 would yield approximately 66.6 million SHIBs. If the price returns to its March 2025 high of $0.000027, the value of that investment could increase to $1,800-equivalent to an 80% return.

Meanwhile, an investment of $5,000 will get you approximately 333.3 million SHIBs, which can grow to $9,000 if the price rises to the same level, resulting in a potential profit of up to $4,000.

If with $10,000 at the current price, and SHIB returns to $0.000027, then the value of the asset could reach $18,000, without the need to wait for SHIB to print a new all-time high .

In terms of on-chain technicals, indicators such as Santiment’s Age Consumed reinforce this bullish outlook.

Santiment data as of Thursday (15/5) shows that SHIB’s Age Consumed remained stable at 91.4 trillion, despite a 3.6% price correction. This indicates minimal sell-offs from long-term holders-a sign that market confidence is still intact.

More broadly, SHIB’s current price movement shows a consolidation pattern, not a breakdown.

If SHIB is able to maintain support at $0.000015 and buyback volume increases, the price has a chance to break to $0.000018, then to $0.000022-which could provide even greater ROI for new investors.

Shiba Inu Price Prediction Today: Klinger Divergence Shrinks, Bulls Maintain $0.000015 Support

The price of Shiba Inu (SHIB) continues to show a consolidation pattern above the $0.000015 level, trading in the range of $0.00001562 on Thursday. This movement began to form a bullish continuation pattern, after previously shaking weak investors (weak hands) at the beginning of the week.

Read also: Dogecoin Dips 2% as Open Interest Surges to $3 Billion—A Bullish Breakout Ahead?

SHIB’s price action is currently seen rallying above the dynamic support of the Donchian Channel midline at $0.00001498, with candles printing higher lows, despite declining trading volume. This indicates that traders would rather hold on than exit the market, anticipating a potential breakout towards the upper limit of the Donchian Channel at $0.00001765.

Meanwhile, the Klinger Oscillator indicator showed a narrowing divergence between the fast line (blue) and the signal line (green), standing at 5.27 billion and 89.18 billion, respectively. This signals that the bearish momentum is starting to weaken.

Another technical indicator, Parabolic SAR, is still printing dots below the current price structure at $0.00001435, which is a classic signal of an active uptrend.

The current price correction is taking place with low volume and without major selling pressure (no big red candles), which could be interpreted as a sign of distribution exhaustion, not a new sell-off.

If buyers are able to push the price through $0.00001600 accompanied by increased volume, then the next resistance is at $0.00001765.

However, if the $0.00001498 support fails to hold, then the $0.00001435 area of the Parabolic SAR becomes the last stronghold before a potential deeper correction to $0.00001230, which is the lower limit of the Donchian Channel.

As of now, the price structure, indicator direction, and weakening selling pressure still suggest that the path of least resistance is upwards.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Shiba Inu Hits $0.000015, What Returns Could Investors Gain with $1K, $5K, and $10K? Accessed on May 15, 2025