Bitcoin (BTC) Surges: Key Indicators Predicting Price Rise Are Active Again!

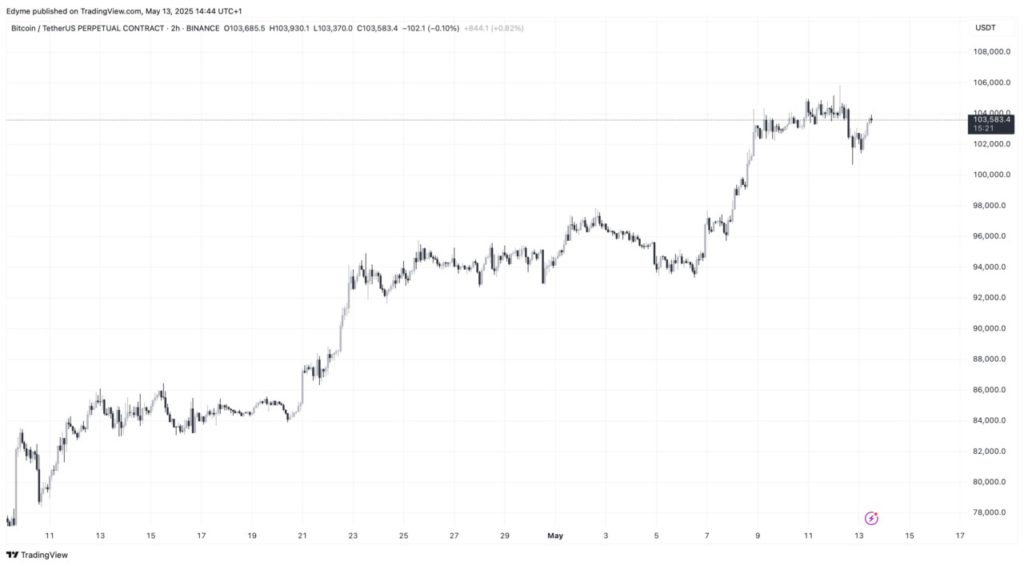

Jakarta, Pintu News – Bitcoin has managed to break the $104,000 level after experiencing double-digit gains over the past week. Currently, Bitcoin (BTC) is trading at $104,271, close to its previous record high of $109,000.

These price increases have not occurred in isolation, but rather are strongly linked to global macroeconomic developments, particularly the easing of trade tensions between the US and China. Both countries have reduced tariffs on some imports and exports, which supports market sentiment.

Taker Buy-Sell Ratio Indicator: Signal of Buyer Dominance

The Taker Buy-Sell Ratio indicator, which measures the ratio between buy and sell orders in the market, has reached a significant threshold of 1.02. This level has previously been reached during the low period of late 2022, when Bitcoin (BTC) was in the range of $15,000 to $20,000, and again in October 2023 when Bitcoin (BTC) broke the $30,000 resistance level.

According to analysts from CryptoQuant, an increase above the 1.00 line indicates increased aggressive buying activity, with market participants back in control of short-term prices. However, the analysts also warned that similar conditions in the past were often followed by spikes in volatility, which marked both the beginning and end of market trends.

Also Read: Bitcoin (BTC) Breaks $100K: What are the Hidden Risks Lurking?

Realized Price Trends: Continued Market Power

A separate analysis by Crypto Dan of CryptoQuant shows that the realized price of Bitcoin (BTC), which reflects the average purchase price of all Bitcoin (BTC) in circulation, is still rising.

This signals that investors continue to accumulate Bitcoin (BTC) at higher prices, in contrast to previous cycles where reversals in realized prices preceded sharp corrections. The current rise in realized prices is driven by institutional flows, mainly through spot Bitcoin (BTC) ETFs and corporate balance purchases, which have brought continuous capital to the market.

Conclusion: Future Prospects of Bitcoin (BTC)

With key indicators such as the Taker Buy-Sell Ratio and realized price trends showing the strength of the market, Bitcoin (BTC) looks set to continue its price rise.

Although the potential for volatility remains, current analysis suggests that strong buyer’s appetite could push Bitcoin (BTC) prices to reach new records. Investors and market participants should remain alert to changes in market conditions that could affect price trends.

Also Read: GD Culture Group Invests $300 Million in Bitcoin and Trump Memecoins

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Buyers Take Control: Indicator That Predicted Previous Bitcoin Rallies Fires Again. Accessed on May 14, 2025

- Featured Image: Generated by AI