Is BTC About to Hit a New Record High? Big Investors Continue to Accumulate!

Jakarta, Pintu News – Recent observations from on-chain data show that large Bitcoin investors continue to accumulate despite the cryptocurrency’s price nearing an all-time record high .

Portfolio Development by Large Investors

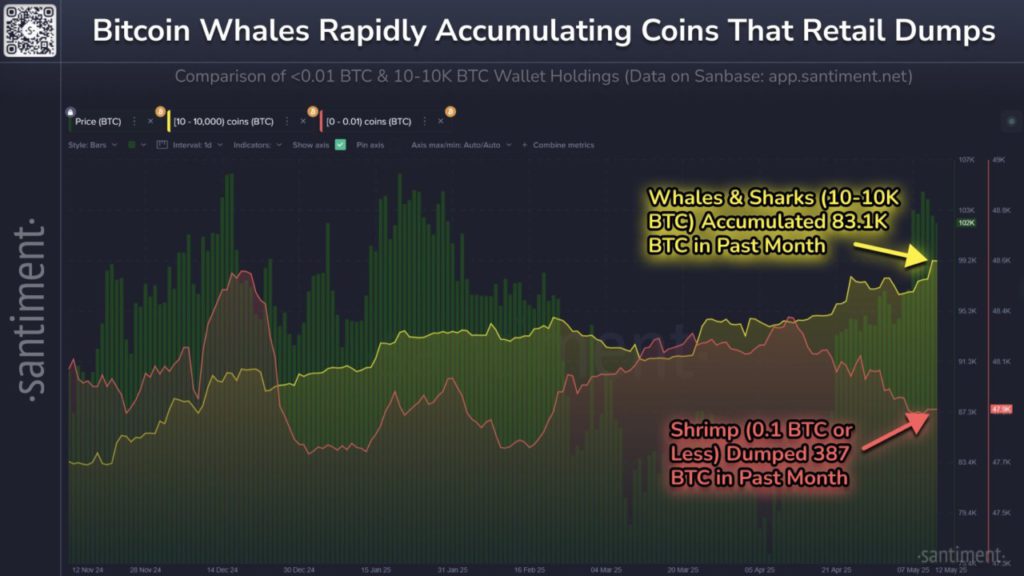

On-chain analytics firm Santiment recently revealed that Bitcoin (BTC) investors who own between 10 and 10,000 BTC have increased their holdings. At the current exchange rate, this amount is equivalent to $1 million to $1 billion. Investors in this category, often referred to as sharks and whales, have significant influence in the market due to the large amount of Bitcoin (BTC) they control.

The rise in holdings by these groups suggests bullish potential for Bitcoin (BTC) prices in the future. The graph shared by Santiment shows that the distribution of supply by sharks and whales has seen an increase.

In the last month, the group has added around 83,100 tokens to their wallet. Despite a drop in supply at the beginning of the month, which was most likely due to profit-taking after the price recovered past $97,000, recent trends show that they have surpassed their previous holdings.

Also Read: Bitcoin (BTC) Breaks $100K: What are the Hidden Risks Lurking?

Current Market Dynamics

During the new bullish phase, sharks and whales have resumed accumulating Bitcoin (BTC) and show no signs of profit-taking. This could be a very positive indicator for the continuation of the rally. On the other hand, investors with holdings of less than 0.1 BTC, often referred to as shrimps, tend to sell their holdings.

This could indicate that they believe that the price may have already peaked. However, with accumulation continuing by large investors, it is possible that Bitcoin (BTC) will soon break a new high of $110,000, especially after the announcement of the suspension of tariffs between the US and China.

Bitcoin (BTC) Price Outlook

Currently, Bitcoin (BTC) is trading around $103,800, up 11% in the past seven days. If the trend of accumulation by sharks and whales continues, there is a high probability that Bitcoin (BTC) will reach and possibly even surpass its previous record high price. This rise is supported by positive market sentiment and growing interest from institutional and speculative investors.

Conclusion

With continued accumulation by large investors and positive signals from the market, the future of Bitcoin (BTC) looks bright. Investors and market watchers should continue to monitor on-chain indicators and global developments that could affect the price.

Also Read: GD Culture Group Invests $300 Million in Bitcoin and Trump Memecoins

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Sharks and Whales Accumulate as BTC Hits New All-Time High. Accessed on May 14, 2025

- Featured Image: Generated by AI