Bitcoin Hits $104K — Arthur Hayes Predicts It’s on the Path to $1 Million!

Jakarta, Pintu News – Bitcoin’s path to $1 million is still open, at least according to BitMEX co-founder Arthur Hayes. While Hayes believes the end goal is undeniable, he cautions that it won’t be a smooth ride.

In his latest essay titled “Fatty Fatty Boom Boom“, Hayes describes the economic condition of the United States in a pessimistic tone, comparing it to the country’s ever-expanding waistline: bloated, unhealthy, and living in denial. However, amidst this chaos, he sees Bitcoin as a potential way out.

Then, how will the Bitcoin price move today?

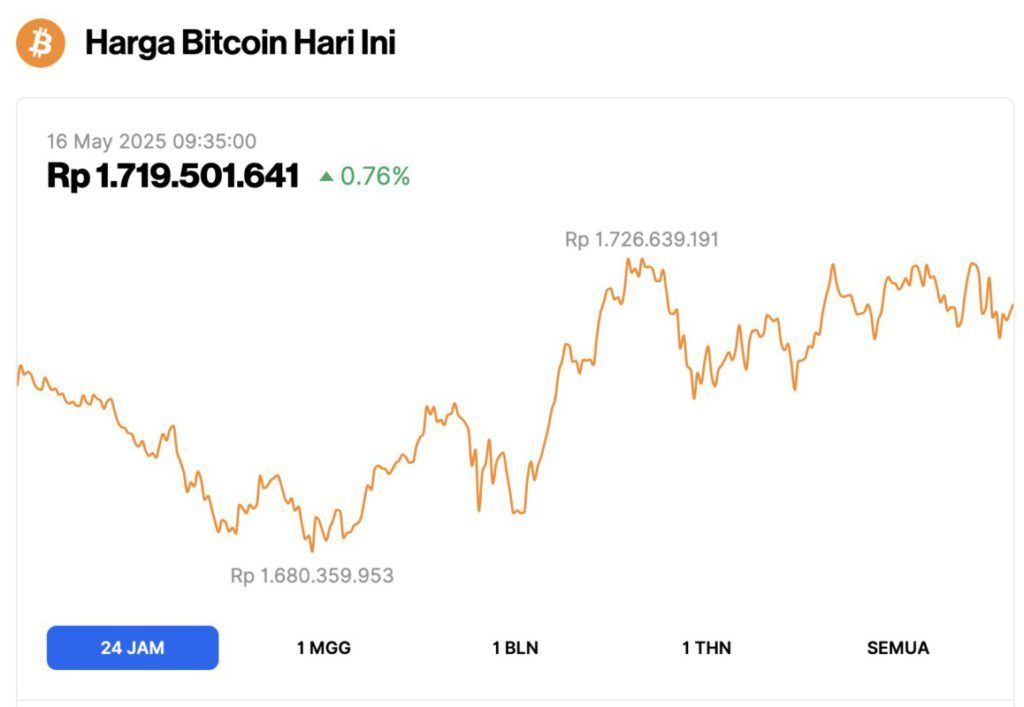

Bitcoin Price Up 0.76% in 24 Hours

On May 16, 2025, the price of Bitcoin stood at $104,162, or approximately IDR 1,719,501,641, marking a modest 0.76% increase over the past 24 hours. During this time, BTC traded between a low of IDR 1,680,359,953 and a high of IDR 1,726,639,191.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.06 trillion, with trading volume in the last 24 hours also up 12% to $50.97 billion.

Read also: Powered by Tether, Twenty One Capital Makes Massive $458 Million Bitcoin Bet!

Sick Economy, Healthy Hedge Assets

Arthur Hayes argues that the direction of the American economy reflects the obesity crisis that the country is going through.

He highlighted that just as processed foods created a dependency on the pharmaceutical industry, the relentless printing of money has created a dependency on monetary stimulus.

According to Hayes, the Federal Reserve’s inability to refrain from “turning on the money printing press” will continue to be a hallmark of the United States’ economic policy.

He predicts rising inflation, higher volatility, and repeated government interventions – all of which, he says, are fueling Bitcoin’s price rise.

In an interview, Hayes reiterated his views. He said that Bitcoin could potentially hit the $150,000 mark this year, before altcoins start to follow the upward trend.

“It looks a lot like 2022,” Hayes said, referring to a combination of market fear, global uncertainty, and loose central bank policy. He adds:

“They will go back to printing money. Again.”

Capital Control: Next Round

In his essay Fatty Fatty Boom Boom, Arthur Hayes warns that the United States’ next political move will no longer be import tariffs, but a more subtle and hidden strategy:capital controls.

Hayes predicts that as foreign capital begins to flee from US assets – such as bonds, stocks, and property – the government, particularly the White House, may take steps to curb this capital flight. One of them is to tax foreign investments coming into the US.

He even suggested the possibility of a 2% annual tax on assets held by foreign investors.

Read also: Ripple (XRP) Potentially Reaches $3, Overtakes USDT as Third Largest Crypto Token!

According to him, this policy could generate enough revenue to eliminate income tax for most American voters.

“Trump could eliminate income taxes for the majority of voters,” Hayes wrote, emphasizing the potential electoral benefits of such a policy.

However, this policy also carries risks. If foreign investors feel disadvantaged by such a tax, they will most likely start unwinding their holdings – which could pressure the US bond market.

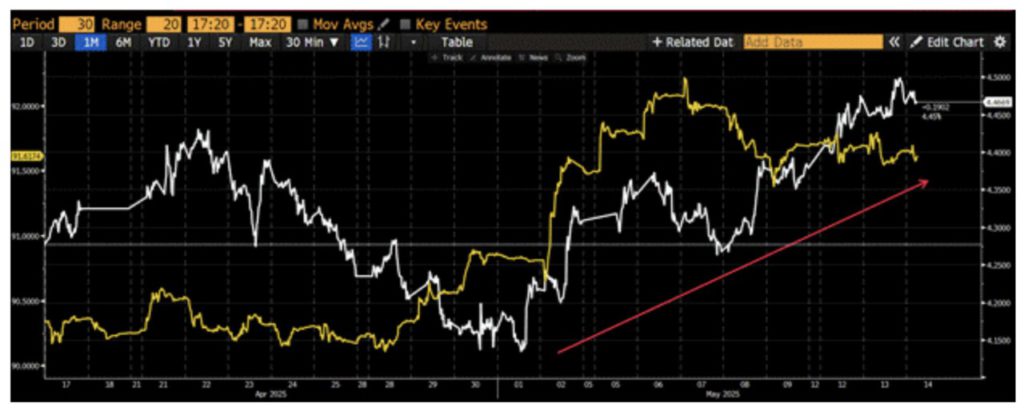

Hayes estimates that if the 10-year bond yield approaches the 5% mark, it could be atipping point for financial markets.

Bitcoin: A Gift from “Lord Satoshi”

In Arthur Hayes’ view, Bitcoin is the only real escape from the financial collapse that is slowly unfolding.

He predicted that as Asian investors begin to pull back their capital, sell American assets and strengthen their respective domestic currencies, this will trigger a spike in volatility in the bond market as well as a weakening of the US dollar.

The situation will further squeeze the Federal Reserve into a difficult corner. The cycle keeps repeating itself: more volatility, more money printing, and more outflows of foreign capital.

However, Bitcoin is different. It doesn’t rely on a traditional financial system full of licenses and rules. Even in countries like China, where crypto exchanges are banned, peer-to-peer markets are alive and well. Hayes calls it religious:

“Lord Satoshi has rewarded Bitcoin to those who are loyal.”

The data supports this view. If just 10% of the total $33 trillion in foreign portfolio assets currently in the United States were diverted to Bitcoin, the market would experience a historic surge.

Hayes stated that a Bitcoin price of $1 million is not impossible and could happen “between now and 2028.”

Sentiment towards Bitcoin also remains very bullish at the moment. The latest US CPI data fueled optimism across risk assets and helped lift momentum in the crypto market.

More than 80% of voters at Polymarket now expect Bitcoin to hit a new record high, as speculation grows that MicroStrategy will make another large purchase.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinSpeaker. Bitcoin to $1M “Sometime Between Now and 2028,” Says Arthur Hayes. Accessed on May 16, 2025