Bitcoin Crashes to $106K — But Smart Investors Are Buying the Dip Like Crazy! (May 30)

Jakarta, Pintu News – Bitcoin has experienced a huge surge over the past month, recording a new record high price of $111,980. This significant price increase raises questions about whether Bitcoin’s momentum will continue until June 2025.

While some investors remain optimistic that the price will continue to rise, others are wondering if the price will drop soon or if Bitcoin holders will start being more cautious.

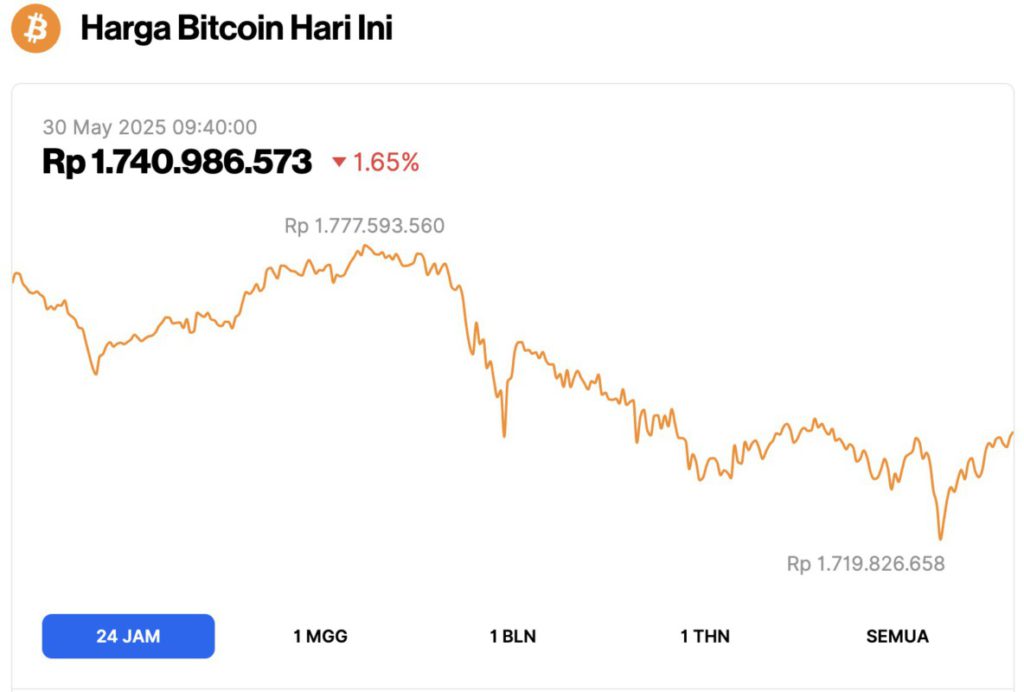

Bitcoin Price Drops 1.65% in 24 Hours

On May 30, 2025, Bitcoin was trading at $106,100 (approximately IDR 1,740,986,573), marking a 1.65% decline over the past 24 hours. Throughout the day, BTC reached a high of IDR 1,777,593,560 and dipped to a low of IDR 1,719,826,658.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.1 trillion, with trading volume in the last 24 hours rising 16% to $58.12 billion.

Read also: Is Bitcoin Headed for a $200,000 Explosion? 5 Shocking Reasons Experts Say YES!

Bitcoin Investors Make Massive Accumulation

The current market sentiment towards Bitcoin is driven by strong accumulation. The amount of Bitcoin stored on exchanges decreased by 66,975 BTC, with a value of over $7.2 billion.

This large drop indicates that investors are moving their assets from exchanges to private wallets. This reflects increased confidence in Bitcoin and the belief that the price will continue to rise.

This accumulation action is partly driven by FOMO (fear of missing out), as new investors come in. However, this phenomenon is also reinforced by a growing belief in Bitcoin’s long-term potential.

However, Juan Pellicer, Vice President of Research at Sentora, explains that the surge in Bitcoin price is not just due to accumulation.

“Investors’ appetite for risk this spring was shaped by a series of macroeconomic factors that all point to looser financial conditions. Inflation is declining, central bank policy easing is again an option, real yields and the value of the dollar are declining, global liquidity is increasing, and fiscal spending remains high. All these factors are pushing up all risky assets, including Bitcoin. This also explains why BTC prices are highly correlated with the S&P 500 index throughout May,” Pellicer said.

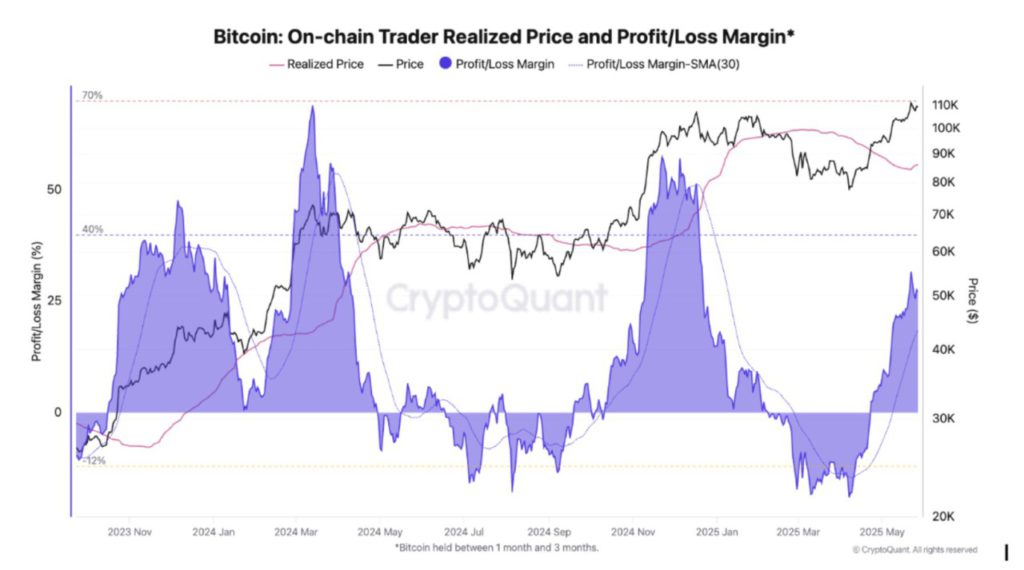

On-chain Data Reveals Bitcoin’s Strong Momentum Continues

On-chain data shows a number of key indicators that suggest Bitcoin’s macro momentum remains strong.

Trader Realized Price and Profit/Loss Margin on the network recorded a sharp increase, indicating that Bitcoin investors – especially those who bought within the last 1 to 3 months – are currently enjoying significant unrealized gains.

This data helps understand investor behavior and shows that many of them still choose to hold assets, hoping that prices will continue to rise.

Read also: 3 Crypto Hidden Gems to Watch out for in June 2025!

Julio Moreno, Head of Research at CryptoQuant, in an interview with the BeInCrypto website explained that this increased profit among short-term holders could be a threat to Bitcoin’s price stability.

“In the short term, there could be profit-taking by traders as their unrealized profit margins are already close to hot levels, around 40%. Look at the chart where we estimate Bitcoin traders’ on-chain profit margins to have reached 31% in recent days (marked purple area),” Moreno said.

BTC Price Eyes New Record Highs

Bitcoin price surged 14% during the month of May, reaching a new record high of $111,980. Currently, Bitcoin is trading at around $108,258 and is testing the $110,000 resistance level.

The next few days will be crucial to see if Bitcoin can maintain its momentum.

If the accumulation trend from both institutional and retail investors continues in June, then Bitcoin price has the potential to continue its upward trend.

In addition, the seasonal strategy of “Sell in May and go away” proved ineffective for the stock market over the past year, as the market rallied despite the seasonal trend.

Bitcoin’s correlation with the stock market, especially in the context of macroeconomic conditions, indicates that BTC may continue to experience upward momentum during June.

With its strong staying power, Bitcoin is expected to continue rising despite the uncertainty in the general market.

Bitcoin price could potentially break the $110,000 level and make it a solid support level before moving past the current record high to target $115,000. However, if profit-taking increases, Bitcoin may experience a correction.

Although a sharp drop seems unlikely, BTC could experience consolidation before resuming its uptrend. Support levels at $102,734 and $106,265 are expected to act as buffers in this scenario.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What To Expect From Bitcoin (BTC) Price In June? Accessed on May 30, 2025