Drastic Pi Network (PI) Decline End of May 2025: Analysis of Causes and Impacts

Jakarta, Pintu News – Pi Network (PI) has experienced significant technical weakness, with a decline of nearly 15% in the last seven days and 4.4% in the last 24 hours. Market capitalization now stands at $5.12 billion. Trading volume increased 25% in the past day, reaching $104.6 million, signaling increased activity amid a deepening downward trend.

Technical Indicators Show Weakness

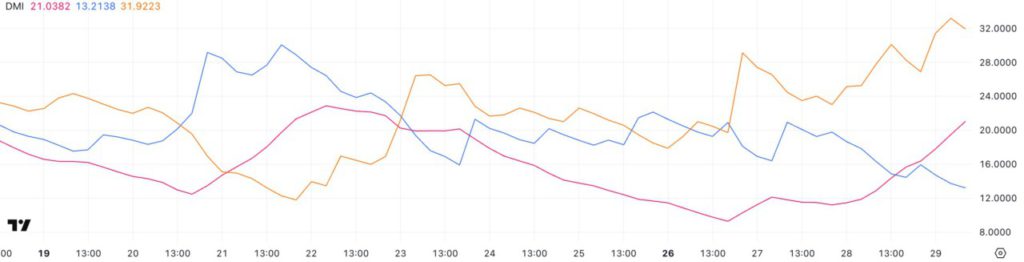

The Directional Movement Index (DMI) for Pi Network (PI) showed a significant increase in the Average Directional Index (ADX), which rose to 21 from 11.46 in just a day. The ADX measures the strength of a trend, regardless of its direction. Generally, an ADX below 20 indicates a weak or trendless market, while a reading above 20 signals that the trend is gaining strength.

With PI’s ADX now exceeding this threshold, the data suggests that a more decisive move-both bullish and bearish-may be developing. This increase in the ADX suggests that the downward trend of the Pi Network (PI) may continue. Investors and market analysts should pay close attention to this indicator to anticipate further price movements. If this trend continues, Pi Network (PI) may face more selling pressure.

Also Read: 3 Latest Airdrop Tokens to Follow in Early June 2025!

Selling Pressure Increases

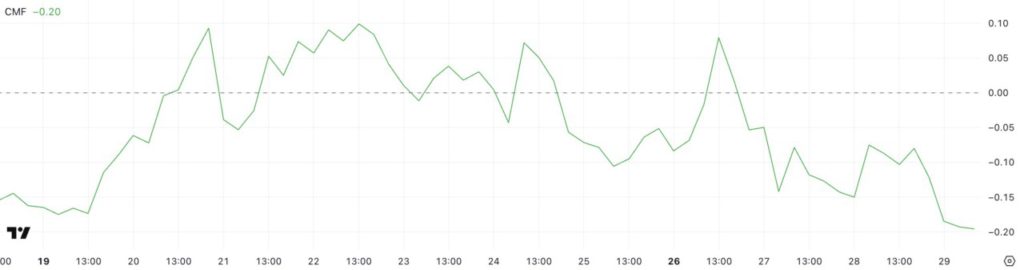

The Chaikin Money Flow (CMF) indicator for Pi Network (PI) has dropped sharply to -0.20, down from 0.08 three days ago and -0.08 one day ago. The CMF is a volume-weighted indicator that measures money flows in and out of an asset over a given period, usually 20 or 21 days. Values above 0 generally indicate buying pressure and accumulation, while values below 0 indicate selling pressure and distribution.

CMF readings outside ±0.10 are usually considered significant, with deeper negative values indicating continued outflows. A sharp decline in the CMF indicates that there is significant capital outflow from Pi Network (PI), which could be an indicator of concern among investors. This could exacerbate the ongoing bearish trend and push PI prices even lower.

PI Price Outlook and Next Support

The Exponential Moving Average (EMA) indicator for PI remains bearish, with the short-term EMA being below the long-term EMA-a sign that the downward momentum still controls the market. The widening distance between these EMA lines reinforces the strength of the current downtrend. If PI continues to slide, the next support level is at $0.66, and losing it could open the door for a further decline towards $0.57.

Conversely, if PI manages to reverse its current direction, the first key resistance to watch out for is at $0.727. A break above that level could signal a short-term recovery and potentially push prices higher towards $0.86. However, until the short-term EMA starts flattening or crossing above the long-term one, any bullish attempts may remain vulnerable to selling pressure.

Conclusion

With various technical indicators pointing to a strong bearish trend, Pi Network (PI) may face further challenges in the near future. Investors should monitor these indicators and be prepared for possible further volatility. Understanding these dynamics is important for making informed investment decisions in the often unpredictable cryptocurrency market.

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Network Slides Deeper into Weekly Losses. Accessed on May 30, 2025

- Featured Image: Coinpedia