Top 3 Meme Coins that Crypto Investors Want in June 2025

Jakarta, Pintu News – The meme coin market is starting to wind down after experiencing a surge in activity throughout most of May. The overall crypto market decline in the past week has weakened momentum, leading to a drop in the value of a number of top meme assets.

Even so, the trading volume of meme coins is still up 5% compared to last month, showing that investor interest has not completely disappeared. Here is a summary of three meme coins that are worth paying attention to in June 2025, quoting the BeInCrypto page.

Central African Republic (CAR)

The official meme coin launched by this African country saw positive developments during the month of May. The country’s president recently announced that the government will use the CAR to tokenize 1,700 hectares of land.

Baca juga: 5 Memecoins Set to Explode in June 2025 – Don’t Miss the Next Big Breakout!

As a result, the CAR experienced a significant spike with a 103% increase in just one week.

As of May 31, the meme coin was trading at $0.047. With the target of breaking the resistance level at $0.059, CAR has the potential to continue its uptrend if overall market conditions improve.

CAR’s Chaikin Money Flow (CMF) indicator, which is still in the positive zone at 0.17, strengthens the chances of a rally above the important resistance level.

CMF itself measures the inflow and outflow of money from an asset. A value above one signals strong buying pressure, indicating that capital is flowing into the CAR.

If this trend continues, CAR has a chance to break the $0.059 level and extend its gains to $0.074.

However, in case ofprofit-taking, the altcoin could drop to $0.345.

Daddy Tate (DADDY)

DADDY is one of the meme coins worth watching for potential gains in June. In the last seven days, the altcoin has gained 14% and is currently trading at $0.039.

Earlier this week, Andrew Tate announced the launch of his online training app, Real World 2.0. According to his statement, the app will be equipped with a digital wallet that has certain uses related to the DADDY token.

This announcement prompted increased speculative interest in the meme coin.

The increase in the Balance of Power (BoP) indicator value indicates a steady increase in buying pressure among DADDY traders. Currently, the momentum indicator stands at 0.85.

BoP measures the power between buyers and sellers by comparing the closing price to the trading range. A positive BoP value such as this indicates that buyers are in control, signaling a stronger market momentum.

If this trend continues, DADDY could potentially extend its rally to reach $0.05. However, if sellers dominate the market again, the token’s price could drop to the $0.029 range.

Read also: 3 Cryptos Whales Are Snapping Up Fast — Could They Skyrocket in June 2025?

SPX6900 (SPX)

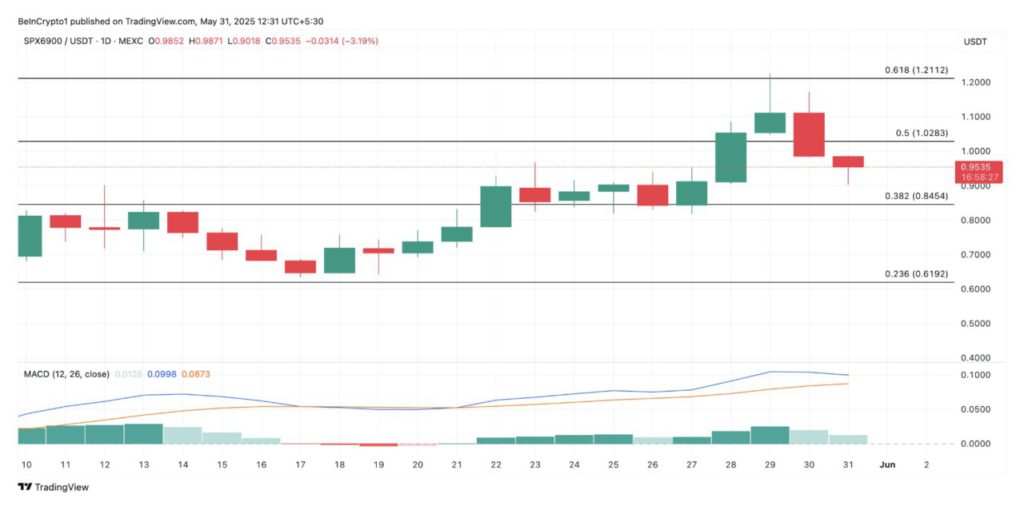

SPX managed to defy the general trend of market weakness in the past week by recording double-digit gains. The meme coin has gained 11% in the last seven days and is currently trading at $0.95.

The Moving Average Convergence Divergence (MACD) indicator setup on the SPX daily chart confirms the presence of buying pressure in the spot market. As of May 31, the MACD line (blue) is well above its signal line (orange).

MACD is an indicator used to identify trends and momentum in asset price movements. Traders usually use it to look for buy or sell signals based on the crossover between the MACD line and the signal line.

In the case of SPX, the position of the MACD line above the signal line indicates the presence of bullish momentum, which means that the asset price is likely to continue rising. This crossover is considered a buy signal that supports the current SPX rally.

If this uptrend continues, the meme coin has a chance to break the $1 mark and continue its rise until it reaches $1.21. However, if buying activity slows down, the SPX could lose some of its gains and drop to the $0.84 level.

Trading volume surges, but Meme Market’s retail euphoria has yet to return

Although some altcoins appear to have the potential to register gains in the next few weeks, the meme coin market in general still faces a number of challenges.

In an interview with S, Neiro’s Community Lead, it was mentioned that market activity usually slows down during the summer-and meme coins are not immune to this seasonal trend.

“It still feels too early for full market euphoria. Historically, summer tends to be a slower period across financial markets, including crypto. Whether there will be a correction or not is still a question mark, but momentum is very important. When growth stops, it usually starts to fade. If momentum slows down, the market needs to take it seriously,” explains S.

He also added that despite the sharp increase in trading volume, the meme coin market is yet to show signs of a return to the retail frenzy of 2021. Currently, activity is still dominated by experienced crypto investors and whales.

“So far, most of the activity is still coming from the core crypto community. We haven’t seen a massive retail wave like in 2021, or even 2017. That wave hasn’t come yet-but when it does, it will definitely bring the chaos, creativity, and memes that we all know and love. Personally, I’m looking forward to it,” says S.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Meme Coins To Watch in June 2025. Accessed on June 1, 2025