Bitcoin Holds Strong at $105K — Are Miner Signals Pointing to the Next Big Bull Run?

Jakarta, Pintu News – The price of Bitcoin has surged by 50% since April 7, and reached a new record high on May 22. This rise occurred without any significant major corrections.

Any short-term dips in BTC prices are recovered quickly, even reaching new highs less than a week after the dip.

Although Bitcoin’s on-chain indicators were showing bearish signals at the beginning of the year, conditions have now reversed as new price records have been achieved.

This article will analyze several on-chain indicators to assess the current market conditions and predict when this cycle will end.

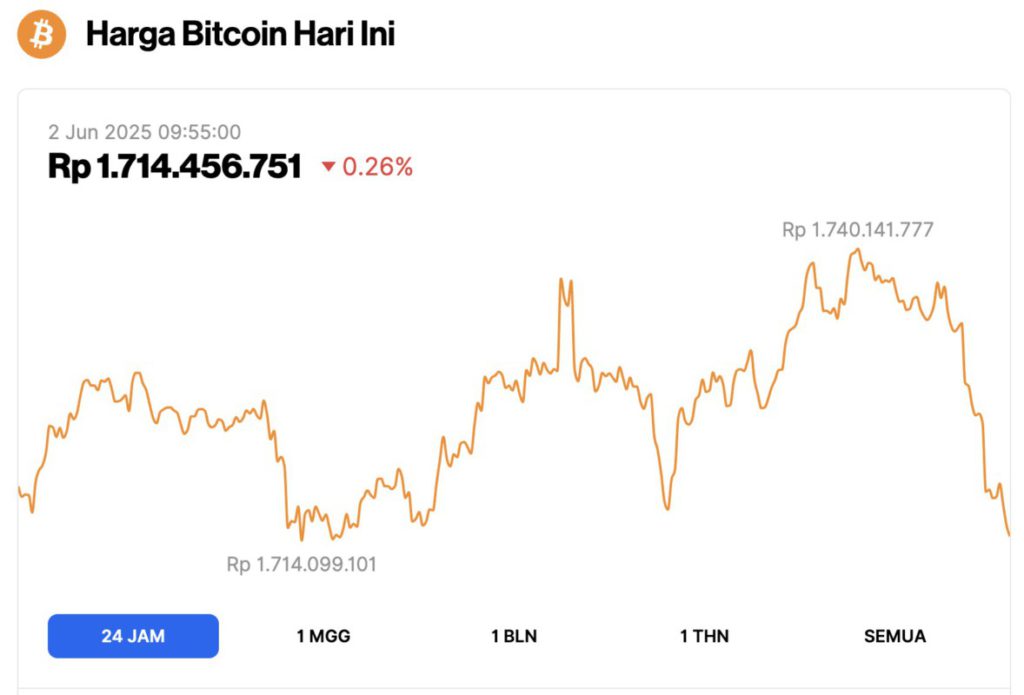

Bitcoin Price Drops 0.26% in 24 Hours

On June 2, 2025, Bitcoin was trading at $105,079, or around IDR 1,714,456,751, marking a slight 0.26% dip over the past 24 hours. During this time, BTC reached a daily high of IDR 1,740,141,777 and a low of IDR 1,714,099,101.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.08 trillion, with trading volume in the last 24 hours rising 0.19% to $36.91 billion.

Read also: These 3 Altcoins are Predicted to Soar and Beat Bitcoin in June 2025!

What does NUPL say?

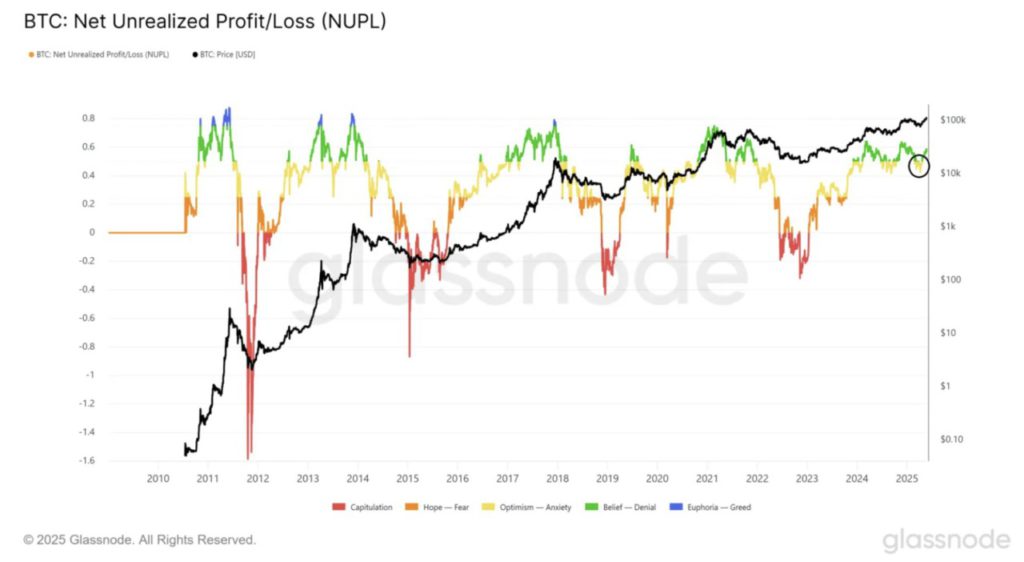

NUPL (Net Unrealized Profit/Loss) is an on-chain metric that shows whether the market is in a profit or loss state. To calculate it, unrealized gains are divided by unrealized losses.

Negative values indicate that the market is in a loss, while positive values indicate the market is in profit.

In simple terms, this indicator gives an idea of whether the circulating supply of Bitcoin is in a profit or loss position.

Historically, the peak of the Bitcoin market cycle occurs when this indicator crosses 0.75. Another sign of the start of a bear market is when there are two breakouts above the 0.5 mark (green zone), followed by a drop below it (yellow zone).

In the current cycle, the NUPL has not yet reached the 0.75 mark. However, it did drop below 0.5 for the second time (black circle) in April, indicating the start of a bear market.

However, the recent surge in Bitcoin price pushed the NUPL value back up to 0.56, invalidating the bearish signal.

If we follow previous patterns, NUPL is expected to cross the 0.75 mark before the market peaks.

Miner Indicator Begins to Show Bullish Signals

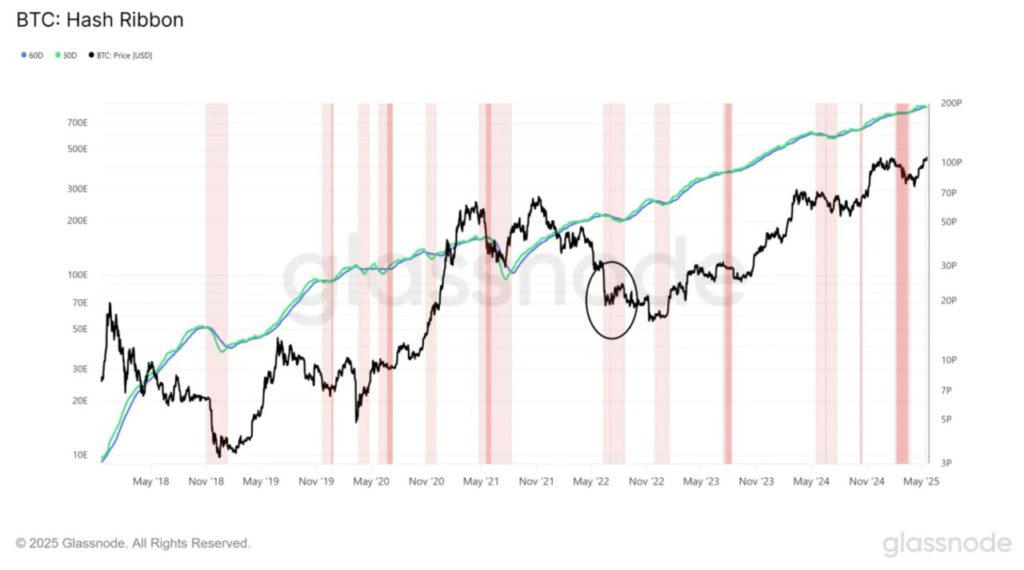

Hash Ribbon is an on-chain indicator that directly compares miners’ fees and revenue. This indicator shows “miner capitulation” when mining fees are higher compared to their revenue.

Read also: Pi Network’s Massive Sell-Off Continues, PI Price Plummets to Weekly Low!

The Hash Ribbon is formed from the short-term and long-term moving averages (MA) of the hash rate. On the chart, periods when mining is not profitable are marked in red, i.e. when the short-term MA is above the long-term MA.

Historically, this signal has almost always been followed by a recovery in Bitcoin price, with one exception in July 2022 (marked by a black circle). When the indicator shows the early stages of miner capitulation, it is usually a bullish signal.

This indicator had shown red signals in February and March 2025. When the price of BTC fell in April, it appeared to be a false signal. However, the subsequent price increase validated it.

Therefore, BTC prices may experience a short-term correction before climbing to higher levels. If this indicator remains accurate, then a new price record is likely to emerge.

In addition, miners also started accumulating again. The Miner Net Position Change indicator shows an accumulation phase in May 2025.

In the current Bitcoin market cycle, miners generally stop accumulating at the end of 2023, except in August 2024 (black circle), just before the BTC price experienced a parabolic surge to record highs.

As such, the current ongoing accumulation period is a positive signal for the future. Miners have proven to be quite accurate in predicting BTC price movements, as they tend to sell when prices rise and buy before prices spike.

Cycle Not Over

NUPL had given a bearish signal in April, which raised concerns that the market cycle had peaked.

Read also: Tether Now Holds Over 100,000 Bitcoins and 50 Tons of Gold!

However, the continued rise in Bitcoin’s price managed to ease those concerns and cancel out the bearish signal.

In addition, Bitcoin’s on-chain indicators are currently showing bullish signals, and miners are starting to accumulate again – a positive sign in favor of a future upward trend.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Bitcoin Miners Accumulate – On-Chain BTC Indicator Predicts New Highs. Accessed on June 2, 2025