Ethereum Hits $2,400 Today (June 2) — Is a Major ETH Comeback on the Horizon?

Jakarta, Pintu News – Amid a massive sell-off in the broader market, the price of Ethereum recently dropped to $2,500. However, on-chain data and rising fund flows into spot Ethereum ETFs suggest that a recovery to the $3,000 level is likely imminent.

In addition, SharpLink Gaming has filed a prospectus with the US Securities and Exchange Commission (SEC) for a $1 billion common stock offering to build its Ether Treasury.

Before discussing further, let’s know the current Ethereum price movement first.

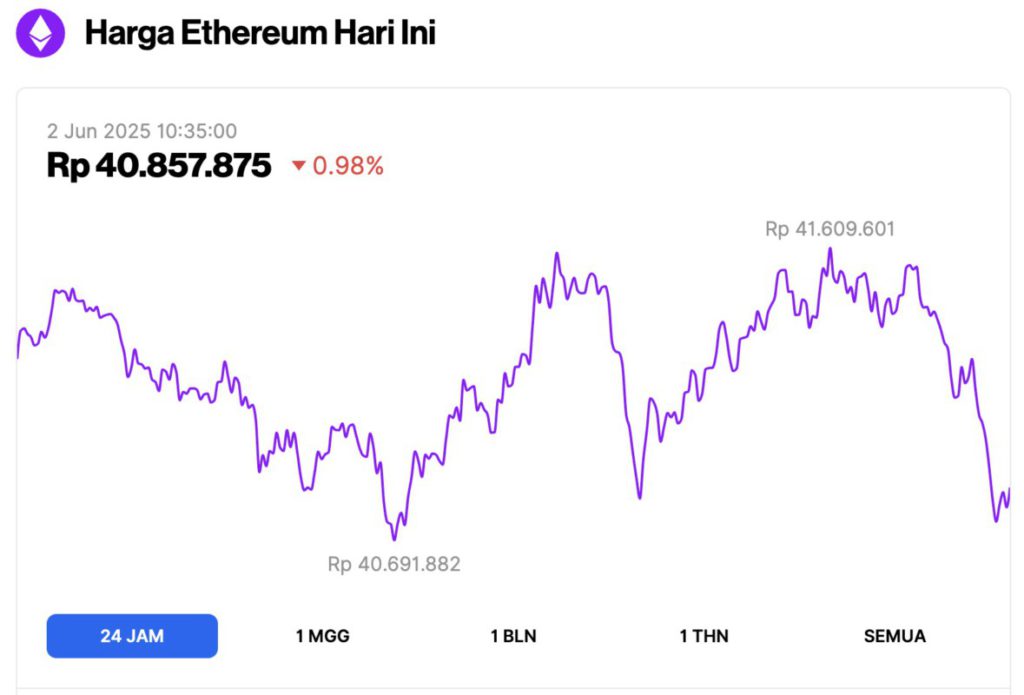

Ethereum Price Drops 0.98% in 24 Hours

As of June 2, 2025, Ethereum (ETH) was trading at approximately $2,496, or around IDR 40,857,875 — marking a 0.98% decline over the past 24 hours. During this timeframe, ETH reached a high of IDR 41,609,601 and dipped to a low of IDR 40,691,882.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $301.55 billion, with daily trading volume rising 6% to $13.06 billion in the last 24 hours.

Read also: Bitcoin Holds Strong at $105K — Are Miner Signals Pointing to the Next Big Bull Run?

On-Chain Metrics Support Ethereum Price Recovery

Some key on-chain metrics clearly support the possibility of an ETH price recovery in the near future.

After being rejected at the $2,700 level, Ethereum corrected by 9% in the last two days and fell back to $2,500. This correction led to the liquidation of $160 million in bullishly leveraged ETH futures positions.

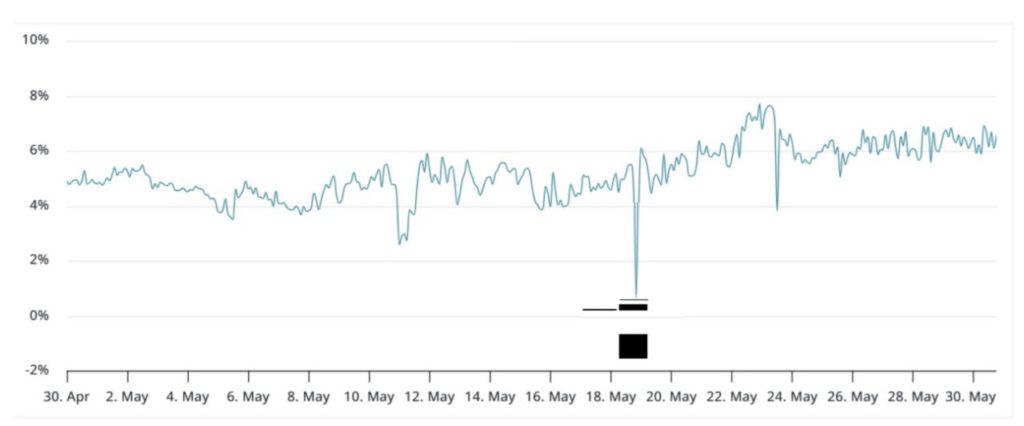

However, despite the decline, the annual premium of ETH futures has remained at around 6%. Under neutral market conditions, premiums are typically in the range of 5% to 10%, reflecting the compensation that sellers demand for delays in contract settlement.

Amid the rejection of the ETH price at the $2,700 level, the Ethereum price has indeed corrected in the last two days.

But according to data from Rekt Capital, as long as the altcoin is able to maintain the support level at $2,468, the opportunity to rally towards $3,900 still remains open from this point.

SharpLink Gaming Files with US SEC for $1 Billion ETH Purchase

In documents filed with the US Securities and Exchange Commission (SEC) on Friday, May 1, SharpLink Gaming announced its plans to conduct a $1 billion common stock offering to increase its stake in their Ethereum Treasury.

In the filing, the SEC noted:

“We intend to use the majority of the proceeds from this offering to purchase Ether, the native cryptocurrency of the Ethereum blockchain, commonly known as ‘ETH’.”

This move follows SharpLink’s announcement on May 27 of its plans to implement an Ethereum-based corporate treasury strategy.

Read also: Top 3 Meme Coins that Crypto Investors Want in June 2025

In another major move, the company also appointed Ethereum co-founder Joseph Lubin as chairman of its board of directors. Following the news, SharpLink Gaming shares jumped sharply, rising up to 400% during the trading session on May 27.

REX Shares applies for staking in Ethereum ETF

Based on a recent filing from REX Shares, the staking feature for spot Ethereum ETFs is likely to come in the next few weeks.

James Seyffart, a leading ETF analyst from Bloomberg, revealed that REX Shares has filed an effective prospectus to introduce Solana and Ethereum staking ETFs in the United States.

These funds are structured as 40-Act funds and use a unique approach that allows them to bypass the traditional 19b-4 approval process.

Meanwhile, inflows into spot Ethereum ETFs picked up again. Ether ETFs recorded ten consecutive days of fund inflows, with BlackRock’s iShares Ethereum Trust (ETHA) being the main contributor.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. ETH Price Recovery to $3,000 Soon Amid Staking Push for Ethereum ETFs. Accessed on June 2, 2025