US Recession Chance Drops 26%, Will Bitcoin (BTC) Rise?

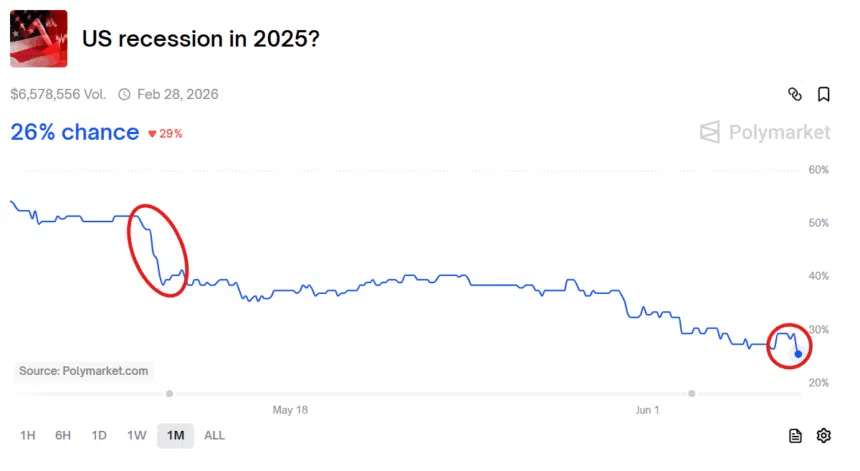

Jakarta, Pintu News—Global markets have recently shown significant signs of recovery, with the risk of recession in the United States (US) in 2025 reduced to just 26% from 56% on May 6, 2025.

This created a positive atmosphere in the financial and crypto markets, although price volatility still occurred in some primary tokens.

Check out the complete analysis here!

Recession Risk Reduction and Its Impact on the Market

The decreasing chances of a recession in the US have considerably impacted global market sentiment. From the available data, whenever the “US Recession 2025?” chart shows major changes, crypto markets tend to experience significant price movements.

For example, when the odds of a recession dropped from 56% to 39% between May 11 and 12, the crypto market experienced a sharp price drop. However, in recent days, when the odds of a recession dropped from 30% to 26%, the crypto market showed a different reaction.

Bitcoin , for example, saw its price increase from $100,550 to $105,106 within 21 hours. This shows that not always a decrease in recession risk means a decrease in crypto prices.

Also read: 2 Key Support Levels for Bitcoin (BTC) Price This Week!

Recent Bitcoin (BTC) Price Movements

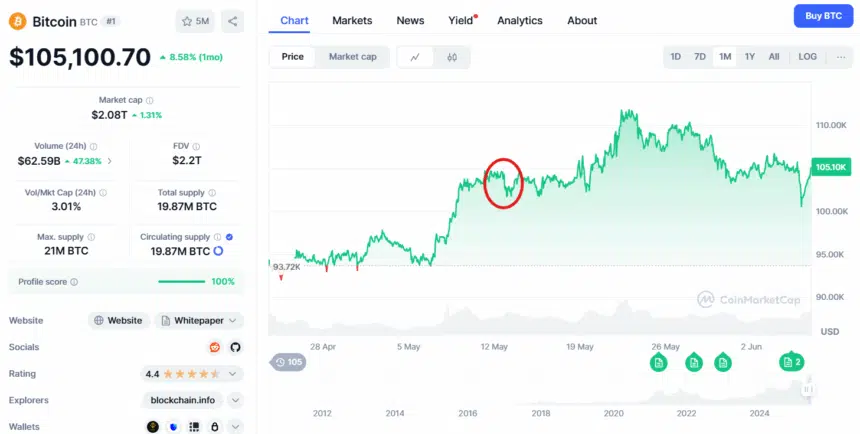

Bitcoin (BTC) has shown remarkable resilience in economic uncertainty. In the past 24 hours, Bitcoin (BTC) price has risen to $105,100.70, with an intraday change of 1.35%. Bitcoin (BTC) trading volume also increased sharply by 47.35%, reaching $62.59 billion, signaling increased interest and activity in the market.

Bitcoin (BTC)’s dominance in the crypto market has reached 63.6457%, showing that it is still the top choice for many investors. This rise might continue if Bitcoin (BTC) breaks through the crucial zone of $106,000, with the following resistance levels at $108,000 and $110,000.

Also read: Eric Balchunas Predicts Memecoin ETF to Emerge in 2026, Here’s What He Says!

Bitcoin (BTC) Price Projections for Next Week

Observing the current trend, Bitcoin (BTC) may continue to increase in price in the coming week. If Bitcoin (BTC) breaks the upper limit of its important zone at $106,000, this could be a strong bullish signal for traders and investors.

Conversely, Bitcoin (BTC) might test its important support level at $102,000 in the event of a decline. If this support cannot hold, Bitcoin (BTC) price could fall to the lower support zone of $100,000. Therefore, it is important for investors to closely monitor price movements and trading volumes.

Conclusion

With the decreased chances of a recession in the US and the positive reaction of the crypto market, especially Bitcoin (BTC), investors may see this as an opportunity to strengthen their positions. Although market volatility is still a factor that cannot be ignored, the current trend shows further potential for Bitcoin (BTC) price recovery and growth.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. US Recession Odds Drop to 26%, Will Bitcoin Price Recover? Accessed on June 0, 2025

- Featured Image: Generated by AI