Plasma Blockchain Raises $500 Million Through ICO Amid Booming Stablecoin Demand!

Jakarta, Pintu News—Plasma, a Layer 1 blockchain, recently demonstrated its high interest in the stablecoin sector by filling out the deposit form for its initial coin offering (ICO) of $500 million in just a few minutes.

Initially, the token sale was capped at $250 million, but after deposits filled up quickly, the cap was raised to $500 million. This increase was immediately met when market participants realized the increased capacity.

The cooperation with Sonar, the ICO arm of the public fundraising platform Echo led by Cobie, shows effective synergy in managing this large fund.

Plasma, which operates as a ‘stablechain’ or Layer 1 blockchain optimized for stablecoin transactions, has the full support of Tether, the leading stablecoin issuer in DeFi, Tether .

Token Sale Details and Dynamics

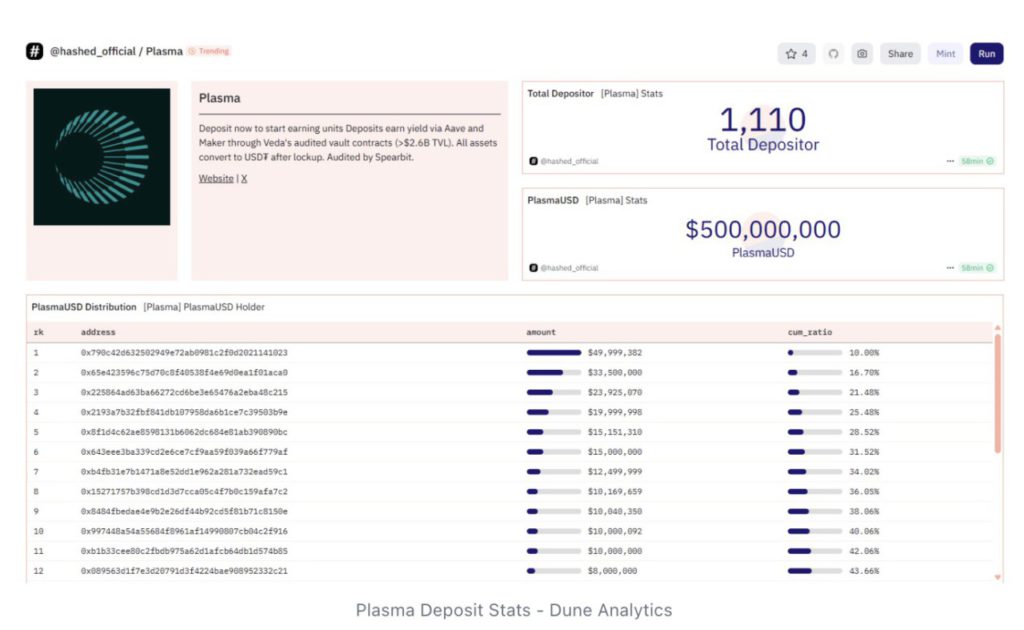

In this sale, Plasma offered 10% of their XPL token supply at a fully diluted valuation (FDV) of $500 million. The sale attracted activity from large investors, with over 1,110 wallets participating and a median deposit of $35,000.

The largest contributor in this pre-sale sent the maximum allocation of $50 million, which was 10% of the total pre-sale. 38% of the total funds raised were held by the top 10 depositors, and 50% were held by the top 17 depositors.

Despite some reservations about the concentration of top holders, many analysts still consider this fundraising a success. This shows the high confidence of major investors in Plasma’s potential.

Read also: John Deaton: “Buying Bitcoin (BTC) at $106,000 is Safer than $25,000!”

Market Response and Capacity Building Potential

The market response to the Plasma ICO has been very positive, reflecting the great enthusiasm for the project. Nathan Lenga, a member of the Plasma team, shared via a message on Discord that there may be an increase in deposit capacity again.

This suggests that demand is still very high and Plasma may consider opening up more XPL token allocations. However, it is not yet clear whether additional deposits will be offered at the same valuation as the initial $500 million.

This decision will largely depend on market dynamics and further responses from the investor community. Plasma must carefully manage expectations and ensure that all parties benefit.

Also read: Cetus DEX Resumes Operations with $30 Million Loan from Sui Foundation!

Implications for the Stablecoin Ecosystem

The success of Plasma’s ICO marks an important point in the evolution of the stablecoin ecosystem. With backing from Tether (USDT), Plasma has the potential to become one of the key players in providing a stable and efficient infrastructure for stablecoin transactions.

This will help in increasing the adoption of stablecoins across different sectors of the economy. Moreover, this success could also spark further innovation in blockchain technology and possibly influence the way stablecoins are integrated in traditional finance. With a stronger platform and more funding, Plasma could accelerate the development of new features and global expansion.

Conclusion

With a successful fundraising campaign and strong community support, Plasma’s future in the stablecoin ecosystem looks bright. The trust shown by major investors shows Plasma’s great potential as the backbone of stablecoin transactions. Going forward, Plasma is expected to continue to innovate and expand its reach in the global market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- The Defiant. Blockchain stablecoin Plasma Fills $500 Million ICO Instantly. Accessed on June 10, 2025

- Featured Image: X