GameStop Buys 4,710 Bitcoin (BTC), Will This Strategy Be Profitable?

Jakarta, Pintu News – GameStop has announced the purchase of 4,710 Bitcoin as part of their financial strategy. This purchase took place between May 3 and June 10, 2025, which was disclosed alongside the first quarter financial results of 2025.

Although GameStop’s revenue did not meet expectations, improvements in operating cost management and free cash flow indicate the potential for recovery.

Check out the full information here!

GameStop’s Financial Performance Below Expectations

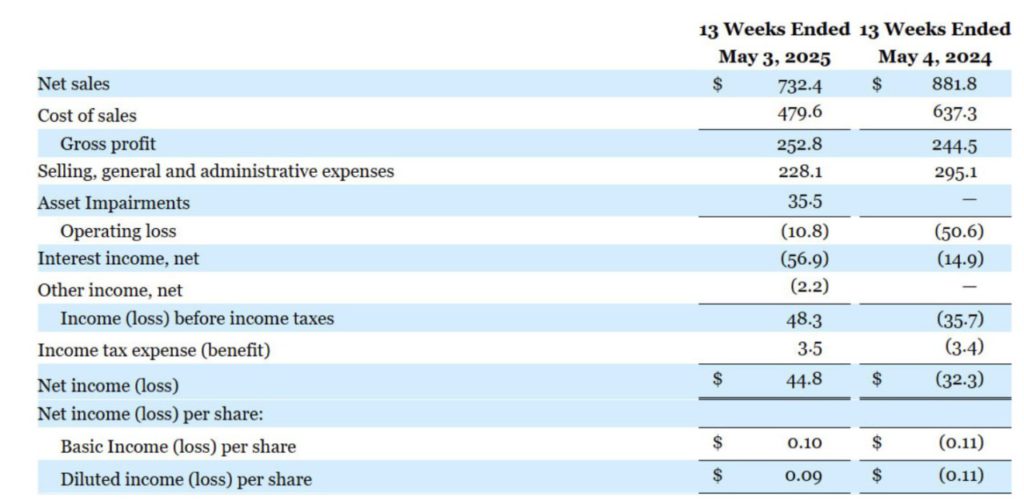

In the first quarter of 2025, GameStop reported revenue of $732.4 million, falling short of analysts’ expectations of $754.2 million. Nonetheless, their earnings per share (EPS) came in at $0.09, surpassing analysts’ predictions of $0.04.

This signifies an improvement from the previous year, where GameStop experienced a negative operating margin. The operating margin has improved from -5.7% to -1.5% from the first quarter of 2024 to the first quarter of 2025.

Also read: 3 Crypto that Potentially Listed on Binance in June 2025!

This shows GameStop’s efforts in controlling operating costs. In addition, their free cash flow also saw a significant improvement, from negative $114.7 million to positive $189.6 million.

Bitcoin Asset Expansion by GameStop

GameStop has purchased 4,710 Bitcoin (BTC) with a current market value of about $516.6 million. This is part of their strategy to keep digital assets in the company’s coffers.

This move follows in the footsteps of other companies such as Strategy that have invested heavily in Bitcoin (BTC). This purchase not only shows GameStop’s confidence in the long-term value of Bitcoin (BTC), but also an attempt at asset diversification and financial risk reduction.

With high market volatility, holding Bitcoin (BTC) could provide GameStop with significant profits if the price of Bitcoin (BTC) continues to rise.

New ETF Based on GameStop’s Bitcoin Strategy

Bitwise Asset Management has launched a new ETF, the Bitwise GME Option Income Strategy ETF (IGME), which focuses on the volatility of GameStop shares and the growth potential of their investments in digital assets. The ETF is designed to provide income to investors through a covered call strategy, as well as exposure to GameStop’s Bitcoin (BTC) holdings.

Read also: Cathie Wood’s Prediction: “Bitcoin (BTC) Will Break $1.5 Million in 5 Years!”

This ETF offers investors the opportunity to benefit from GameStop’s strategy without having to directly buy shares or Bitcoin (BTC). This could be an attractive investment option for those seeking exposure to the crypto market through a more stable and diversified instrument.

Conclusion

Although GameStop faces challenges in sales and competition from digital and streaming game services, their move into Bitcoin (BTC) shows innovation and adaptation.

With improved operating margins and free cash flow, as well as strategic investments in Bitcoin (BTC), GameStop may be on the right track for long-term recovery. This investment also indicates a shift in GameStop’s strategy from a traditional gaming retailer to a company more focused on technology and financial innovation.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. GameStop Acquired 4,710 Bitcoin as Part of Strategic BTC Treasury: Report. Accessed on June 11, 2025

- Featured Image: Coin Journal