Is Pepe Coin About to Skyrocket 40% or Plunge 50%? A Major Move is Coming!

Jakarta, Pintu News – In the turbulent world of cryptocurrencies, Pepe Coin is currently at a tipping point.

With chart patterns indicating potential upside, as well as trading volumes reaching record highs, the frog-based meme currency may experience a price spike or a drastic drop.

Recent analysis suggests that Pepe Coin (PEPE) could surge by 40% or fall by 50%, depending on the next price movement.

Technical Analysis Shows Pepe Coin’s Potential Surge

Since peaking on May 23 at $0.0000163, Pepe Coin (PEPE) has formed a pattern of lower highs and lower lows, which indicates a bullish falling wedge pattern.

Read also: Top 5 Altcoins Worth Buying When Ethereum (ETH) Surges

If Pepe Coin (PEPE) manages to break the upper trendline of this wedge, a price surge up to $0.0000181 is expected. Currently, the price is approaching the upper trendline, and a strong daily candlestick close above $0.0000108 would confirm this breakout opportunity.

This pattern is supported by a bullish crossover on the Moving Average Convergence Divergence (MACD) on the daily chart, which indicates a change in momentum to a more positive direction. In addition, the close above the 200-day Simple Moving Average (SMA) also signals a bullish change in market structure.

If the current pullback can hold above this SMA, Pepe Coin (PEPE) might enter a sustainable uptrend.

Increased Trading Volume Supports Bullishness

Pepe Coin (PEPE) spot and derivatives trading volume has reached new highs, with 24-hour trading volume reaching $1.6 billion, surpassing other meme currencies such as Dogecoin .

Data from Coinglass also shows a 37% jump in derivatives volume in the last 24 hours, reaching $3.94 billion. This spike signals high trader interest and speculative positioning ahead of major price movements.

The 10% increase in open interest to $573 million also goes hand in hand with the increase in 24-hour volume, indicating the opening of new positions on Pepe Coin (PEPE).

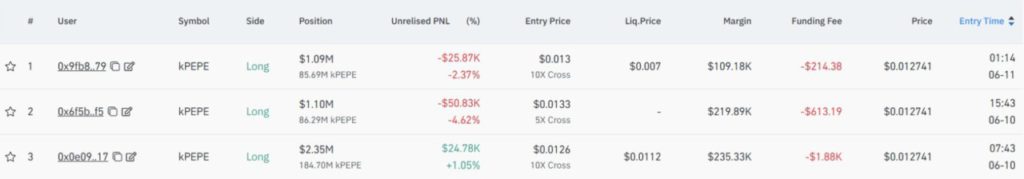

Furthermore, the hyperliquid whale tracker reports that whales have opened long positions of over $4.5 million in the last 24 hours, providing further support for a potential Pepe Coin (PEPE) price rally of 40%.

Read also: Shiba Inu Upgrade Triggers Real-Time Burning, But One Metric Plummets 98%!

Risk of Failure and Potential Pepe Coin Decline

Although there are many indicators supporting the price increase, the risk of failure remains. If Pepe Coin (PEPE) fails to maintain critical support at $0.0000106, this will validate the falling wedge pattern and bullish expectations up to $0.0000181.

In this scenario, Pepe Coin (PEPE) price could fall by 50%, as previously analyzed by CoinGape page. Failure to break wedge resistance or maintain support at the lower trendline could invalidate this bullish setup and pave the way for further declines.

Investors and traders should monitor these indicators closely to make informed investment decisions.

With all the technical indicators and trading volumes in favor, the future of Pepe Coin (PEPE) looks set to be heavily influenced by price movements in the near future.

Whether there will be a big surge or a sharp drop, the crypto market is always full of surprises. Market participants should remain vigilant and prepared for every eventuality.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Pepe Coin Price at Tipping Point: 40% Rally or 50% Crash? 1.6B Volume Hints at Imminent Move. Accessed on June 12, 2025