Will Selling Pressure Shake Chainlink’s Bullish Dominance?

Jakarta, Pintu News – The uncertainties surrounding Chainlink’s bullish strength and short-term market sentiment is full of worries, suggesting a less than encouraging outlook for the LINK exchange rate in the future.

Recent Analysis of Chainlink (LINK) Performance

Chainlink (LINK) saw a 2% rise on June 16, which briefly gave hope of a 16% rally. However, those hopes were dashed in the last 24 hours, with Chainlink recording a 3% price drop as of press time. This decline coincided with fluctuations in the price of Bitcoin , which was affected by the latest news from the Middle East.

Meanwhile, Bitcoin (BTC) is expected to experience a bullish reaction in the range of $102,000-$104,000 and a bearish reaction near $108,000-$110,000 in the coming week. On the other hand, Chainlink currently offers a good buying opportunity with clear exit points. The middle support at $13.2 is expected to act as support.

Also Read: Bitcoin (BTC) Hits a New Low, What’s the Impact on the Market? (6/18/25)

Chainlink (LINK) Price Movement Prediction

The Volume Balance (OBV) shows seller dominance and the Relative Strength Index (RSI) is bearish, signaling that although there is a chance for a rally from the middle support, traders should prepare for a possible price drop below $12.64. Bitcoin’s (BTC) price recovery could change Chainlink’s (LINK) market sentiment again.

According to IntoTheBlock’s In/Out of the Money data, a sizable supply zone is in the range of $13.6-$13.9. For a rally from the $13 support, it would take significant demand to push prices past $14-$14.4, another supply zone. However, weak price action in June supports the prediction that prices may drop to $12.1, or even lower to $10.8.

On-Chain Chainlink (LINK) Data Analysis

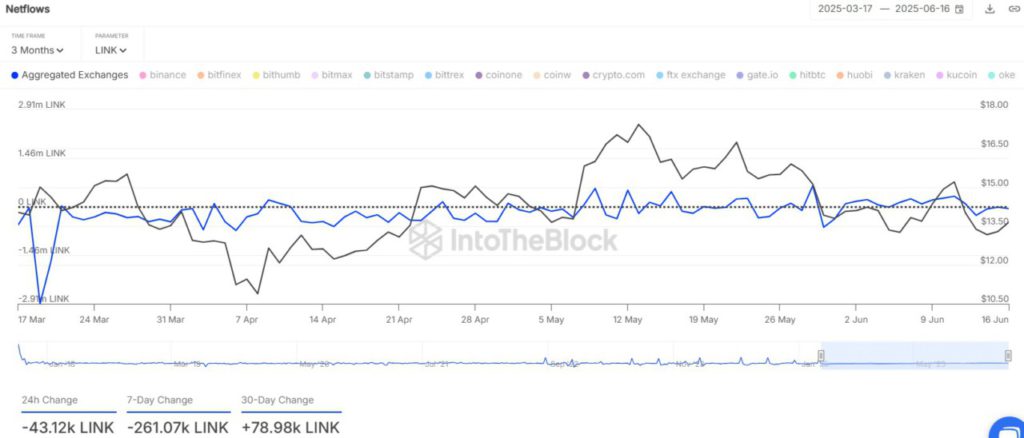

Exchange netflows data showed some accumulation over the past week, with a figure of -261,000 LINKs meaning outflows worth $3.44 million. Outflows from exchanges are a positive indication as they show accumulation. However, netflows in June were generally positive, with approximately 79,000 LINKs worth $1.04 million moving to exchanges.

Overall, price action and IntoTheBlock data favor a bearish move in the next few days. Traders can take advantage of the drop below $12.64 and the retest of $13 as resistance to enter short positions.

Conclusion: Chainlink (LINK) Outlook in the Short Term

The overall data and analysis suggests that Chainlink (LINK) may face more selling pressure in the near future. While there are opportunities for recovery, market participants should remain wary of the potential for further declines. Investment decisions should be based on in-depth analysis and continuous monitoring of market indicators.

Also Read: Global Tensions Heat Up, Crypto Takes a Hit: What Really Happened? (6/18/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Will Chainlink bulls fall as selling pressure rises? Examining. Accessed on June 19, 2025

- Featured Image: Finimize