FARTCOIN Drastic Decline, Bearish Signal Threatening? (6/19/25)

Jakarta, Pintu News – In recent crypto-coin trading, FARTCOIN has experienced a sharp decline of more than 13% in the past 24 hours, putting its $1 billion market capitalization in jeopardy. After experiencing significant gains earlier in the month, the momentum has now turned bearish as signaled by several technical indicators.

The BBTrend indicator shows a sharp decline, the ADX indicates a weakening trend strength, and a possible death cross on the EMA chart. Without buying pressure coming back, FARTCOIN may experience a deeper decline.

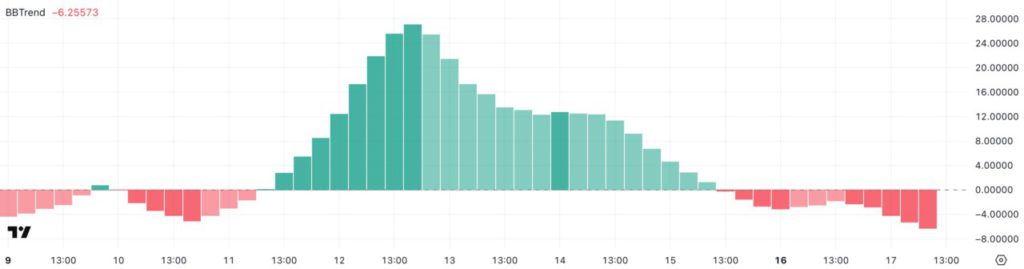

BBTrend FARTCOIN: Negative Signals Strengthen

FARTCOIN’s BBTrend has turned sharply negative, currently standing at -6.22 after turning negative two days ago. This is a significant reversal from its recent high value of 27 just five days ago, signaling a major momentum shift.

BBTrend, or Bollinger Band Trend, measures the strength of price movement direction by analyzing how far prices move relative to their Bollinger Bands. Positive values indicate a strong bullish trend with increasing volatility, while negative values indicate bearish momentum and contraction of price movement.

With FARTCOIN’s BBTrend now well below zero, the indicator is showing increasing downward pressure. A reading of -6.22 implies that the asset is trading close to the lower limit of its volatility envelope and also doing so with growing intensity. This usually reflects a loss of buyer interest and could be a precursor to continued price weakness unless sentiment quickly reverses.

Also Read: Ethereum (ETH) Prepares for a Surge: Bullish Signs Strengthen

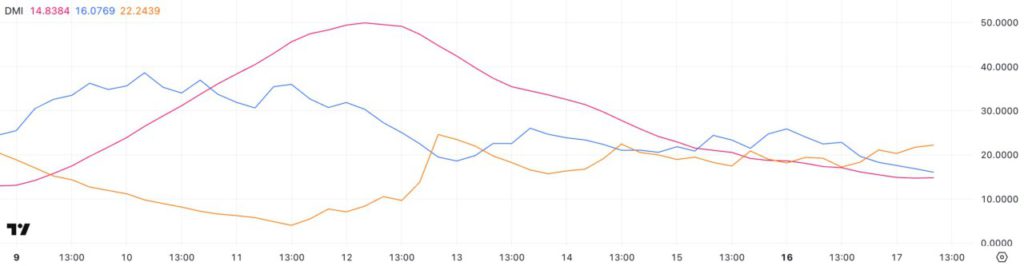

DMI and ADX FARTCOIN: Trend Strength Fades

FARTCOIN’s Directional Movement Index (DMI) is showing clear signs of weakening trend strength, with its Average Directional Index (ADX) dropping to 14.83 from 27.82 just three days ago. The ADX measures trend strength, regardless of direction-values above 25 usually indicate a strong trend, while values below 20 imply low momentum or consolidation.

With the ADX now below 15, FARTCOIN appears to be entering a low volatility phase, where directional conviction fades and price action may become erratic. Meanwhile, directional indicators point to a bearish short-term picture for the meme coin. The +DI, which tracks bullish pressure, dropped sharply to 16 from 25.89, indicating waning buying interest.

At the same time, the -DI rose to 22.24 from 17.27, indicating growing selling momentum. The widening gap between bearish and bullish forces, combined with the drop in ADX, indicates a market where sellers are taking control-but not yet with strong conviction. If the trend strength starts to rebuild with bearish dominance, FARTCOIN may face further declines.

Death Cross Threatens: FARTCOIN Down 22% in 6 Days

FARTCOIN, which was one of the best performing meme coins earlier this month with a 64% gain between June 5 and June 11, has now seen its momentum shift sharply with the token down 22% over the past six days. Recent withdrawals have put technical pressure on the price, and chart indicators point to a potential trend reversal.

FARTCOIN’s EMA line is now close to forming a death cross-a bearish signal that often precedes a prolonged downtrend. If the death cross is confirmed, the meme coin could slide to test support at $1.06, then $1.00, and possibly fall as low as $0.86 if bearish momentum accelerates.

On the other hand, if the bulls take control and the trend turns to the upside, FARTCOIN could retest the resistance at $1.20. A clean break above that level could pave the way for a move towards $1.53.

Conclusion

With various technical indicators pointing to a bearish trend, market participants should be wary of a potential further decline of FARTCOIN. Observation of changes in these indicators will be key to predicting the next direction of this meme coin. Investors and traders should consider organizing their strategies based on the current market dynamics to avoid possible losses.

Read More: Will Selling Pressure Shake Chainlink’s Bullish Dominance?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Fartcoin Drops Signals Deeper Decline. Accessed on June 19, 2025

- Featured Image: CCN