MicroStrategy’s Profit is Predicted to Skyrocket in Q3, Supported by Bitcoin Price Increase!

Jakarta, Pintu News – In the third quarter of this year, Strategy (formerly known as MicroStrategy) has the potential to set a record for the highest profit in the company’s public financial history.

If the price of Bitcoin reaches $119,000 by the end of August, the profits achieved could surpass Nvidia’s achievement and come close to the record held by Apple.

Check out the full info below!

Aggressive Bitcoin Strategy by Michael Saylor

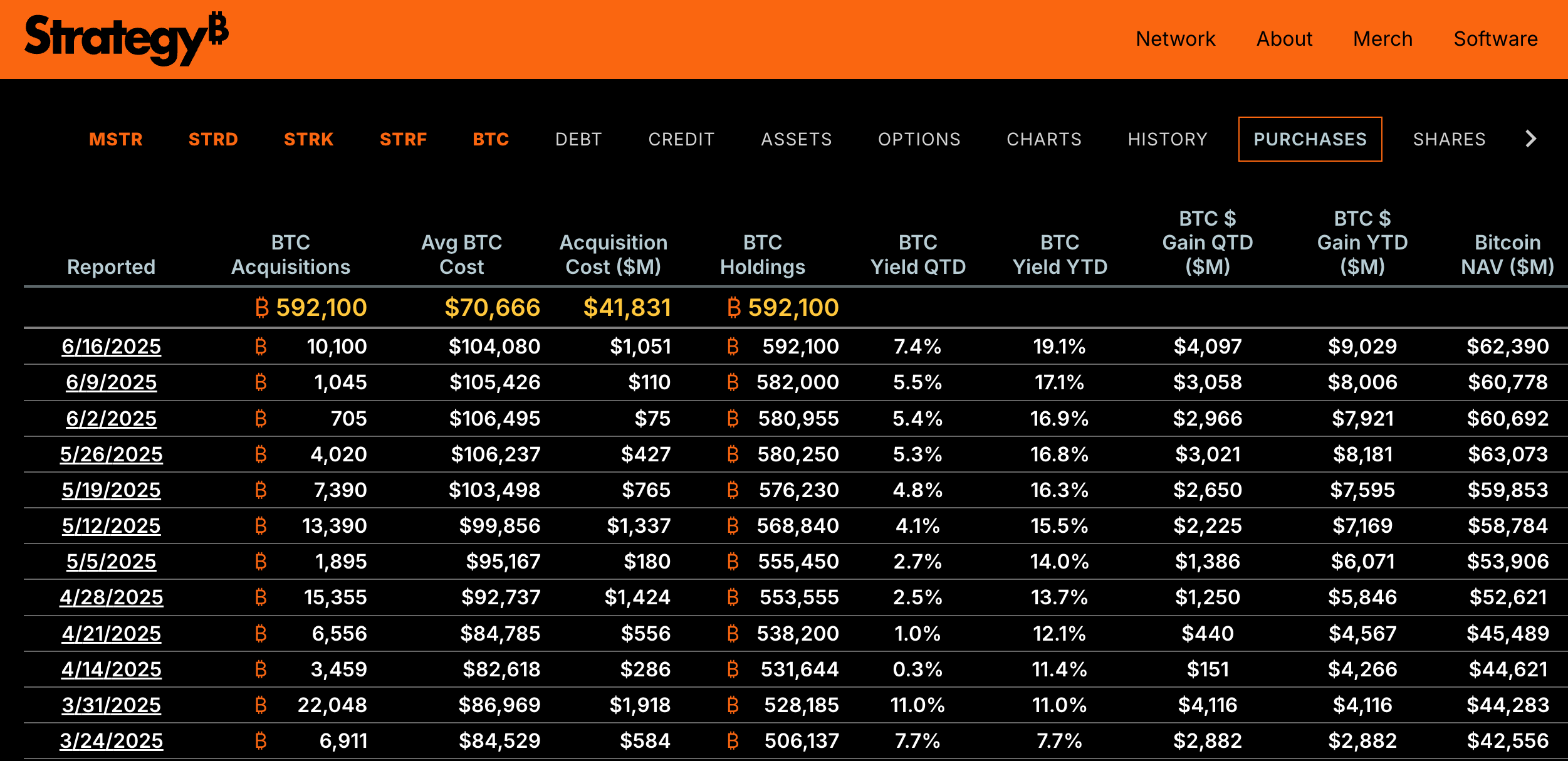

Michael Saylor has led Strategy with an aggressive Bitcoin (BTC) investment strategy, which continues without showing any signs of slowing down. With 592,100 Bitcoin (BTC) on its balance sheet, Strategy is the largest corporate holder in the world.

This success not only confirms Strategy’s position in the market, but also attracts attention from other industry players. The spectacular rise in the price of Bitcoin (BTC) could change the map of global financial competition, with Strategy at the forefront.

The profits that may be achieved will be a true testament to the effectiveness of the bold strategy taken by Saylor, and could be a model emulated by other companies looking to utilize digital assets as financial leverage.

Read also: Data Leak of 16 Billion Passwords Shocks the Crypto World, What Happened?

Big Profits, But Are They Coming from Core Operations?

Although Strategy recorded significant profits from their Bitcoin (BTC) holdings, it is important to note that these profits mostly came from tax advantages, not from their core business operations.

This raises questions about the sustainability and stability of long-term profits that depend on fluctuations in the price of crypto assets. This approach, while profitable, may not be suitable for all companies.

Before adopting a similar strategy, other companies should carefully consider their financial position. The risks associated with Bitcoin (BTC) price volatility can have a significant impact on balance sheets if not managed carefully.

Also read: LGHL Poised to Become a Market Leader with $600 Million Investment in Hyperliquid!

Sustainability and Environmental Impact Considerations

One of the major concerns arising from the adoption of Bitcoin (BTC) by large corporations such as Strategy is the environmental impact of Bitcoin (BTC) mining. This activity is known to require huge energy consumption, which contributes to climate change and environmental damage.

Strategy, through their acquisition of Bitcoin (BTC), indirectly supports industries that have a negative impact on the environment. This raises questions about corporate social responsibility and how large companies should balance financial gain with environmental sustainability.

Conclusion

With the potential to set unprecedented profit records, Strategy suggests that investing in Bitcoin (BTC) could be very lucrative. However, other companies interested in following suit should consider all aspects, from financial risk to environmental impact, before making an investment decision.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. MicroStrategy Bitcoin Earnings Q3 Speculation. Accessed on June 20, 2025

- Featured Image: Unchained Crypto