Hashflow (HFT) Skyrockets Over 100% in a Day — What’s Fueling This Explosive Rally?

Jakarta, Pintu News – Hashflow , a decentralized exchange(DEX) that uses the Request for Quote(RFQ) mechanism, has just recorded a sharp spike in trading volume as well as impressive price performance in early July.

While the altcoin market in general is still struggling to recover, what makes HFTs able to move in the opposite direction of the trend?

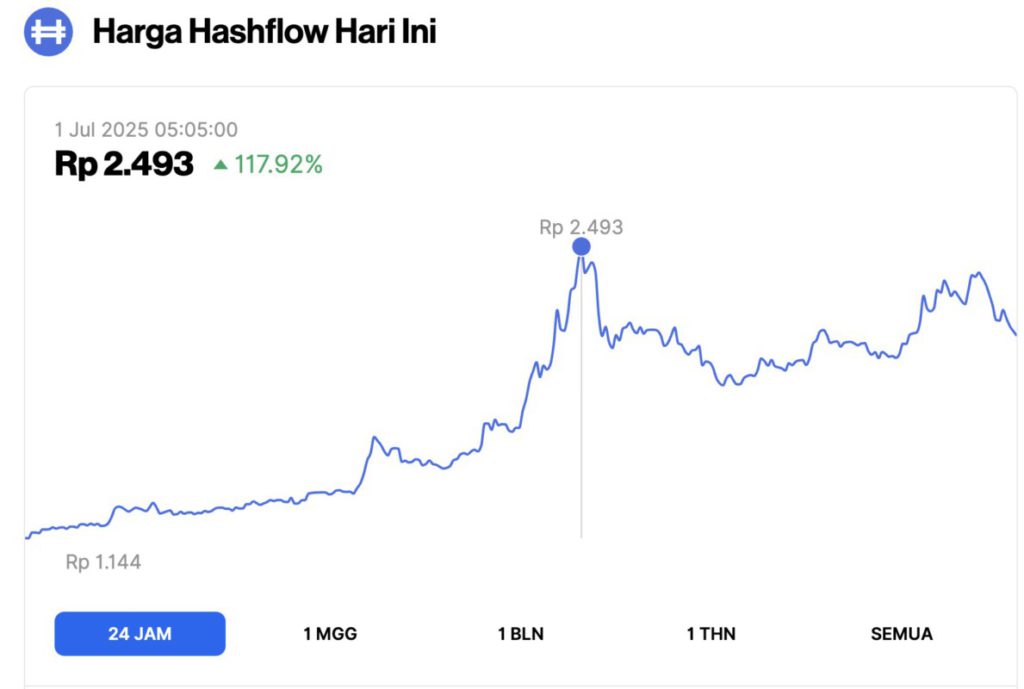

Hashflow Crypto Price Up 117.92% in 24 Hours

According to data from Pintu Market, HFT prices surged over 117% in just the past 24 hours. Currently, the HFT is trading at around IDR2,493 – its highest price since February 2025.

On June 30, HFT recorded a daily gain of more than 80%. The day was the strongest daily performance since its peak in 2023.

Read also: Top 3 Crypto Airdrops to Watch out for in Early July!

In addition, data from CoinMarketCap shows that HFT spot trading volume in 24 hours has surpassed half a billion USD. This is the highest daily volume so far this year, and 25 times greater than the previous daily average.

This price spike makes HFT the best performing DEX token, as well as making the DEX sector the best performing crypto segment over the past week.

Data shows that investors are starting to come back into HFT in a big way, after the token had lost up to 95% of its value over the past almost three years.

What’s Driving the Crypto HFT Price Rally?

In June, Binance announced support for HFT deposits on the Solana network, along with other integrations through platforms such as Jupiter and Titan.

“Hashflow is growing rapidly in the Solana ecosystem. Binance now supports HFT on Solana, and so do we. We are already integrated with Jupiter, Kamino, and Titan. There will be more integrations in the future,” said Hashflow.

This development is likely to trigger positive sentiment from investors and fuel the HFT price rally.

However, this rally could face a number of challenges. First, the project’s token unlock schedule is still ongoing on a daily basis and will continue until the end of 2028.

Currently, only 36.5% of the total HFT supply is in circulation, while every month, as many as 15.8 million HFTs – equivalent to 1.58% of the total supply – are released into the market.

Moreover, data from CoinMarketCap shows that almost 70% of HFT supply is controlled by whales.

Read also: XRP Price Prediction July 2025: Ready to Soar or Fall?

While more than 71% of HFT holders have held tokens for more than a year, many of them have experienced price drops of more than 90% in the past almost three years. If prices start to recover, these long-term holders may be tempted to sell.

Despite the surge in HFT prices, Hashflow’s Total Value Locked(TVL) did not show a significant spike. The figure is still relatively low, only around $618,000, while its DEX daily trading volume is around $7.6 million.

Overall, this data shows that the main challenge for Hashflow is not just to score a short-term breakout, but to maintain price momentum over the long term.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Hashflow (HFT) Leads DEX Tokens With Over 100% Surge – What’s Fueling the Rally? Accessed on July 1, 2025