Price of 1 Pi Network (PI) in Indonesia Today (7/2/25)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia as of July 2, 2025 is recorded to be in the range of IDR 7,900 – IDR 8,000, experiencing a slight decrease compared to the previous day.

This decline comes amid the increasing dominance of stablecoins globally, which are now starting to affect the growth of the Pi Network ecosystem.

The popularity of stablecoins that offer price stability and regulatory support is considered to be a major challenge for Pi in achieving mass adoption as an alternative crypto asset.

Check out the full analysis here!

How much is 1 PI in Indonesia today?

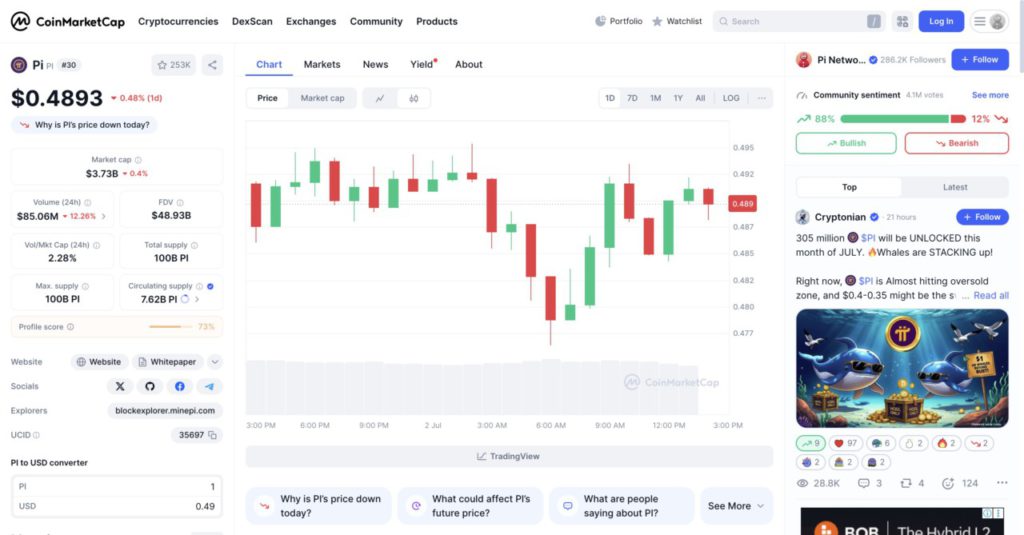

On July 2, 2025, Pi Network (PI) price was recorded at $0.4893, having decreased by 0.48% in the last 24 hours. The candlestick chart shows high price volatility in the last 24 hours, with rapid up and down movements.

Visually, the chart shows the dominance of red candlesticks in the early to mid-day, signaling strong selling pressure. However, towards the afternoon and evening, green candlesticks began to appear as a signal of reversal and buying pressure from the market.

The trading volume in the last 24 hours stood at $85.06 million, a decrease of 12.26%, indicating a decrease in market activity although prices are still moving dynamically. The current market capitalization of PI stands at $3.73 billion with an outstanding supply of around 7.628 billion PI out of a maximum total of 100 billion PI.

Read also: Gold Jewelry Price Today July 2, 2025, Up or Down?

With community sentiment still very positive (88% bullish), investors still seem to see the long-term potential of the Pi Network project, despite the current price consolidation below the $0.50 mark.

Stablecoin popularity influences Pi Network growth

Pi Coin is facing a major challenge amidst the growing global demand for stablecoins. According to renowned analyst and trader Kim H Wong, the popularity of stablecoins could hinder Pi Coin’s goal of becoming a widely used global cryptocurrency.

Stablecoins, whose value is pegged to assets such as fiat currencies or commodities, offer price stability, wide adoption, regulatory compliance, and a wide range of uses. It is these features that are currently considered beyond Pi Coin’s capabilities, according to Wong.

Factors such as Pi Coin’s price volatility, limited liquidity, and regulatory uncertainty are major barriers to competing with stablecoins. In addition, the passage of stablecoin legislation in the US known as the GENIUS Act has further strengthened market confidence in stablecoins.

Even so, Wong believes that Pi Network still has its own advantages that can reduce the impact of stablecoin dominance. Pi’s mobile app-based mining model, which only requires one tap per day, is considered more accessible than stablecoins.

Read also: 4 Crypto’s That Are Widely Talked About in Mid-2025

In addition, Pi’s user base of 65 million people and the reference system they use have created a strong and loyal community. If Pi is able to leverage the real-world benefits of its ecosystem, the potential for mass adoption remains wide open.

Wong also highlighted the launch of Pi App Studio, which now features AI, making it easier to develop apps on the Pi network. An ecosystem with many useful apps can keep users active on the Pi network while attracting new users.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinmarketcap

- Featured Image: Generated by Ai