Shiba Inu (SHIB) Plunges 45%, But the SHIBArmy Isn’t Budging — Is a Massive Comeback on the Horizon?

Jakarta, Pintu News – Shiba Inu has had a tough year so far, with prices down by 45% since the start of the year.

For most assets, a drop of that magnitude would normally send investors fleeing, but the SHIB Army held on undaunted.

Despite the decline, on-chain data shows that holders are holding on, reflecting a level of loyalty and confidence rarely seen in the crypto world.

While this does not necessarily signal an imminent recovery, it could have an important impact on SHIB’s long-term prospects.

Shiba Inu Sentiment Strengthens

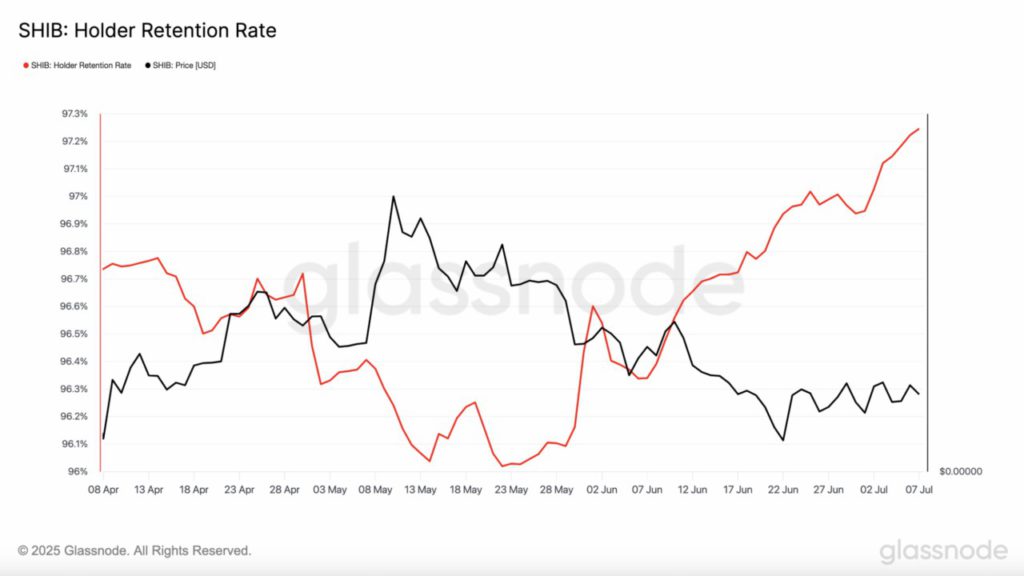

According to data from Glassnode, the SHIB holder retention rate jumped to the highest level of the year at 97.25%. This metric measures the percentage of addresses that consistently hold an asset for a period of 30 consecutive days.

Read also: Aptos Surges to Top 3 in Global RWA — But Is a $50M Token Unlock About to Crash the Party?

A high retention rate indicates strong trust and long-term commitment. For example, an 80% retention rate means that 8 out of 10 previous holders still keep, which signals confidence.

Conversely, low retention could indicate increasing selling pressure or waning interest. Since the opposite is true for these memecoins, SHIB prices are likely to trade much higher in the medium to long term.

However, this will only happen if SHIB holders’ confidence in the asset remains strong in the coming weeks and months. If the retention rate falls below 50% over time, this projection may become irrelevant.

Approaching the Lowest Point

Furthermore, data from Santiment shows that this development is also in line with the signals displayed by the Market Value to Realized Value(MVRV) ratio.

The MVRV ratio shows whether a cryptocurrency is near its bottom(accumulation) or near its top(distribution zone).

When this metric is at a very high level, it signals that the price is nearing the top of the cycle and a correction is likely.

However, as of this writing, SHIB’s MVRV ratio stands at -30.52%, indicating that losses have not been realized to a considerable extent in recent times.

Because of this, SHIB holders tend to be reluctant to sell. This situation indicates that SHIB is in the accumulation zone, which means the price still has the potential to recover.

Read also: Sei Network Breaks Records as TVL Soars Past $626 Million—What’s Fueling the Surge?

SHIB Price Analysis: Potential Reversal

Despite SHIB’s correction, there now appears to be potential for a short-term recovery. For example, on the 4-hour chart (8/7), SHIB price is trading within an ascending triangle pattern, with a target to retest the support level at $0.000012.

Amidst this movement, the Chaikin Money Flow(CMF) has risen above the zero signal line. This indicates increasing buying pressure which could push SHIB’s market value higher.

If this buying pressure continues, the price of the cryptocurrency could potentially break the resistance at $0.000014 and rise to $0.000016 in the short term. However, this prediction could fall if selling pressure returns.

In that scenario, the price could fall through the lower trend line of the triangle pattern. If this pattern is validated, SHIB risks dropping below $0.000010.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Shiba Inu (SHIB) Retains Holders’ Trust Despite 45% Price Decline – What It Means. Accessed on July 9, 2025