Kiyosaki’s Warning: Bitcoin and Global Markets Could Collapse!

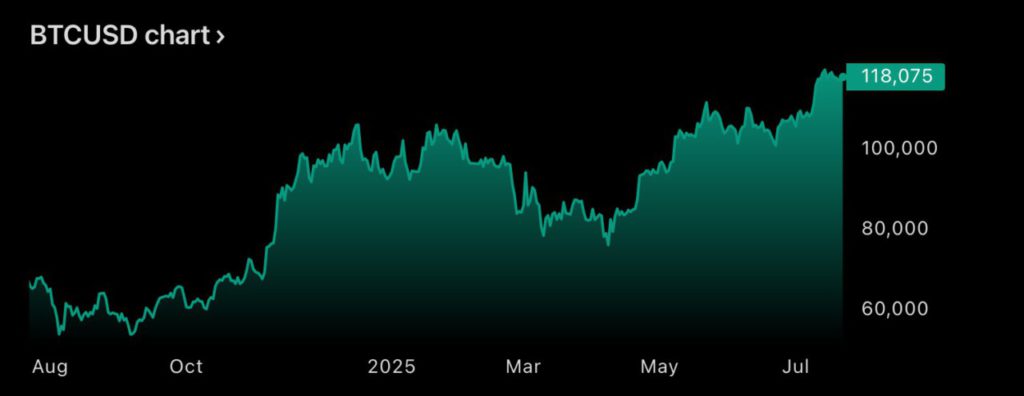

Jakarta, Pintu News – Veteran investor Robert Kiyosaki recently issued a stern warning against market conditions that saw Bitcoin hit a new record high of $123,000. According to Kiyosaki, the long-standing economic bubble in the United States is poised to burst, and Bitcoin (BTC) could slip along with stocks and bonds. Currently, Bitcoin (BTC) has come down from its peak, trading above $118,000 after profit-taking by long-term holders.

Big Debt and Stubborn Inflation

Recent reports show that the US national debt has risen to over $36 trillion, a figure that was hard to imagine a decade ago. Meanwhile, the June Consumer Price Index showed that inflation is not easing as quickly as expected. This has left many investors feeling anxious.

Kiyosaki, who has long supported Bitcoin (BTC) as a hedge against currency weakness, believes that this squeeze will trigger a broad market withdrawal. He warns that gold, silver, and Bitcoin (BTC) may experience a sharp correction when the broader “bubble” finally bursts.

Also Read: Wealth Planning: J.P. Morgan Private Bank’s DCA Crypto Strategy, The Importance of Diversification!

Big Move to the Exchange

On-chain data shows similar caution. According to Glassnode, the 7-day simple moving average of whale transfers to exchanges is approaching 12,000 BTC, the highest level seen in 2025. This spike reflects activity from November 24, 2024, when large holders began moving coins to trading platforms to lock in profits.

Bitcoin (BTC) has risen more than 50% since its April low, so some withdrawals are an almost certainty. Miners have also started moving coins, suggesting that they are also taking advantage.

Firm Increases Investment in Bitcoin

Despite talk of a crash, institutional appetite remains strong. Twenty-one firms added around $810 million of Bitcoin (BTC) to their balance sheets last week as part of their treasury plans. Spot Bitcoin (BTC) ETFs continue to attract steady inflows, offering a regulated path for investors to gain exposure. P

This sustained buying could cushion the blow if massive selling occurs. Market watchers see a tug-of-war going on. On the one hand, large holders are cashing out after a historical rally. On the other hand, companies and funds continue to invest, betting that any dips will be short-lived.

Bitcoin’s Endurance Test

The coming weeks could test Bitcoin’s (BTC) resilience. If stubborn debt and inflation concerns dominate the news, volatility could increase. However, continued institutional support and Kiyosaki’s buy-when-it’s-down stance hint that any dip could set the stage for a new rally.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Not Even Bitcoin is Safe: Kiyosaki Warns of Massive Market Collapse. Accessed on July 22, 2025