Bitcoin Soars to $119K as Crypto Whale Moves $920 Million in Massive Power Play!

Jakarta, Pintu News – As reported by Coingape (23/7), the price of Bitcoin briefly touched $120,000, with daily trading volume surpassing $77 billion.

This rise in BTC price comes after more than $920 million in Bitcoin was withdrawn from the Kraken exchange and sent to unidentified wallets in less than an hour today.

There is a strong accumulation pattern based on these transfers, coupled with increased purchases from ETFs. So, what is the current price movement of Bitcoin?

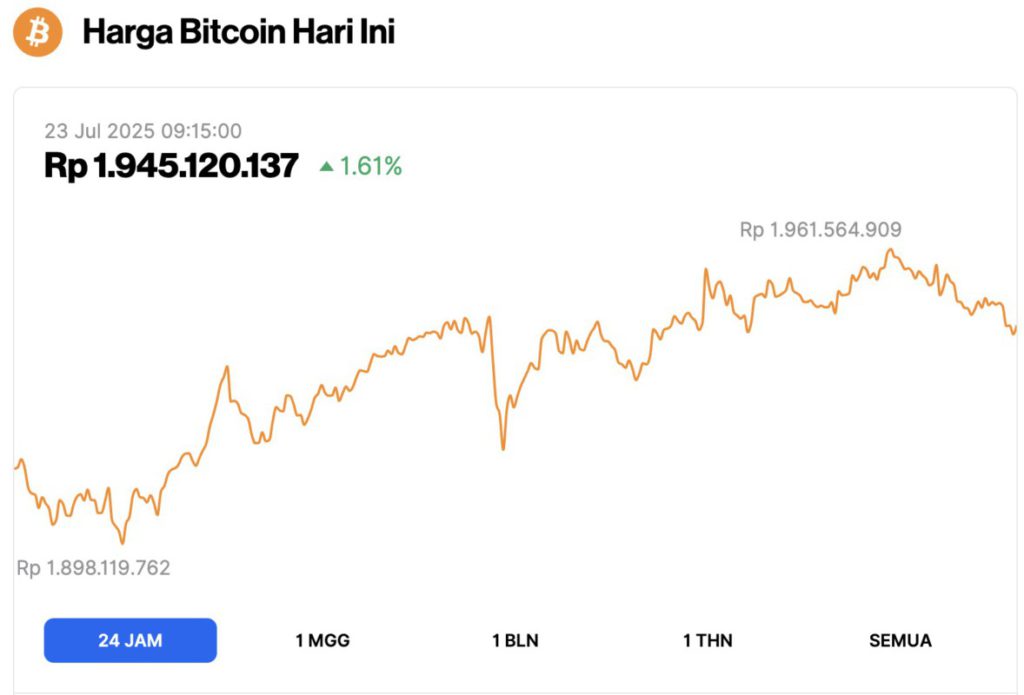

Bitcoin Price Rises 1.61% in 24 Hours

On July 23, 2025, Bitcoin was trading at $119,331, which is equivalent to IDR 1,945,120,137 — marking a 1.61% increase over the past 24 hours. During this time, BTC hit a low of IDR 1,898,119,762 and climbed to a high of IDR 1,961,564,909.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.37 trillion, with trading volume in the last 24 hours rising 7% to $76.5 billion.

Read also: 3 Crypto Predicted to Rise in the Fourth Week of July 2025!

Bitcoin Whale Activity Boosts Demand, Pushing BTC Price Up

As revealed by Whale Alert through a post on platform X, the largest transfer recorded was for 4,166 BTC, worth over $496 million based on the current BTC price.

A few minutes later, another X post reported the transfer of 2,605 BTC worth approximately $310 million.

The third transaction (which was also shared in X’s post) sent 947 BTC, equivalent to nearly $113 million. All of these funds were sent to wallets with no known public affiliation.

All of these transactions took place within 43 minutes, and Whale Alert flagged them with several red alerts. These red alerts indicate high impact market activity.

Mass transfers from exchanges like this can be taken as an indication of investor confidence or a signal that the asset will be held for the long term. This generally has a price-boosting effect on the associated digital asset, in this case the price of BTC.

Whale Accumulation Following Michael Saylor’s Steps?

The amount and speed of withdrawals are likely to be from sustained purchases by individuals or organized groups of whales. Therefore, this action has a direct influence on the price of BTC.

This situation indicates a large demand pressure, where buyers are moving coins to cold storage instead of keeping them in liquid form.

Kraken itself has not issued an official statement regarding this transfer. There were no reports of system maintenance or technical issues when the outflow occurred.

Today’s $920 million transfer was one of the largest hourly BTC outflows from a single exchange in recent months. The speed and magnitude of this transaction adds urgency to the discussion about whale behavior.

Read also: 3 Crypto Predicted to Print New All Time High!

The whale’s BTC accumulation also follows the latest move by strategist Michael Saylor, who plans to raise funds to buy more Bitcoin. The strategy includes plans to raise $500 million through the launch of an IPO of STRC shares.

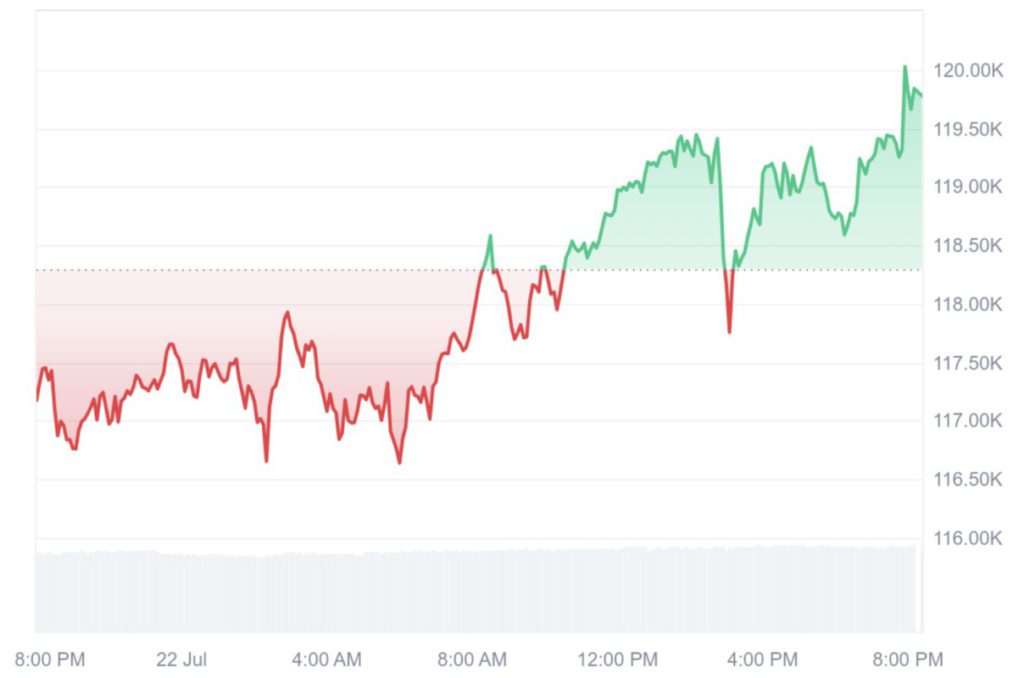

Bitcoin Breaks $120,000 as Trading Volume Surges

At the time of the big transfer, Bitcoin (BTC) price was trading at around $119,559, up 1.96% in one day. In fact, the price of BTC had touched a peak of $120,027 before finally experiencing a slight decline.

Daily trading volumes surged by over $77.5 billion, reflecting an 8.11% increase in just one day. This kind of volume surge accompanied by price increases usually indicates strong buying pressure behind the market.

Interestingly, Peter Schiff – a vocal Bitcoin critic – made a surprising statement this time.

He advised his followers to sell their Ethereum assets and buy more Bitcoin. Schiff cited the BTC price chart as the main reason behind his suggestion.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. BTC Price Reclaims $120K As Whale Accumulates $920M in Bitcoin. Accessed on July 23, 2025