Shocking! Algorithmic Trading Increasingly Dominant, Crypto Also Fearful?

Jakarta, Pintu News – In today’s digital era, the term algorithmic trading is increasingly heard by stock and crypto market players. Not only institutional investors, retail traders have also begun to utilize this technology to obtain maximum profits.

Trading algorithms are considered capable of executing transactions with speed and accuracy that far exceeds humans, so they are able to influence price movements in the stock and cryptocurrency markets. So, what exactly is a trading algorithm and how does it affect modern investing?

What is a Trading Algorithm? How it works and its advantages

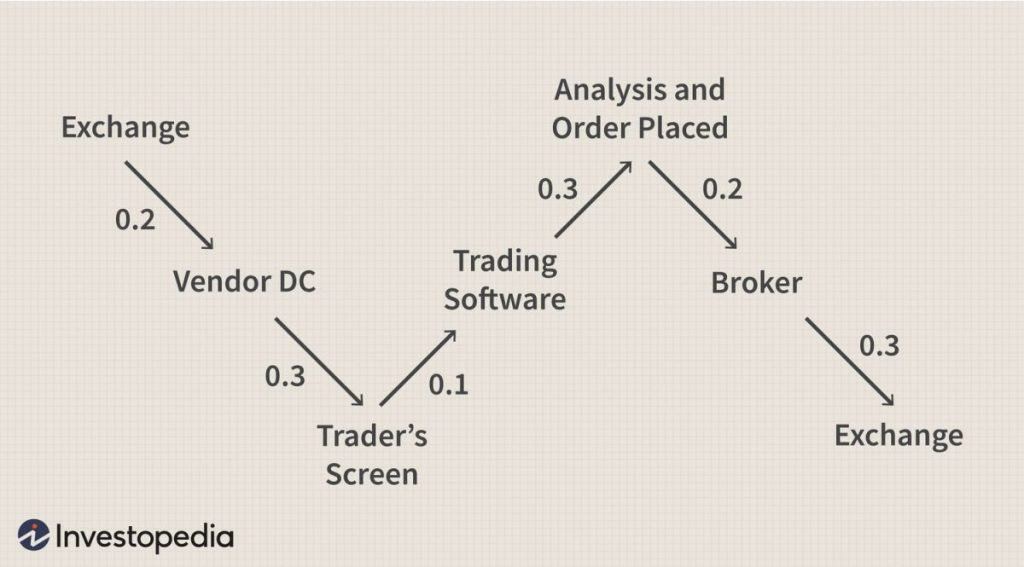

A trading algorithm is a method of automating transactions in financial markets using mathematical and statistical instructions programmed into a computer. The main way a trading algorithm works is that it detects transaction opportunities with certain parameters, such as price, volume, or time, and then executes trades without human intervention.

With this system, thousands of transactions can take place in a matter of seconds, creating high liquidity in the market. One of the main advantages of trading algorithms is their ability to reduce human error and emotions in trading. Algorithms are able to follow a pre-designed strategy in a disciplined manner, without being influenced by market sentiment or rumors.

Moreover, these systems are particularly effective for high-frequency trading strategies, where speed and accuracy are key. Not only in the stock market, trading algorithms are now also widely adopted in crypto and cryptocurrency trading such as Bitcoin , Ethereum , and Ripple .

Also Read: 6 Top Crypto Movers 24 Hours July 23, 2025: Some skyrocketed, some heavily discounted!

Impact of Algorithmic Trading on Stock and Crypto Markets

The use of trading algorithms has had a significant impact on the stock and crypto markets. In the stock market, trading algorithms help create efficiency and liquidity, but on the other hand, they can trigger volatility if many traders use the same strategy at the same time. In some cases, trading algorithms have even been cited as triggering “flash crashes”, which are sudden price drops in a very short period of time.

Meanwhile, in the crypto market, the use of trading algorithms is growing in popularity as transactions on digital assets such as Bitcoin (BTC), Ethereum (ETH), and Pepe Coin increase. Leading crypto platforms have provided APIs and automated trading bots to facilitate users to execute algorithmic strategies.

Another advantage is that traders can set automatic strategies according to the desired parameters, so the opportunity for profit remains open even though the crypto market is very volatile. In recent months, the global trading volume of crypto derivatives has reached more than US$397 billion or equivalent to Rp6,455 trillion (at an exchange rate of 1 USD = Rp16,270).

Risks and Challenges of Using Algorithmic Trading

While they offer many advantages, the use of trading algorithms also comes with risks. One of the biggest challenges is the possibility of “overfitting”, where the algorithm overcorrects to historical data and is therefore less effective in real market conditions. In addition, any bugs or errors in the code can be fatal, as the execution of transactions takes place very quickly without manual checking.

In the crypto market, another risk is market manipulation or pump and dump which can also be executed automatically by malicious algorithms. Therefore, traders are advised to do in-depth research and test algorithms regularly before they are actually implemented in the real market. It is also important to keep safety and regulatory factors in mind, especially given the rapid developments in the cryptocurrency sector.

Conclusion: Algorithmic Trading is Not Just a Trend, but the Future of Modern Investing

Trading algorithms have revolutionized the way stock and crypto markets are traded. By combining speed, accuracy and discipline, algorithms are able to deliver efficiencies and profits that are difficult to achieve manually.

However, traders and investors must still be careful to understand the risks, including in choosing crypto assets such as Bitcoin (BTC), Ethereum (ETH), and other altcoins that are increasingly diverse. In the future, trading algorithms are predicted to dominate, not only in the global stock market, but also in the increasingly dynamic cryptocurrency ecosystem.

Also Read: 5 Cryptos with the Highest Gains at the Market on July 23, 2025-Anything Over 24% in a Day!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Corporate Finance Institute. Algorithmic Trading. Accessed July 24, 2025.