Ethereum Crashes to $3,600 — Is a Drop to $2,800 Coming Next?

Jakarta, Pintu News – As of July 25, the price of Ethereum has fallen by 1% in the last 24 hours and was trading at $3,614.

According to a Coingape report, ETH is now facing a possible drop to $2,800 after more than 640,000 validators queued up to exit staking. This leaves traders wondering if $2,800 will be the next point.

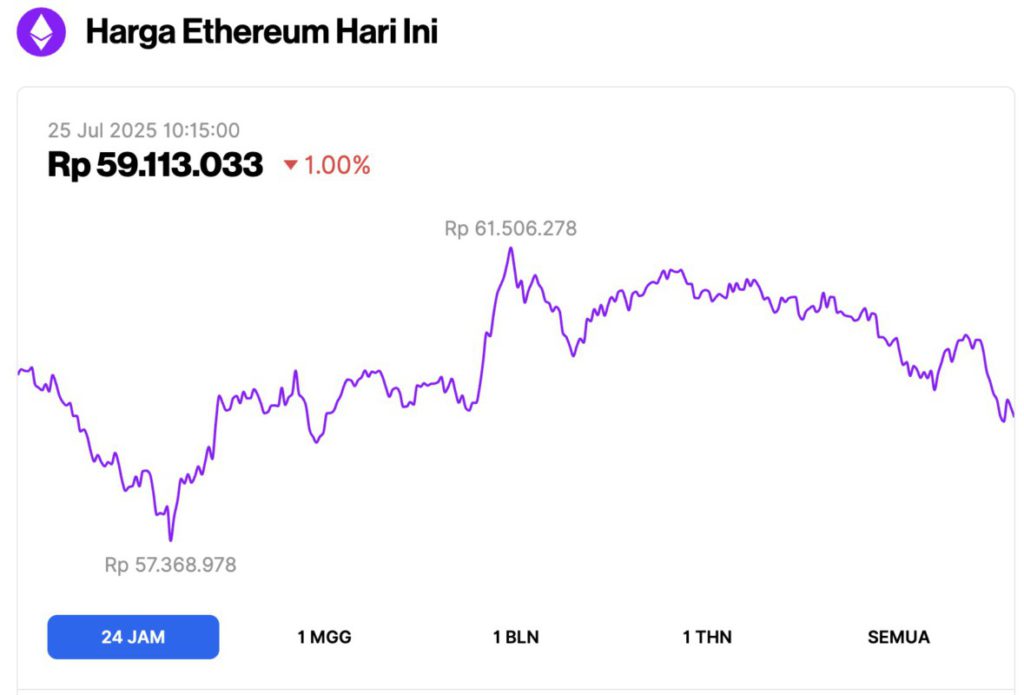

Ethereum Price Drops 1.00% in 24 Hours

As of July 25, 2025, Ethereum was trading at approximately $3,614, or around IDR 59,113,033, marking a 1.00% decline over the past 24 hours. Within this timeframe, ETH hit a low of IDR 57,368,978 and climbed to a high of IDR 61,506,278.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $436.7 billion, with daily trading volume rising 10% to $43.55 billion in the last 24 hours.

Read also: Bitcoin Crashes to $116K Today (July 25) — But Here’s Why Its Market Dominance Is Surging Again!

Ethereum Price Heads to $2,800 as Crypto Market Plunges

According to Coingape, the price of ETH did not escape the impact of the market crash on July 24. In fact, the drop from $3,681 to $3,515 made many traders, especially long-term buyers, lose money.

However, despite this drop, Ethereum managed to maintain its bullish structure, although it may need to return to $2,800 first.

The reason why the $2,800 price is back in focus, despite Ethereum having crossed it on July 10, lies in a technical pattern. This price previously served as resistance in a head and shoulders pattern, but after breaking through it, ETH has not returned to retest it properly.

If the price drops back here, it could be an opportunity to confirm the level as support.

Below $2,800 there is also a demand zone between $2,500 and $2,600 that might give Ethereum a breather if $2,800 doesn’t hold. If ETH retests these lower levels and manages to hold, it could rally to above $6,000.

Nonetheless, it is hard to ignore that the CMF remains on the positive side, which is a clear sign that the bulls have not retreated. These observations suggest that ETH may miss the opportunity to retest $2,800. However, the journey towards $6,000 will still be maintained.

For now, ETH seems to remain bullish until the end of this quarter. However, when looking at Ethereum’s long-term price projections – especially towards 2025 and beyond – the road to new highs still looks rocky.

Read also: 3 Cryptos Ready to Rally in Altseason!

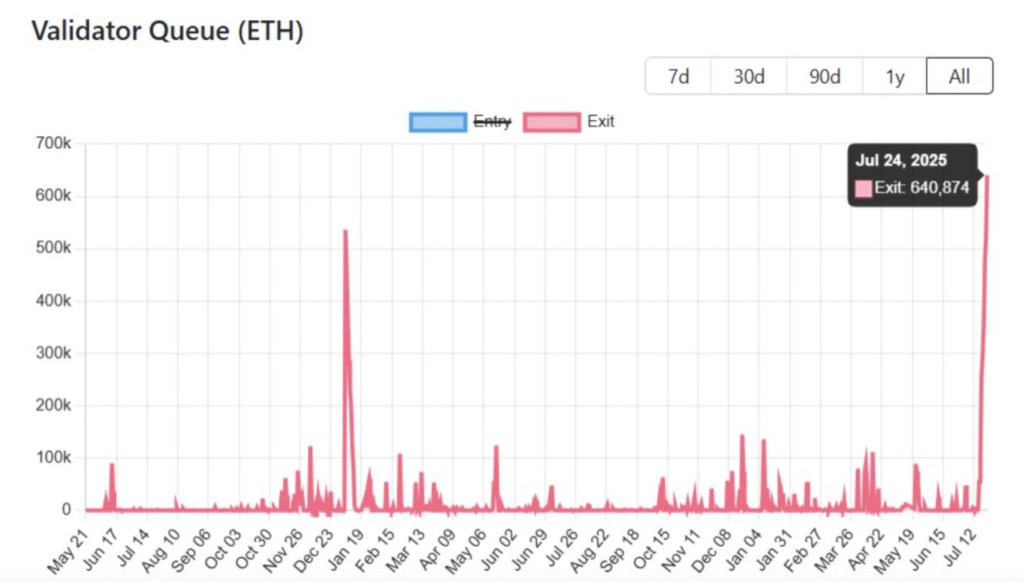

640,000 ETH Out of Staking as Price Declines Concerns

The Ethereum validator exit queue suddenly jumped over 640,000 ETH. This is the highest amount ever recorded exiting the network at once. This situation could mean that they are simply selling for profit, and if this is indeed the case, the ETH price could drop to $2,800.

However, Everstake noted that even though stakers are selling, this just shows how decentralized the Ethereum network is. They say,

“Indeed, activity like this shows how mature Ethereum staking is. It’s a protocol that does what it was designed to do. And that’s what decentralization is all about.”

In summary, the Ethereum price still looks strong despite today’s decline, but the activity of this validator is quite worrying.

If whales or institutions can absorb these coins if they end up being sold, and ETH avoids dropping below $2,800, it would be a much-needed sign that the $6,000 price might be reached.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Fears Crashing to $2,800 As 640,000 ETH Exits Staking. Accessed on July 25, 2025