Ethereum (ETH) Price Approaches $4,000, Signaling a Price Rise?

Jakarta, Pintu News – Ethereum is back in the limelight in the crypto market with its price approaching the critical $4,000 mark. Currently, Ethereum (ETH) is trading at $3,933.77, showing a significant increase that adds more than $474 billion to its valuation.

This increase was driven by strong institutional flows and technical momentum. With trading volumes increasing by 26.18% to nearly $30 billion, many are wondering if this will be the breakthrough moment Ethereum (ETH) enthusiasts have been waiting for.

Check out the full analysis in this article!

Ethereum (ETH) Price Analysis

Currently, Ethereum (ETH) price is at $3,933.77 after briefly touching a daily high of $3,934.75. The RSI indicator shows overbought levels at 72.03, while the price continues to follow the upper Bollinger Band.

If the bulls can break the $4,096.82 resistance zone, Ethereum (ETH) could surge higher towards a new yearly peak. However, if it fails to hold current levels, a quick correction could occur towards support at $3,687, then to $3,585 or even $3,550 if selling pressure increases.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (7/29/25)

Speculation and Institutional Flows

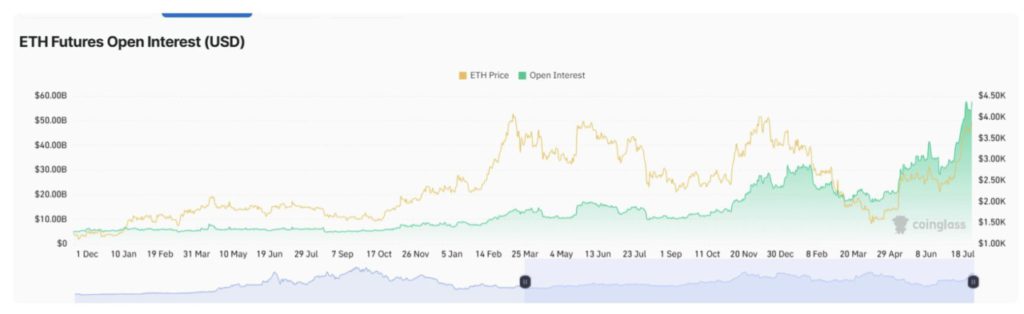

Ethereum (ETH) futures on the Chicago Mercantile Exchange (CME) have reached a record high with open interest of $7.85 billion. This rapid growth in open interest signals strong speculative activity in the crypto market and enlarged institutional involvement.

These trends are often associated with upcoming price volatility. Any spike in open interest is usually followed by price appreciation, indicating that leveraged long positions are dominating the market at the moment.

Also read: BTC, ETH, and XRP Price Predictions for Early August 2025, Bullish or Bearish?

Liquidation and Market Movement Risk

If Ethereum (ETH) manages to break above $4,062, around $1.31 billion in short positions could be liquidated, which could trigger a cascade of buy orders. Conversely, a drop below $3,687 could put $2.9 billion in long positions at risk, showing how strong the current position is despite the uncertainty.

Both scenarios suggest the potential for significant price movements in the near term, depending on market dynamics and decisions made by the Federal Reserve (FED).

Conclusion

With all the indicators and speculations in place, the future of Ethereum (ETH) price largely depends on how the market responds to the current conditions. Whether this will be a turning point for Ethereum (ETH) or just a warm-up before further corrections, only time will tell. Investors and market watchers should stay alert to any changes that may occur.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinpedia. Ethereum Price Eyes $4, Liquidation Risks Loom. Accessed on July 29, 2025

- Featured Image: FX Empire