Bitcoin (BTC) Prediction in August 2025, Bullish or Bearish?

Jakarta, Pintu News – Bitcoin reached a new peak of $122,054 on July 14, but its bullish momentum is starting to stall. Miners who previously accumulated assets are now starting to sell, creating new selling pressure.

On the other hand, inflows from institutions can be a crucial counterbalance. This article will dig deeper into the possible dynamics of Bitcoin (BTC) in August.

Miners’ Strategy Changes

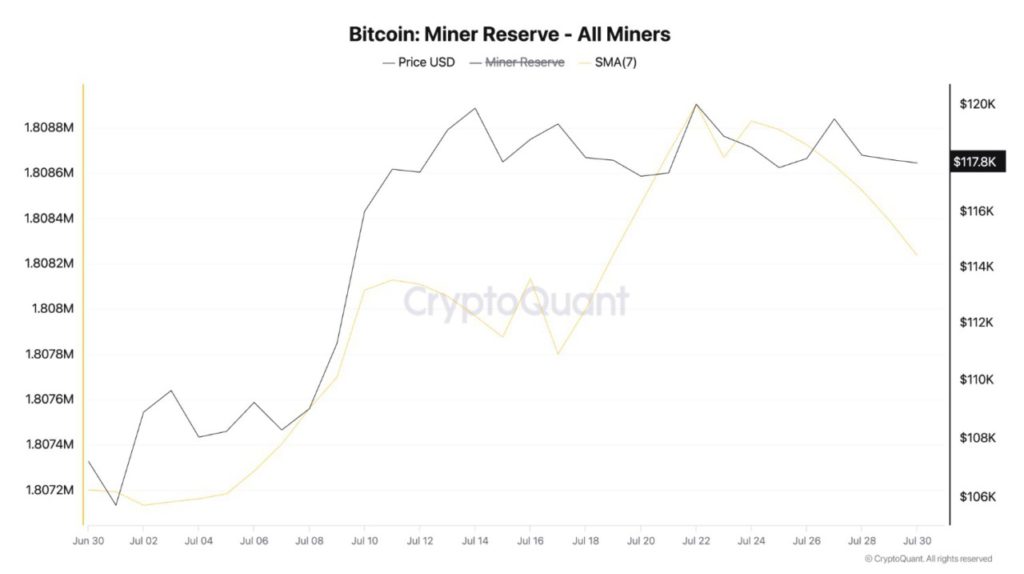

At the beginning of the month, as the price of Bitcoin (BTC) began to rise, miners also increased their accumulation, as seen by the rise in the Miner Reserve. Data from CryptoQuant shows that this metric, which is observed using a seven-day moving average (7-day SMA), rose by 0.05% between July 1 and July 22, peaking at 1.808 million coins.

However, after reaching new highs, miners started selling their assets to lock in profits, which added to the selling pressure on Bitcoin (BTC). As the price began to stabilize, miners who had previously held their assets started selling.

This selling is done to secure the profits they have made during periods of price increases. This selling by miners could exacerbate the already existing selling pressure, and potentially hold back future Bitcoin (BTC) price increases.

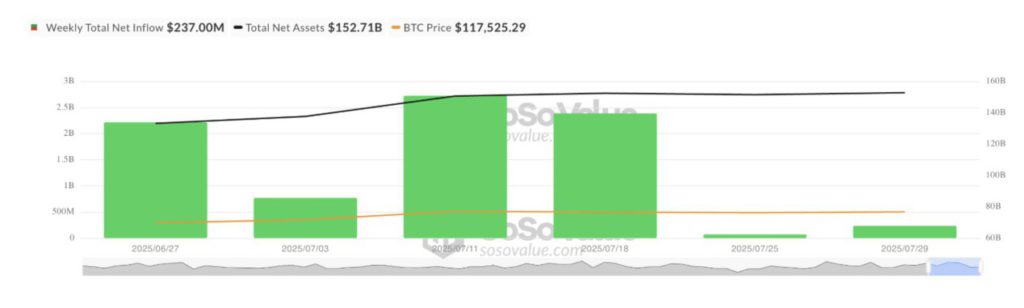

Effect of Institutional Inflows

Abdul Rafay Gadit, Co-Founder and Chief Financial Officer at Zignaly, in an exclusive interview, stated that the increase in miner reserves in early July was more of a temporary pause rather than the beginning of aggressive accumulation. According to him, demand from institutions is the main backbone of the current Bitcoin (BTC) price structure.

If demand from these institutions continues to increase, it could help offset the selling pressure from miners. This increase in institutional demand is crucial to supporting the price of Bitcoin (BTC) amidst selling pressure from miners.

If institutions continue to buy Bitcoin (BTC) in large quantities, it could push the price past the $120,811 resistance and approach the previous high. However, if institutional demand is not as strong as expected, Bitcoin (BTC) may continue to move sideways or even decline.

Read also: Cardano ETF Opportunities Increase, Price Predicted to Break $4!

Possible Bitcoin (BTC) Price Movement

Currently, Bitcoin (BTC) is trading at $117,826, between the support floor at $116,952 and resistance at $120,811. If institutional demand increases and general market sentiment improves, Bitcoin (BTC) price could push past that resistance. However, if bearish pressure increases, the price could fall below $116,925 and drop to $114,354.

Bitcoin’s (BTC) price movement in August will be heavily influenced by two main factors: selling activity from miners and inflows from institutions. The balance between these two factors will determine whether Bitcoin (BTC) will return to a bullish trend or continue to experience selling pressure.

Conclusion

The dynamic between miners and institutions will largely determine the direction of Bitcoin’s (BTC) price movement in August. Despite potential selling pressure from miners, inflows from institutions could provide enough support to sustain or even increase the price. Market watchers should continue to monitor these two factors to get a clearer picture of the future of Bitcoin (BTC).

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Miners and BTC Price in August. Accessed on August 1, 2025

- Featured Image: Generated by AI