Smart Strategies in Investing: Getting to Know the Scale Out Technique in Trading

Jakarta, Pintu News – In the investment world, taking advantage of rising stocks is one of the strategies often used by investors. One popular method is the scale out technique, which allows investors to sell shares gradually as the price rises. This article will explain more about what scale out is, how it works, and the criticisms that exist against this strategy.

What is Scale Out?

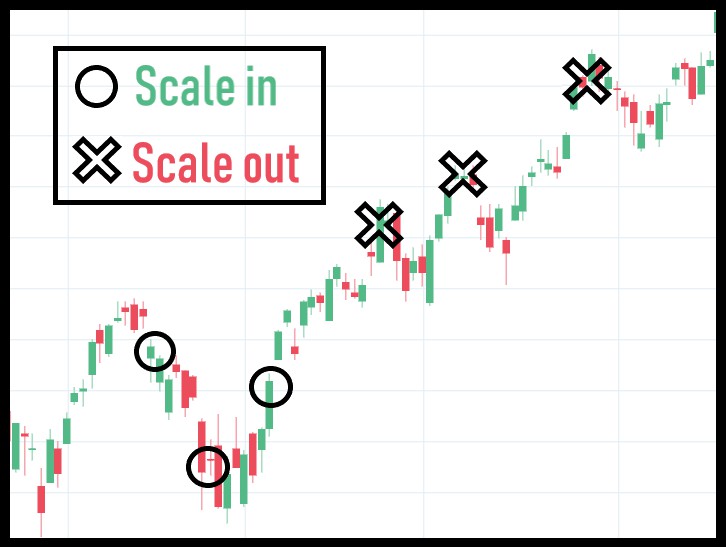

Scale out is the process by which an investor gradually sells a portion of the shares they own as the price of the stock increases. This technique is done with the aim of reducing risk and securing profits before the stock price potentially drops. By selling shares gradually, investors can take advantage of rising prices, without having to wait and try to guess the highest price that may never be reached.

This technique is especially useful when the upward momentum of the stock price starts to slow down. Investors start reducing their exposure to the stock by selling it little by little. This allows them to secure profits while still having the opportunity to earn more if the stock price continues to rise.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

How does Scale Out Work?

An investor may own 600 shares of a company with an average price per share of $20. When the price of the stock starts to rise, the investor decides to use a scale out strategy. For example, the investor sells 200 shares when the price reaches $39, then another 200 shares at $39.50, and the last 200 shares at $39.75.

Thus, the average selling price obtained is $39.42 per share. This strategy allows investors to reduce the risk of losing profits if the stock price suddenly drops. However, it also has the potential to reduce the total amount of profit that can be made if the investor chooses to hold on to all of their shares until the price reaches its peak.

Criticism of Scale Out

Some critics argue that investors who use the scale out strategy often do this because they initially take larger positions than they are comfortable with. As such, scale out is simply a way of adjusting the position size to a size that better suits their risk tolerance and account capacity. Critics argue that it is better to determine the right position size from the start rather than having to adjust it midway.

In addition, there is a concern that when stock prices fall below the purchase price, investors using this strategy tend to let their losses continue rather than cutting losses early. This shows that the importance of risk management and discipline in executing investment strategies.

Conclusion

Scale out is a strategy that allows investors to secure profits by gradually reducing their exposure to stocks. While this strategy may reduce the maximum potential profit, it offers protection against market volatility and sudden price drops. It is important for every investor to understand the advantages and disadvantages of these strategies and apply them according to their risk profile and investment goals.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. Scale Out. Accessed on August 1, 2025