4 On-Chain Data Signals an Upswing is Near: Bitcoin’s Next Big Spike?

Jakarta, Pintu News – After breaking a new record and now stuck below the $120,000 level (equivalent to Rp1.98 billion at an exchange rate of 1 USD = Rp16,518), Bitcoin is back in the spotlight. Although its movement tends to stagnate in a narrow range above $118,000, various on-chain indicators suggest that BTC could soon experience its next price surge. Check out the full analysis below, including technical signals, new investor data, and what you can anticipate from the price shift of the world’s largest crypto.

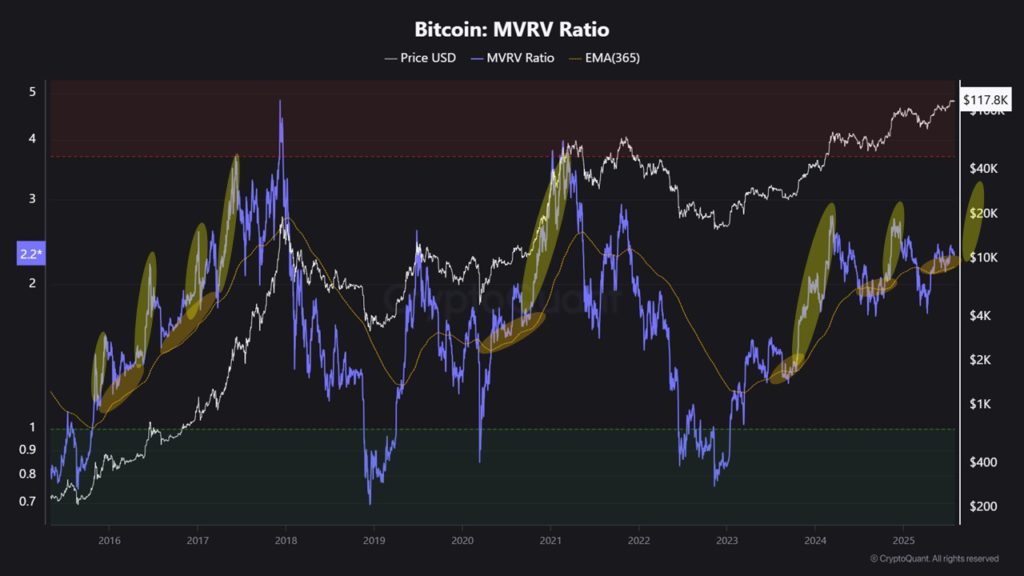

1. MVRV Ratio Indicates Chance of Increase

The Market Value to Realized Value (MVRV) ratio indicator is one of the key analytical tools to measure whether Bitcoin’s price is above or below its fair value.

Currently, Bitcoin’s MVRV stands at 2.2 and is slowly approaching its 365-day moving average. Based on historical data, when this ratio touches the long-term average, there is usually a rebound towards overvalued territory that is often accompanied by a price spike.

As such, analysis from CryptoQuant suggests that BTC is consolidating energy and could potentially rise again if buying activity strengthens.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

2. Domination of New Investors: Fresh Capital Entering the Market

Data from another CryptoQuant analyst shows that the dominance of new investors in Bitcoin is currently around 30%.

This is well below the saturation level (64%-72%) that usually occurs when prices are already very “hot” at local peaks. The steady influx of new investors since July 2024 indicates that there is fresh liquidity supporting the medium-term bullish sentiment.

With a lot of new capital coming in without any signs of excessive euphoria, the chance of a big price spike remains open, especially if the buying volume gets stronger.

3. Moderate Sales from Long-Term Holders

Bitcoin holders who have kept their coins for more than 3 years are now starting to sell gradually, but the selling pressure can still be absorbed by the market.

The long-term holder sales coefficient of around 0.3 indicates that the distribution of the coin is not large enough to trigger a sharp correction. In other words, the market is still able to absorb these sales without jeopardizing the price structure.

Situations like this are often the basis for accumulation before the next bullish phase occurs.

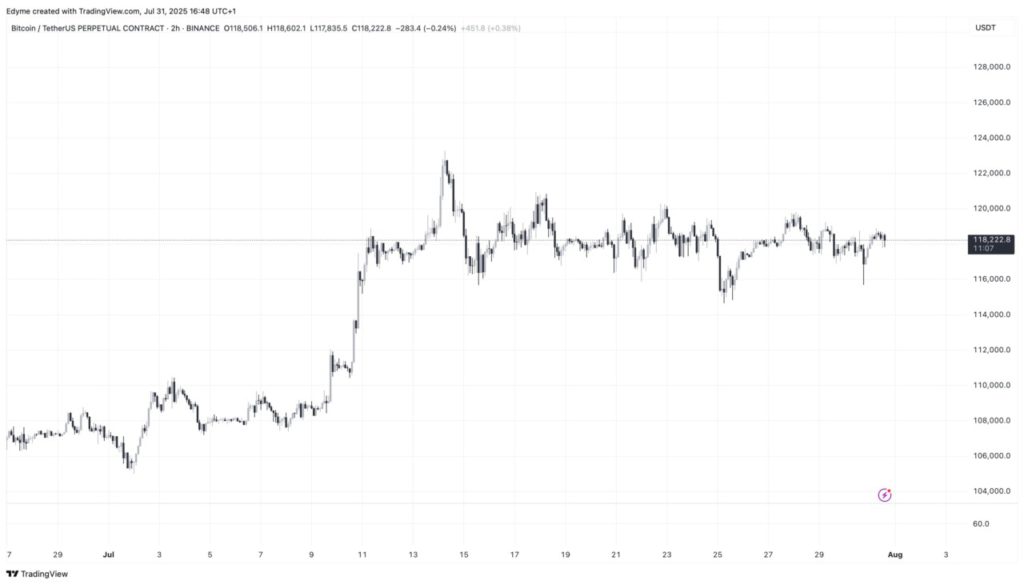

4. Consolidation = Calm Phase Before a Spike?

Bitcoin’s relatively flat movement in recent days often signals a consolidation phase of market energy.

If historical patterns repeat themselves, this consolidation period could be followed by a significant price breakout when buying pressure starts to dominate again. Observant investors usually take advantage of stagnant moments for accumulation before upward momentum returns.

Conclusion

Various key on-chain indicators indicate that Bitcoin is in a healthy consolidation phase with the potential for renewed gains in the near future. The influx of new investors, stable burn rate, and relatively low dominance of long-term holders keep the potential for BTC price spikes high. However, crypto market volatility remains high-plan your strategy and risk management carefully before entering into new positions.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin’s Next Big Surge? On-Chain Metrics Suggest a Price Shift Is Near. Accessed August 1, 2025.