Dogecoin Climbs Today (August 5) — Is Its RSI Sparking a Bullish Turn?

Jakarta, Pintu News – As of August 4, Dogecoin was trading around $0.20 with a daily transaction volume of around $1.4 billion. Throughout the period, the price of DOGE moved in the range of $0.19 to $0.20, signaling short-term volatility.

Meanwhile, net buying by large holders drove this latest rise. This suggests that the market is likely to undergo a consolidation phase before resuming its next move.

Then, how is the current Dogecoin price movement?

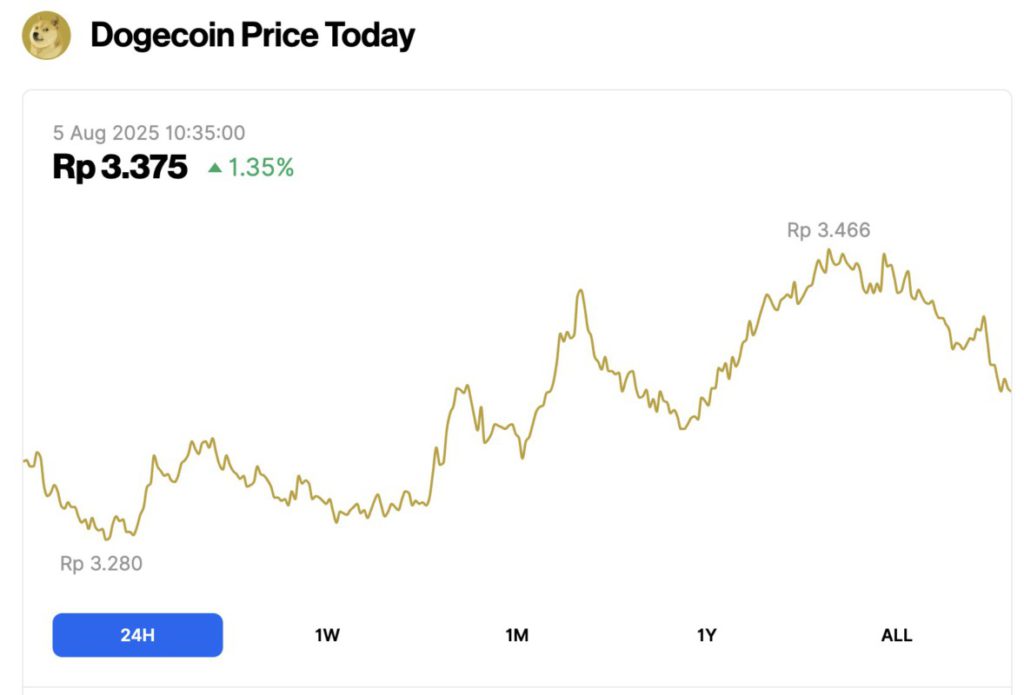

Dogecoin Price Rises 1.35% in 24 Hours

On August 5, 2025, Dogecoin’s price rose 1.35% over the past 24 hours, reaching $0.2065, or roughly IDR 3,375. During the day, DOGE dipped to a low of IDR 3,280 and climbed as high as IDR 3,466.

At the time of writing, Dogecoin’s market cap stands at around $31.07 billion, with trading volume rising 38% to $1.74 billion within 24 hours.

Read also: Bitcoin Holds at $114K as Analysts Eye a Potential Surge to $124K

RSI Approaches an Important Bullish Threshold

On the 4-hour chart (4/8), Tardigrade Traders noted that Dogecoin’s (DOGE) Relative Strength Index (RSI) is approaching the 50 level. This level is often the divide between short-term bearish and bullish conditions.

If the price continues to rise and the RSI manages to break 50, this could signal the beginning of a new bullish phase.

Recent price movements also suggest that DOGE is starting to climb out of the consolidation phase. The RSI approaching 50 signals that the selling pressure is starting to ease. If the RSI manages to break 50 decisively, the bullish momentum could get stronger.

Conversely, if rejected at this level, the market is likely to move sideways or even experience another correction.

Breakout Above $0.20 and Technical Structure

On the 1-hour chart (4/8), Dogecoin (DOGE) briefly broke back through $0.20 via a strong breakout .

According to Tardigrade Trader’s chart, two narrow descending channels were seen forming before a sharp bullish candle broke through the $0.20 level. Such patterns usually reflect a short consolidation phase that often triggers further movement.

Market activity picked up as large holders accumulated around 310 million DOGE, prompting the breakout despite the general relative calm of the crypto market.

Meanwhile, Bitcoin and Ethereum have stabilized, while meme coins like DOGE have been subject to short-term speculation and opportunistic capital flows.

Sentiment Signals and Short-term Outlook

Market sentiment is currently mixed. Market Prophit reports that public sentiment is bearish, while their internal prediction model remains bullish.

The direction of DOGE’s short-term trend will largely depend on the ability of the price to hold above $0.20 as well as the confirmation of the RSI breaking the 50 level. Additional buying from market participants could potentially drive the next leg up.

However, if the price fails to hold at the current level, the accumulation phase is likely to continue, as traders will still monitor the price movement and accumulation pattern before taking new steps.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptopotato. Dogecoin (DOGE) Reclaims Key Level as RSI Signals Potential Trend Shift. Accessed on August 5, 2025