Fed Rate Cut Chances Increase, What Impact on the Economy?

Jakarta, Pintu News – In the upcoming monetary policy meeting in September, the US Federal Reserve (Fed) faces pressure to cut interest rates by 25 basis points.

This was triggered by the disappointing July jobs report, which showed a decline in job creation. Currently, the market estimates the chance of a rate cut at 78.5%, a significant jump from previous estimates.

Check out the full information in this article!

Possible Interest Rate Cut by the Fed

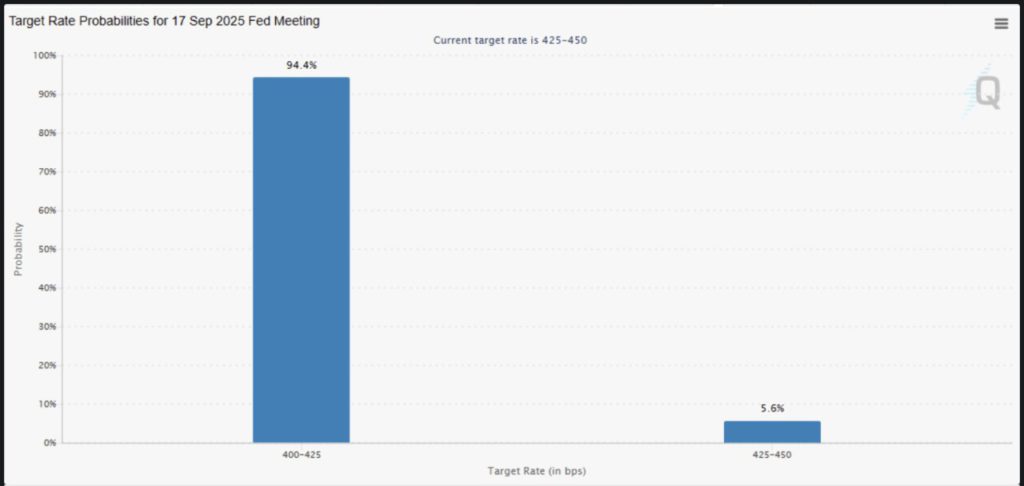

Having kept interest rates at a range of 4.25% to 4.5% since December 2024, the Fed is now under the spotlight to take the next step. The weak jobs report has boosted market expectations of a rate cut.

According to data from CME Group’s Fed futures, the odds for a 25 basis point rate cut have increased, indicating a market response to recent economic data.

Previously, the odds of a September rate cut stood at 39%, but after the July jobs report, the figure jumped over 80%. This signifies how sensitive the market is to new economic data developments and how they can influence monetary policy decisions.

Read also: Japan’s Metaplanet Invests heavily in Bitcoin (BTC) Amid Recovering Market

Analysis from Experts and Implications for the Market

Rick Rieder, Chief Investment Officer at BlackRock, suggested that there is a possibility of a 50 basis point rate cut in September. This was based on the jobs report which fell short of expectations, with only 73,000 new jobs compared to a prediction of 147,000.

Rieder also predicts that the Fed will ease monetary policy until the end of 2025, with two to three rate cuts in response to inflationary pressures and consumer spending trends.

This prediction is in line with BlackRock’s institutional market view, which anticipates interest rate cuts to begin in the fourth quarter. Thus, it is expected that the Fed will take a more accommodative stance, focusing on economic growth and maximum job creation.

Also read: Justin Sun and his Earth-changing Space Experience, Here’s the Project!

Market Reaction and Impact on Investment

Financial markets reacted to the expectation of a rate cut with increased optimism, especially among the crypto community on the X platform. The high chance of a rate cut is expected to provide a boost to investment and consumption.

However, this policy change also brings uncertainty regarding its long-term impact on the economy. Investors and analysts continue to monitor other economic indicators to get a clearer picture of the Fed’s next policy direction.

The Fed’s decision in September will be crucial in determining the future direction of financial markets and the overall economy.

Conclusion

With the chances of a rate cut increasing, financial markets and the global economy are at a critical juncture. The Fed’s decision in September will be an important determinant for the future direction of monetary policy and economic stability. Market watchers and investors are advised to keep abreast of the latest developments to anticipate possible impacts.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Breaking: September Fed Rate Cut Odds Soar to 78.5% Following Soft U.S. Jobs Data. Accessed on August 5, 2025

- Featured Image: Generated by Ai