Ethereum (ETH) Price Plummets to $3,500 as Crypto Analysts Reveal 3 Key Insights!

Jakarta, Pintu News – The price of Ethereum has been in the spotlight in the cryptocurrency market, after plummeting more than 8.6% in the past week and trading at around $3,533 or around Rp57.8 million as of August 6, 2025.

This drop has many traders wondering: is ETH preparing to break $4,000 or is it about to collapse further?

However, behind this decline, on-chain data shows a potential bear trap, where sellers could be trapped in a hidden bullish scenario.

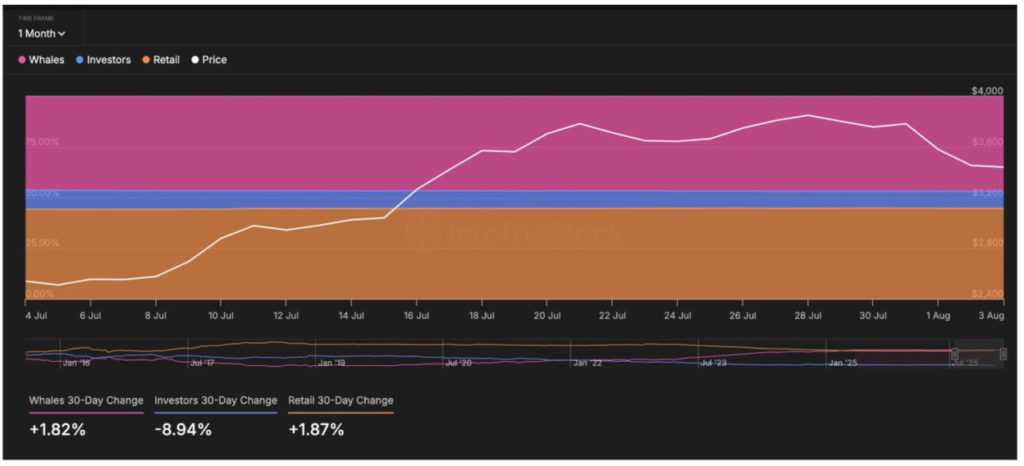

Whale and Retail Concentrations Turn Bullish

The first signal comes from on-chain data regarding the distribution of ETH holdings. In the last 30 days, whale holdings increased by 1.82%, while retail wallets increased by 1.87%. Typically, whale movements are more dominant in influencing crypto prices due to the large volumes they control.

Interestingly, mid-sized investors are seen selling, indicating a redistribution of assets from mid-sized wallets to retail and whale wallets. These two groups have different motivations, but when they move in sync, the price trend tends to strengthen.

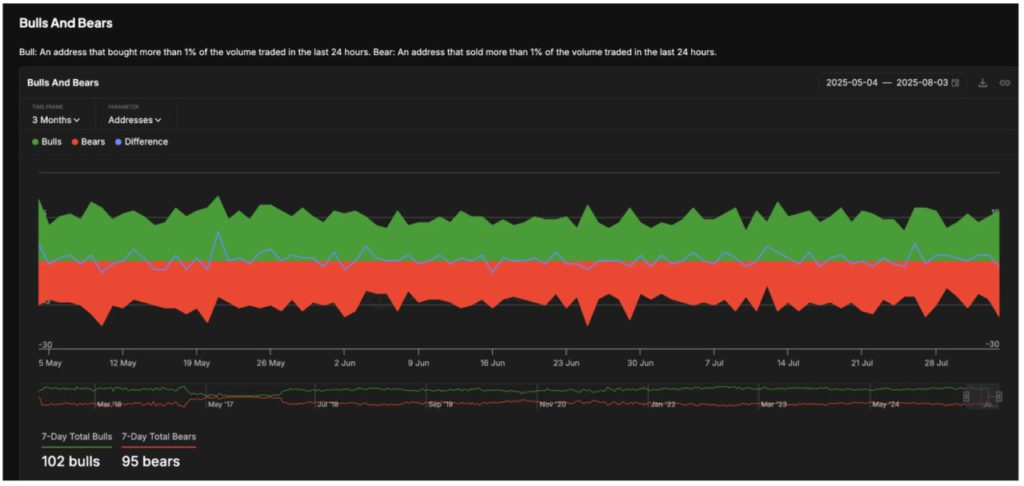

IntoTheBlock data shows that bullish addresses outnumbered bearish ones by a ratio of 7:1 in the past week, indicating silent accumulation amidst market panic.

Read also: Potential Interest Rate Cut by Fed, What Impact?

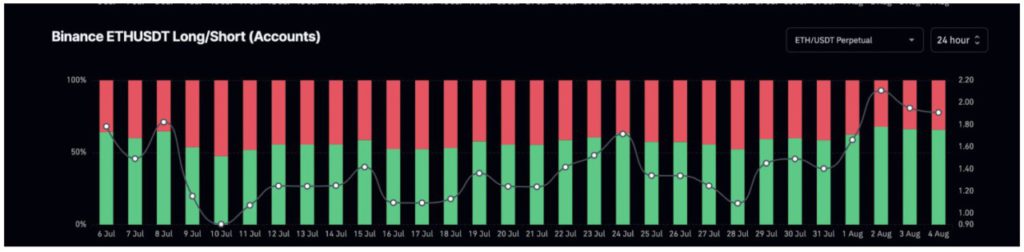

Traders Still Optimistic Based on Long/Short Ratio

In addition to on-chain data, trader behavior on derivatives exchanges also shows bullish tendencies. Binance Long/Short Account Ratio data puts ETH at 1.91, meaning that the number of accounts opening long positions is almost double that of short ones. This ratio differs from the position volume ratio in that it counts the number of accounts, not the size of transactions.

Typically, a ratio above 1.5 indicates expectations of a significant price increase. Even amid sideways price movements and short-term selling pressure, traders still seem to believe that the potential for an upward surge is greater. Patterns like this in ETH history often occur before significant price movements.

Read also: Franklin Templeton Partners with Anchorage Digital, BENJI Token Officially Coming?

Bullish Triangle Pattern Still Forming

From a technical perspective, Ethereum’s daily chart shows an ascending triangle pattern, signaling a potential continuation of the bullish trend. ETH had experienced a surge from the level of $2,120 (IDR 34.7 million) to $3,939 (IDR 64.5 million), before entering a tight consolidation phase. The Fibonacci 0.236 level of $3,785 was tested but broken, triggering a long red candle and a short sell-off in the market.

Interestingly, ETH only touched the critical support level of $3,356 briefly before bouncing back. This situation likely trapped many traders who opened short positions, which then risked a short squeeze.

If the daily candle is able to close above $3,785, ETH has the opportunity to retest the resistance at $3,939 to $4,051. However, if the key support of $3,356 is broken, this bullish scenario could be canceled.

Conclusion

With a combination of three strong signals – concentration of ownership by whales and retail, dominance of long positions on derivatives exchanges, as well as a bullish triangle pattern on the daily chart – Ethereum has the potential to reverse the current bearish sentiment.

If this is indeed a bear trap, then patient investors could see ETH return near the psychological $4,000 level in the near future. However, traders still need to be aware of key supports to avoid getting caught up in the high volatility of the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Did Ethereum Just Trap the Bears? 3 Signals Suggest It Might Have. Accessed August 6, 2025

- Featured Image: Generated by Ai