3 Main Catalysts Driving Bitcoin (BTC) Price in 2025

Jakarta, Pintu News – The price of Bitcoin is back in the spotlight after touching the level of $120,000 or the equivalent of IDR 1.94 billion (exchange rate of $1 = IDR 16,295) on July 23, 2025.

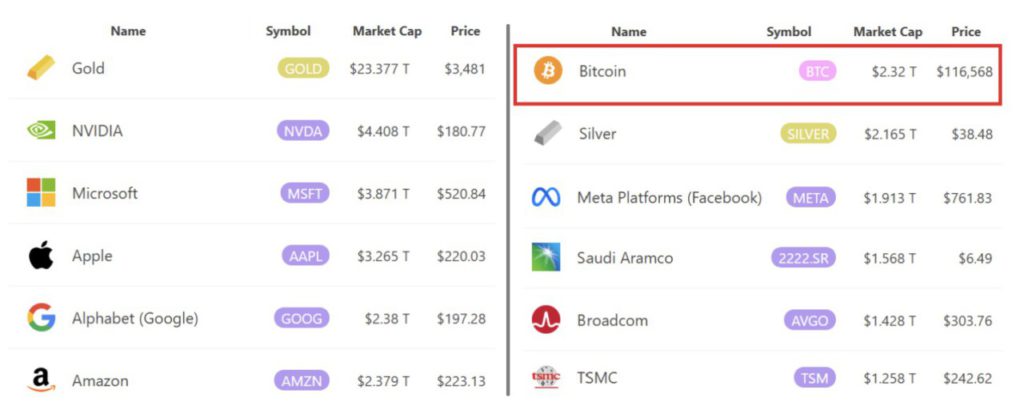

Despite global economic uncertainty and risks in the artificial intelligence sector, Marcel Pechman, crypto analyst at Cointelegraph, sees three major catalysts that could push BTC beyond its $2.3 trillion market capitalization and break a new record.

Check out the full analysis in this article!

Global Money Supply Growth is a Fresh Wind

According to Pechman’s analysis, one of the biggest drivers is the surging global money supply (M2) that reached a record IDR902,670 trillion ($55.5 trillion) in July 2025. This comes on the heels of the US budget deficit reaching IDR21,122 trillion ($1.3 trillion) in just nine months.

This massive liquidity makes Bitcoin even more attractive as a hedge against inflation, similar to gold. Although BTC’s correlation with tech stocks is still strong, many think that global monetary expansion will be the foundation of future price increases.

Also read: Gold Jewelry Price Today, Tuesday August 12, 2025, Up or Down?

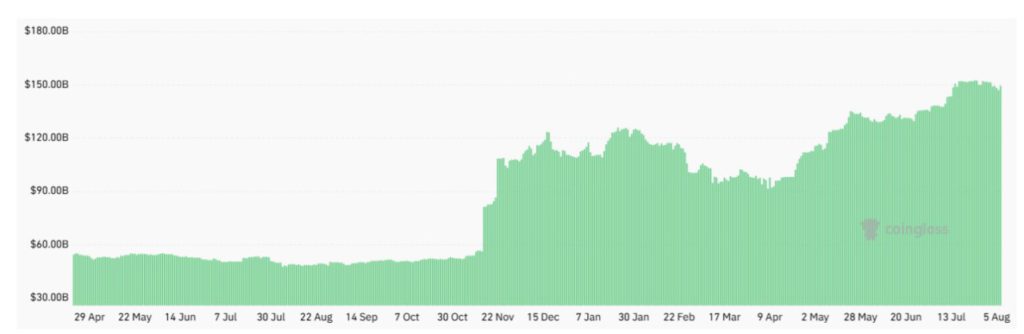

Bitcoin ETF ready to overtake gold as a reserve asset

The launch of a spot Bitcoin ETF in early 2024 has been a major catalyst, with total assets under management in the US now standing at IDR2,437 trillion ($150 billion). This is just shy of the gold ETF that holds IDR3,216 trillion ($198 billion).

If Bitcoin ETFs manage to surpass gold holdings, it will strengthen BTC’s image as a strategic reserve asset. Some crypto analysts predict this could encourage more institutional investors, such as sovereign wealth funds and public companies, to include Bitcoin in their reserve portfolios.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (12/8/25)

Potential Surge from Retail Investor Inflows

Although BTC has risen 116% in the past year, retail investor participation is still relatively low. Crypto trading apps like Coinbase and Robinhood haven’t even returned to the top 10 of the finance category on the US App Store, a position last reached in November 2024.

However, major regulatory changes could trigger a new surge. One of them is President Donald Trump’s policy of allowing cryptocurrencies, including Bitcoin, in 401(k) retirement plans. This move is expected to unlock the potential flow of trillions of dollars of funds from retirement savings into the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. These three catalysts will help Bitcoin break $122K. Accessed August 12, 2025.

- Featured image: Generated by Ai